Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Cornell Co. signed a contract to lease a fleet of delivery trucks for six years. The implicit rate on the lease,

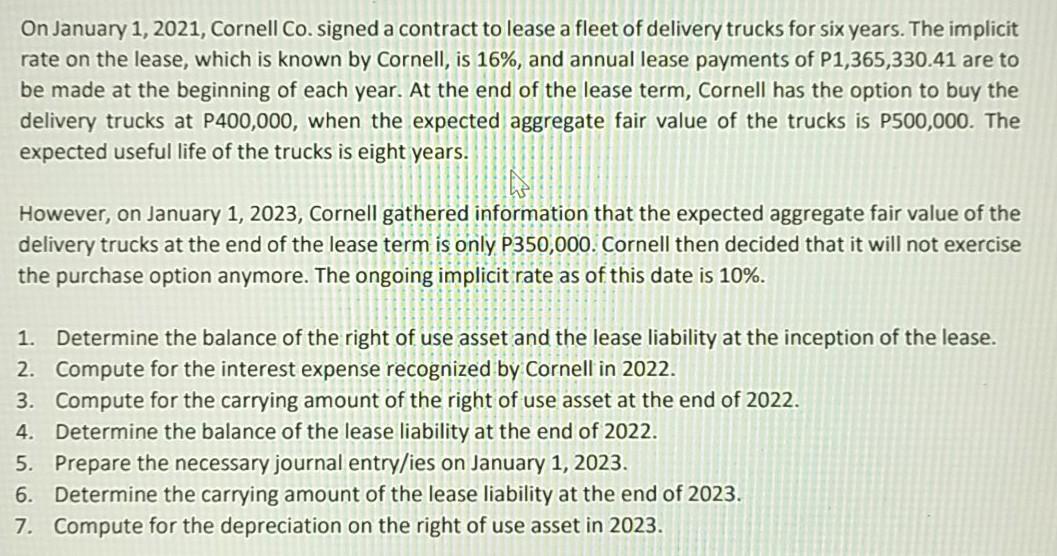

On January 1, 2021, Cornell Co. signed a contract to lease a fleet of delivery trucks for six years. The implicit rate on the lease, which is known by Cornell, is 16%, and annual lease payments of P1,365,330.41 are to be made at the beginning of each year. At the end of the lease term, Cornell has the option to buy the delivery trucks at P400,000, when the expected aggregate fair value of the trucks is P500,000. The expected useful life of the trucks is eight years. However, on January 1, 2023, Cornell gathered information that the expected aggregate fair value of the delivery trucks at the end of the lease term is only P350,000. Cornell then decided that it will not exercise the purchase option anymore. The ongoing implicit rate as of this date is 10%. 1. Determine the balance of the right of use asset and the lease liability at the inception of the lease. 2. Compute for the interest expense recognized by Cornell in 2022. 3. Compute for the carrying amount of the right of use asset at the end of 2022. 4. Determine the balance of the lease liability at the end of 2022. 5. Prepare the necessary journal entry/ies on January 1, 2023. 6. Determine the carrying amount of the lease liability at the end of 2023. 7. Compute for the depreciation on the right of use asset in 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started