Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, A&A Company purchased 7% bonds with a face value of $4,400,000 in Champion Incorporated. Interest is paid semi-annually, on January

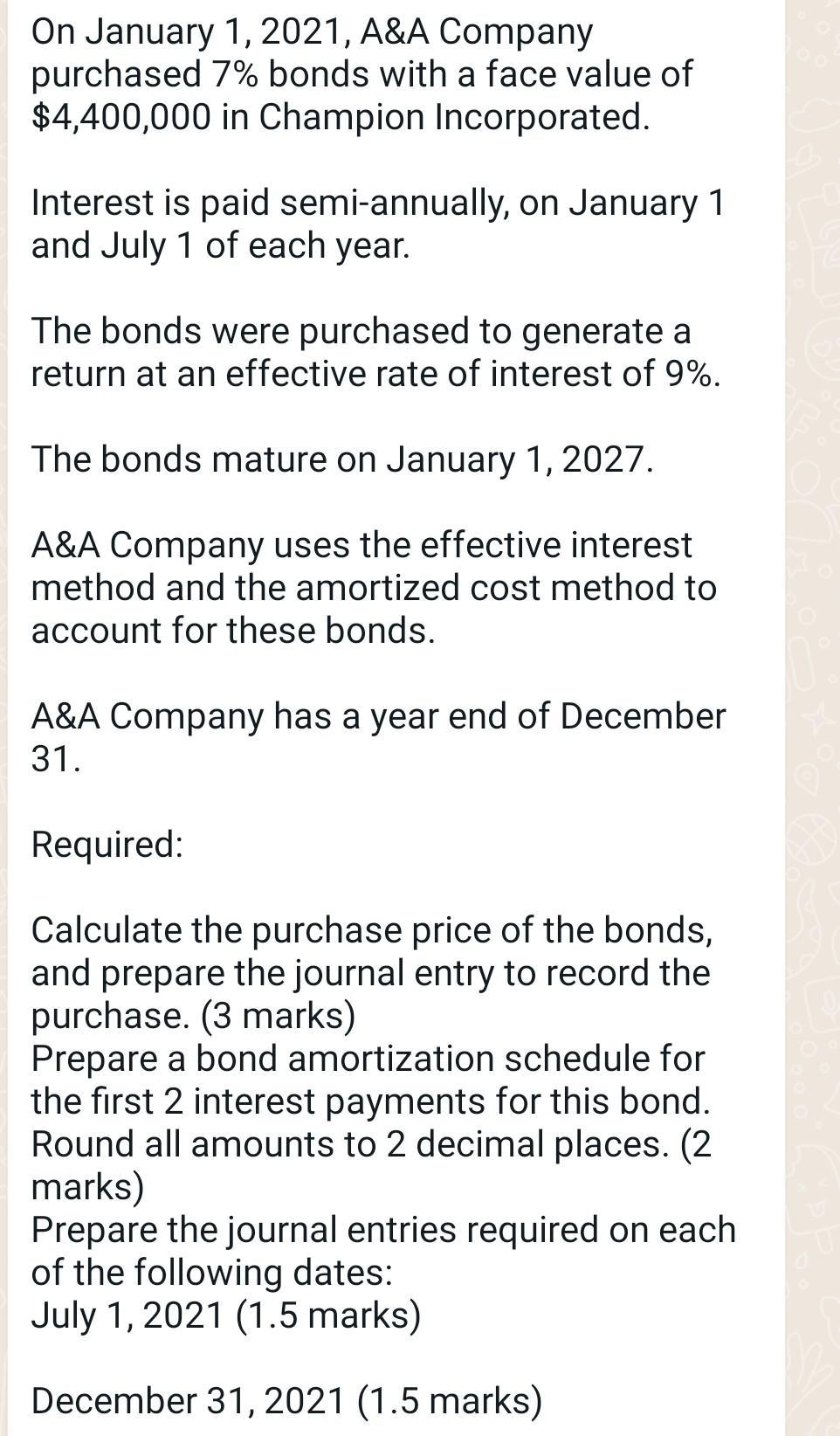

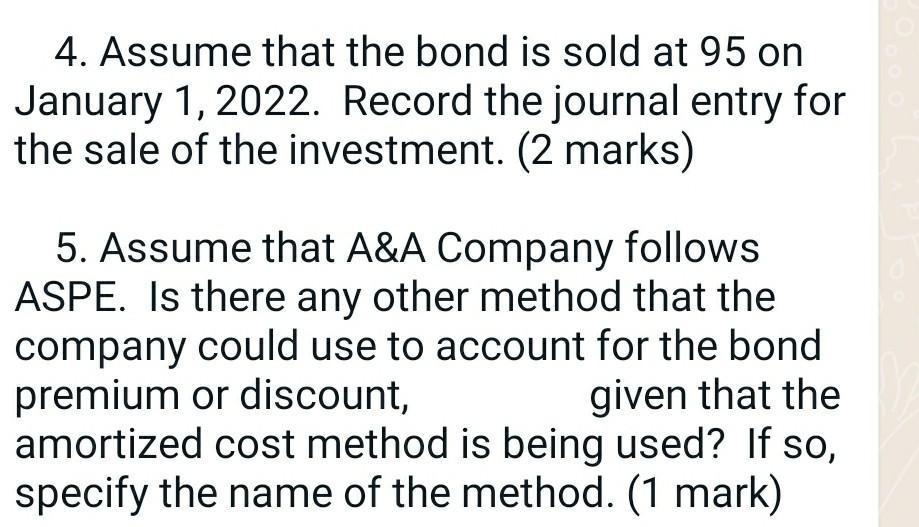

On January 1, 2021, A&A Company purchased 7% bonds with a face value of $4,400,000 in Champion Incorporated. Interest is paid semi-annually, on January 1 and July 1 of each year. The bonds were purchased to generate a return at an effective rate of interest of 9%. The bonds mature on January 1, 2027. A&A Company uses the effective interest method and the amortized cost method to account for these bonds. A&A Company has a year end of December 31. Required: Calculate the purchase price of the bonds, and prepare the journal entry to record the purchase. (3 marks) Prepare a bond amortization schedule for the first 2 interest payments for this bond. Round all amounts to 2 decimal places. (2 marks) Prepare the journal entries required on each of the following dates: July 1, 2021 (1.5 marks) December 31, 2021 (1.5 marks) 4. Assume that the bond is sold at 95 on January 1, 2022. Record the journal entry for the sale of the investment. (2 marks) 5. Assume that A&A Company follows ASPE. Is there any other method that the company could use to account for the bond premium or discount, given that the amortized cost method is being used? If so, specify the name of the method. (1 mark)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

5 The company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started