Answered step by step

Verified Expert Solution

Question

1 Approved Answer

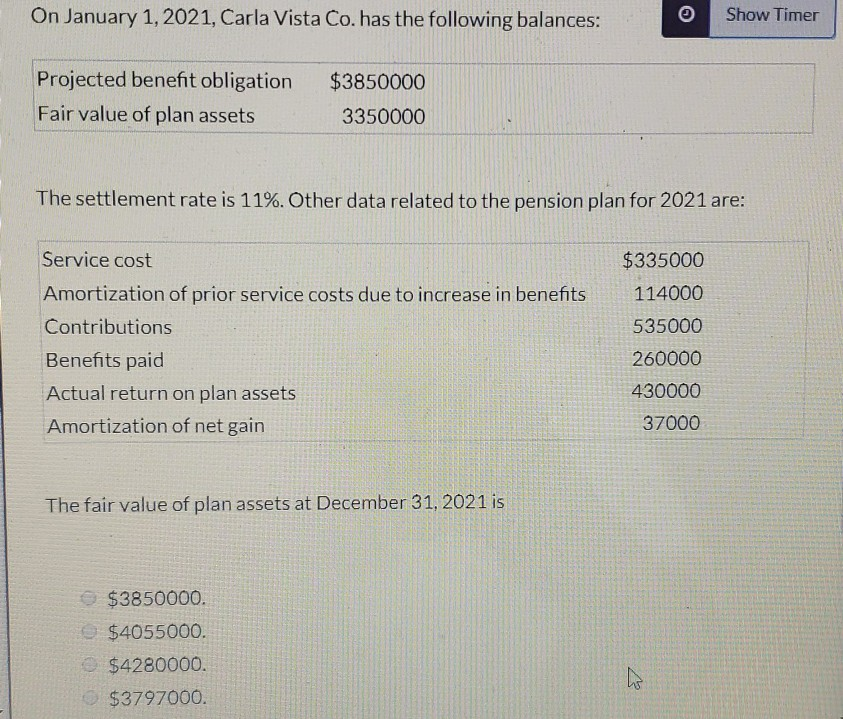

On January 1, 2021, Carla Vista Co. has the following balances: Show Timer Projected benefit obligation Fair value of plan assets $3850000 3350000 The settlement

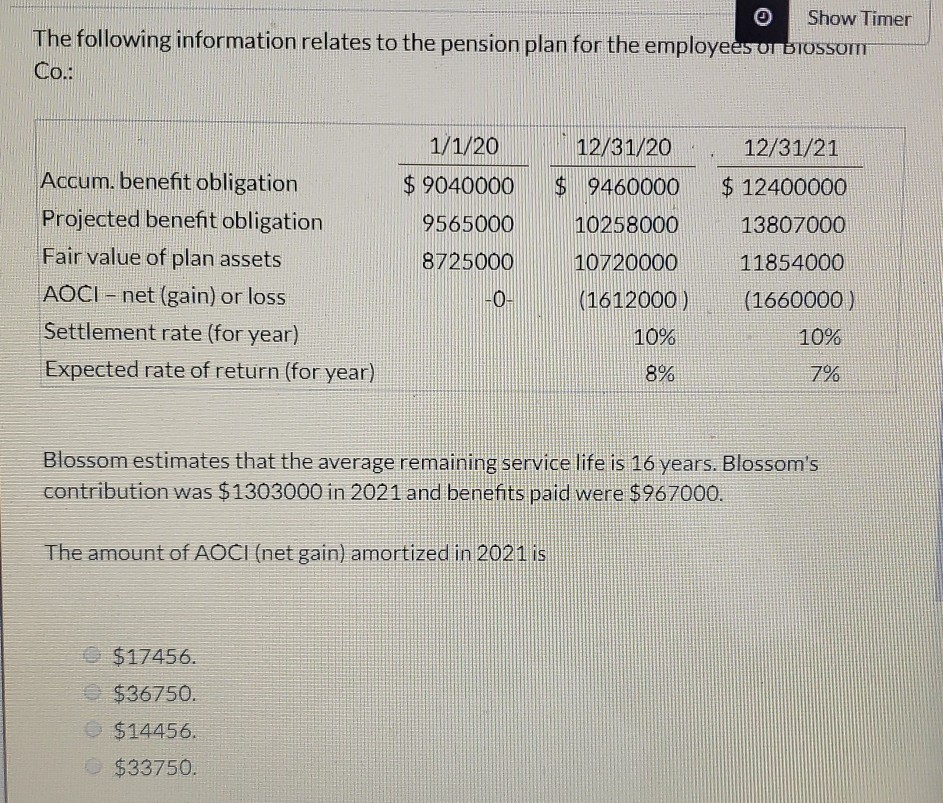

On January 1, 2021, Carla Vista Co. has the following balances: Show Timer Projected benefit obligation Fair value of plan assets $3850000 3350000 The settlement rate is 11%. Other data related to the pension plan for 2021 are: $335000 114000 535000 Service cost Amortization of prior service costs due to increase in benefits Contributions Benefits paid Actual return on plan assets Amortization of net gain 260000 430000 37000 The fair value of plan assets at December 31, 2021 is $3850000. $4055000. $4280000. ho $3797000. Show Timer The following information relates to the pension plan for the employees om BIOSSUM Co.: 1/1/20 12/31/20 12/31/21 $ 9040000 $ 9460000 $ 12400000 13807000 9565000 10258000 8725000 10720000 11854000 Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) -0 (1612000) (1660000) 10% 10% 8% 7% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1303000 in 2021 and benefits paid were $967000. The amount of AOCI (net gain) amortized in 2021 is $17456. $36750 $14456. $33750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started