Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Entity A Company acquired all the assets and assumed all the liabilities of Entity B Company and merged Entity B

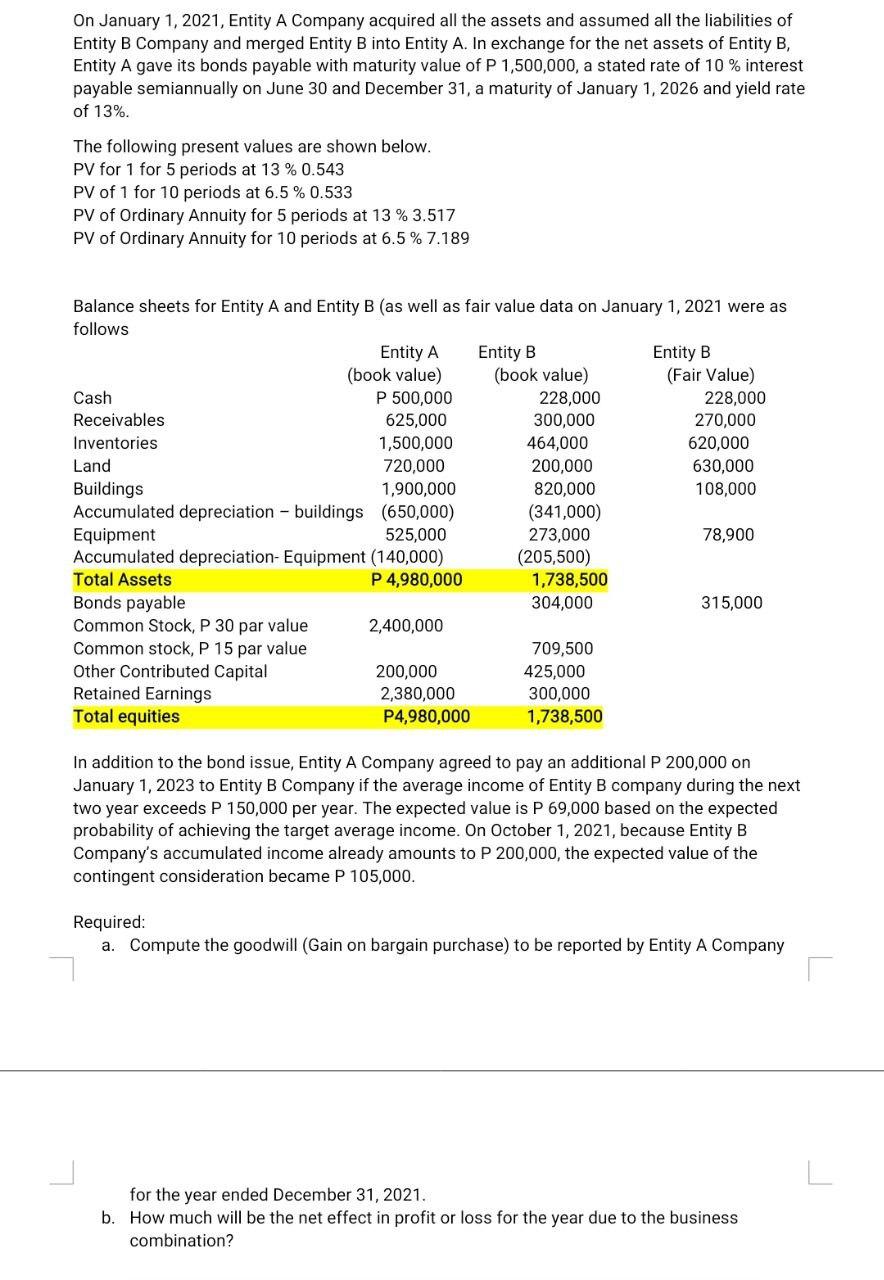

On January 1, 2021, Entity A Company acquired all the assets and assumed all the liabilities of Entity B Company and merged Entity B into Entity A. In exchange for the net assets of Entity B, Entity A gave its bonds payable with maturity value of P 1,500,000, a stated rate of 10% interest payable semiannually on June 30 and December 31, a maturity of January 1, 2026 and yield rate of 13%. The following present values are shown below. PV for 1 for 5 periods at 13% 0.543 PV of 1 for 10 periods at 6.5 % 0.533 PV of Ordinary Annuity for 5 periods at 13% 3.517 PV of Ordinary Annuity for 10 periods at 6.5 % 7.189 Balance sheets for Entity A and Entity B (as well as fair value data on January 1, 2021 were as follows Entity A (book value) Entity B Entity B (book value) (Fair Value) Cash P 500,000 228,000 228,000 Receivables 625,000 300,000 270,000 Inventories 1,500,000 464,000 620,000 Land 720,000 200,000 630,000 Buildings 1,900,000 820,000 108,000 Accumulated depreciation-buildings (650,000) (341,000) Equipment 525,000 273,000 78,900 Accumulated depreciation- Equipment (140,000) (205,500) Total Assets P 4,980,000 1,738,500 Bonds payable 304,000 315,000 Common Stock, P 30 par value 2,400,000 Common stock, P 15 par value 709,500 Other Contributed Capital Retained Earnings Total equities 200,000 425,000 2,380,000 300,000 P4,980,000 1,738,500 In addition to the bond issue, Entity A Company agreed to pay an additional P 200,000 on January 1, 2023 to Entity B Company if the average income of Entity B company during the next two year exceeds P 150,000 per year. The expected value is P 69,000 based on the expected probability of achieving the target average income. On October 1, 2021, because Entity B Company's accumulated income already amounts to P 200,000, the expected value of the contingent consideration became P 105,000. Required: a. Compute the goodwill (Gain on bargain purchase) to be reported by Entity A Company for the year ended December 31, 2021. b. How much will be the net effect in profit or loss for the year due to the business combination?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure based on the image you sent I can answer the following questions about the business combination ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started