Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Ayayai Company purchased on credit machinery costing $193,500 and incurred $6,605 in installation costs. The machinery has an estimated useful

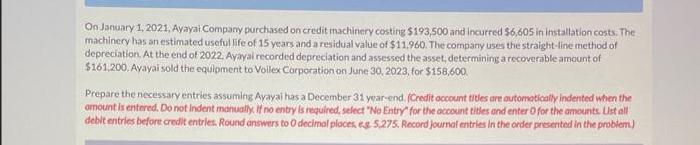

On January 1, 2021, Ayayai Company purchased on credit machinery costing $193,500 and incurred $6,605 in installation costs. The machinery has an estimated useful life of 15 years and a residual value of $11.960. The company uses the straight-line method of depreciation. At the end of 2022, Ayayai recorded depreciation and assessed the asset, determining a recoverable amount of $161,200. Ayayai sold the equipment to Voilex Corporation on June 30, 2023, for $158,600. Prepare the necessary entries assuming Ayayai has a December 31 year-end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round answers to O decimal places, eg 5,275. Record journal entries in the order presented in the problem)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries Date Account Title Debit Credit Jan 1 2021 Machinery 200105 Accounts Payable 200105 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started