Answered step by step

Verified Expert Solution

Question

1 Approved Answer

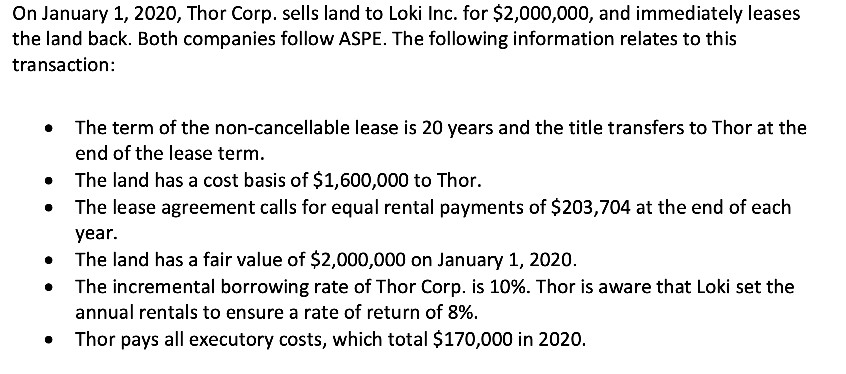

On January 1, 2020, Thor Corp. sells land to Loki Inc. for $2,000,000, and immediately leases the land back. Both companies follow ASPE. The following

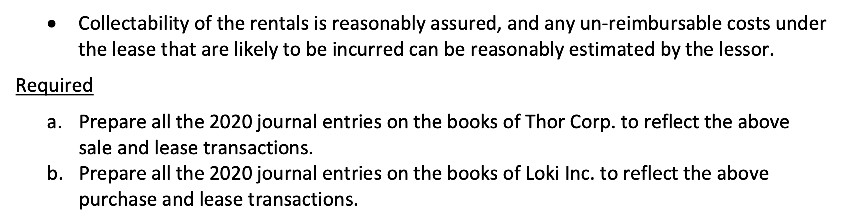

On January 1, 2020, Thor Corp. sells land to Loki Inc. for $2,000,000, and immediately leases the land back. Both companies follow ASPE. The following information relates to this transaction: . The term of the non-cancellable lease is 20 years and the title transfers to Thor at the end of the lease term. The land has a cost basis of $1,600,000 to Thor. The lease agreement calls for equal rental payments of $203,704 at the end of each year. The land has a fair value of $2,000,000 on January 1, 2020. The incremental borrowing rate of Thor Corp. is 10%. Thor is aware that Loki set the annual rentals to ensure a rate of return of 8%. Thor pays all executory costs, which total $170,000 in 2020. 0 O Collectability of the rentals is reasonably assured, and any un-reimbursable costs under the lease that are likely to be incurred can be reasonably estimated by the lessor. Required a. Prepare all the 2020 journal entries on the books of Thor Corp. to reflect the above sale and lease transactions. b. Prepare all the 2020 journal entries on the books of Loki Inc. to reflect the above purchase and lease transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started