Trini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $5.10 per pound) Direct labor (8

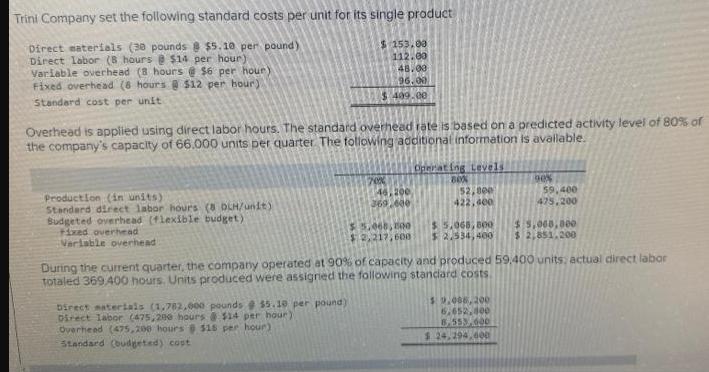

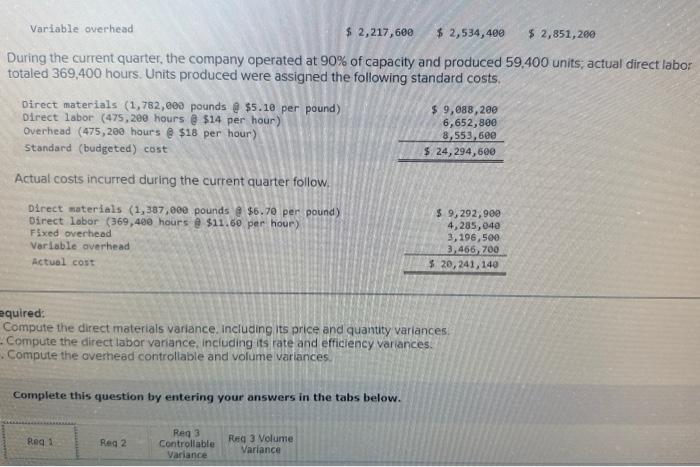

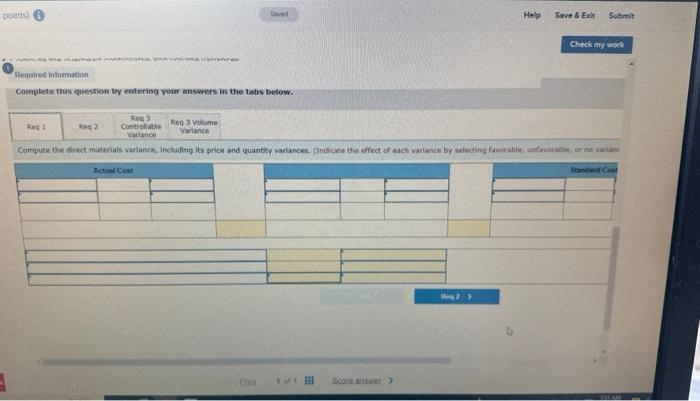

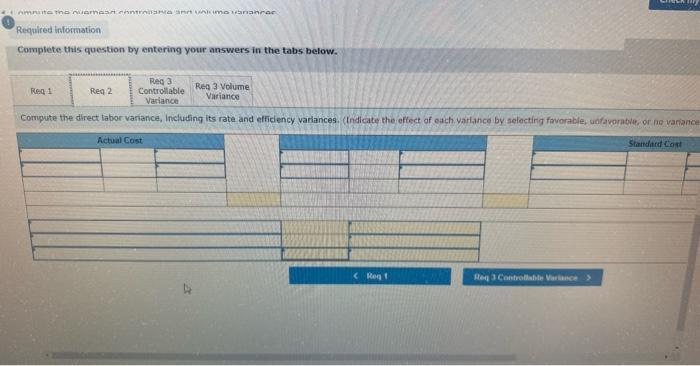

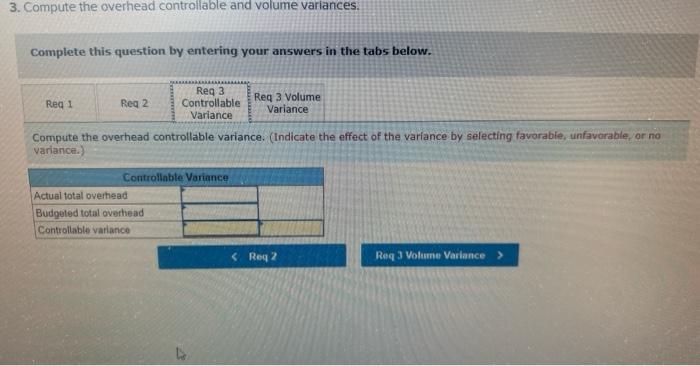

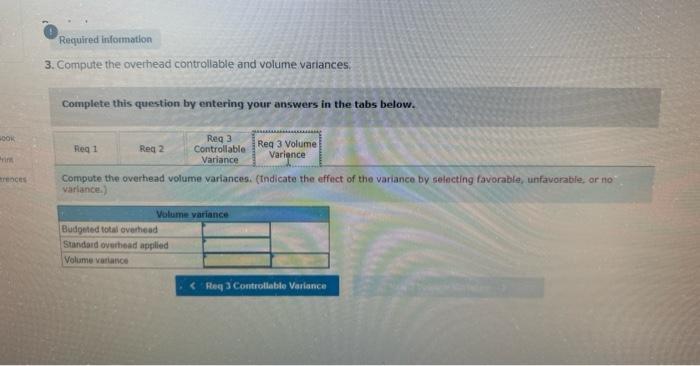

Trini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $5.10 per pound) Direct labor (8 hours @ $14 per hour) Variable overhead (8 hours@ $6 per hour) Fixed overhead (8 hours @ $12 per hour). Standard cost per unit Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 66.000 units per quarter. The following additional information is available. Operating Levels Production (in units) Standard direct labor hours (8 DLH/unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead $153.00 112.00 48.00 96.00 $ 409.00 Direct materials (1,782,000 pounds @ $5.10 per pound) Direct labor (475,200 hours $14 per hour) Overhead (475,200 hours @ $18 per hour) Standard (budgeted) copt 70% 46,200 369,600 BOX 52,000 422,400 $5.068,000 $5,068,800 $2,217,600 $2,534,400 90% 59,400 475,200 During the current quarter, the company operated at 90% of capacity and produced 59.400 units; actual direct labor totaled 369,400 hours. Units produced were assigned the following standard costs. $9.008, 200 6.652,800 8.555.600 $ 24,294,600 $5,000,000 $ 2,851.200 Variable overhead $ 2,217,600 $ 2,534,400 $ 2,851,200 During the current quarter, the company operated at 90% of capacity and produced 59,400 units; actual direct labor totaled 369,400 hours. Units produced were assigned the following standard costs. Direct materials (1,782,000 pounds @ $5.10 per pound) Direct labor (475,200 hours @ $14 per hour) Overhead (475,200 hours @ $18 per hour) Standard (budgeted) cost Actual costs incurred during the current quarter follow. Direct materials (1,387,000 pounds @ $6.70 per pound) Direct labor (369,400 hours @ $11.60 per hour) Fixed overhead Variable overhead Actual cost Complete this question by entering your answers in the tabs below. equired: Compute the direct materials variance, including its price and quantity variances. Compute the direct labor variance, including its rate and efficiency variances. Compute the overhead controllable and volume variances. Reg 1 Reg 2 Req 3 Controllable Variance $9,088,200 6,652,800 8,553,600 $ 24,294,600 Reg 3 Volume Variance $ 9,292,900 4,285,040 3,196,500 3,466,700 $ 20,241,140 points) mnie the quares Required information Complete this question by entering your answers in the tabs below. ma vanancer Reg 2 Saved Req 3 Volume Varlance Prev Req 1 Rea 3 Controllable Variance Compute the direct materials variance, including its price and quantity variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no vartan Actual Cost Standard Col Score.answer > Help Heq 2 > Save & Exit Submit Check my work AMBITS The nuamaan entrana ann Alimo variancar Required information Complete this question by entering your answers in the tabs below. Req 1 Req 3 Controllable Variance Req 3 Volume Variance Compute the direct labor variance, Including its rate and efficiency variances. (Indicate the effect of each varlance by selecting favorable, unfavorable, or ne variances Reg 2 Actual Cost < Reg f HUSK HIS Req 3 Controllable Variance > Standard Cost 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Controllable Variance Compute the overhead controllable variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Controllable Variance Actual total overhead Budgeted total overhead Controllable variance Req 3 Volume Variance < Req 2 Req 3 Volume Variance > BOOK Prim mrences Required information 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Req 3 Controllable Variance Req 1 Req 2 Compute the overhead volume variances. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Volume variance Req 3 Volume Varience Budgeted total overhead Standard overhead applied Volume variance < Req 3 Controllable Variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started