Answered step by step

Verified Expert Solution

Question

1 Approved Answer

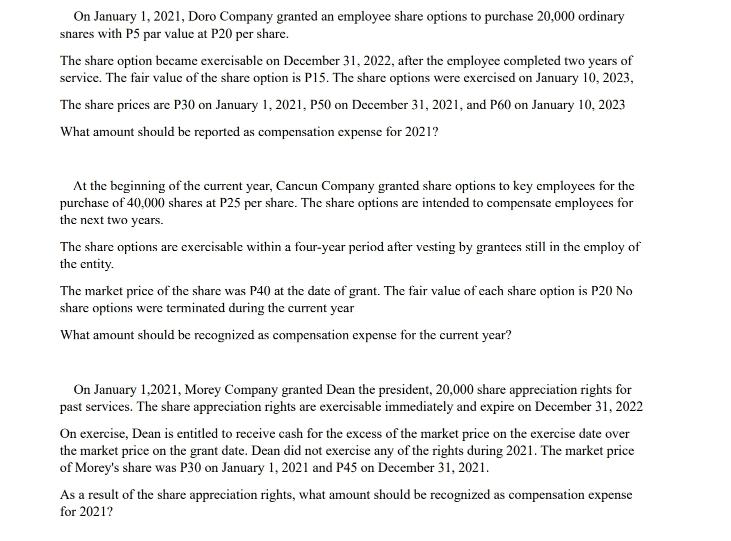

On January 1, 2021, Doro Company granted an employee share options to purchase 20,000 ordinary shares with P5 par value at P20 per share.

On January 1, 2021, Doro Company granted an employee share options to purchase 20,000 ordinary shares with P5 par value at P20 per share. The share option became exercisable on December 31, 2022, after the employee completed two years of service. The fair value of the share option is P15. The share options were exercised on January 10, 2023, The share prices are P30 on January 1, 2021, P50 on December 31, 2021, and P60 on January 10, 2023 What amount should be reported as compensation expense for 2021? At the beginning of the current year, Cancun Company granted share options to key employees for the purchase of 40,000 shares at P25 per share. The share options are intended to compensate employees for the next two years. The share options are exercisable within a four-year period after vesting by grantees still in the employ of the entity. The market price of the share was P40) at the date of grant. The fair value of each share option is P20 No share options were terminated during the current year What amount should be recognized as compensation expense for the current year? On January 1,2021, Morey Company granted Dean the president, 20,000 share appreciation rights for past services. The share appreciation rights are exercisable immediately and expire on December 31, 2022 On exercise, Dean is entitled to receive cash for the excess of the market price on the exercise date over the market price on the grant date. Dean did not exercise any of the rights during 2021. The market price of Morey's share was P30 on January 1, 2021 and P45 on December 31, 2021. As a result of the share appreciation rights, what amount should be recognized as compensation expense for 2021?

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Doro Company 1 Grant Date January 1 2021 2 Exercise Date January 10 2023 3 Fair Value of Option P15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started