Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Nocetti Inc. is currently selling at $50 per share. I a. How much will it cost you to buy 500 shares? b.

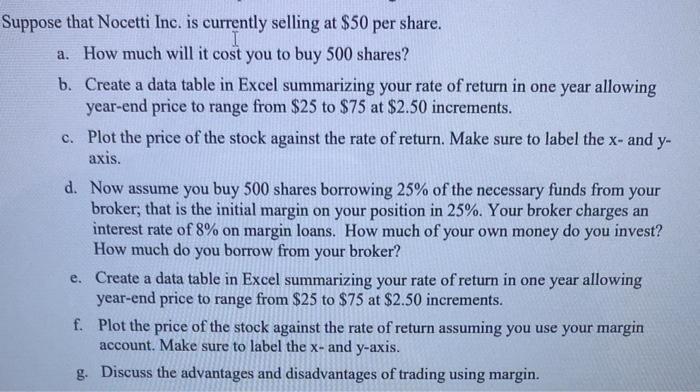

Suppose that Nocetti Inc. is currently selling at $50 per share. I a. How much will it cost you to buy 500 shares? b. Create a data table in Excel summarizing your rate of return in one year allowing year-end price to range from $25 to $75 at $2.50 increments. c. Plot the price of the stock against the rate of return. Make sure to label the x- and y- axis. d. Now assume you buy 500 shares borrowing 25% of the necessary funds from your broker; that is the initial margin on your position in 25%. Your broker charges an interest rate of 8% on margin loans. How much of your own money do you invest? How much do you borrow from your broker? e. Create a data table in Excel summarizing your rate of return in one year allowing year-end price to range from $25 to $75 at $2.50 increments. f. Plot the price of the stock against the rate of return assuming you use your margin account. Make sure to label the x- and y-axis. g. Discuss the advantages and disadvantages of trading using margin.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To buy 500 shares at 50 per share it will cost 25000 b To create a data table in Excel summarizing your rate of return in one year follow these step...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started