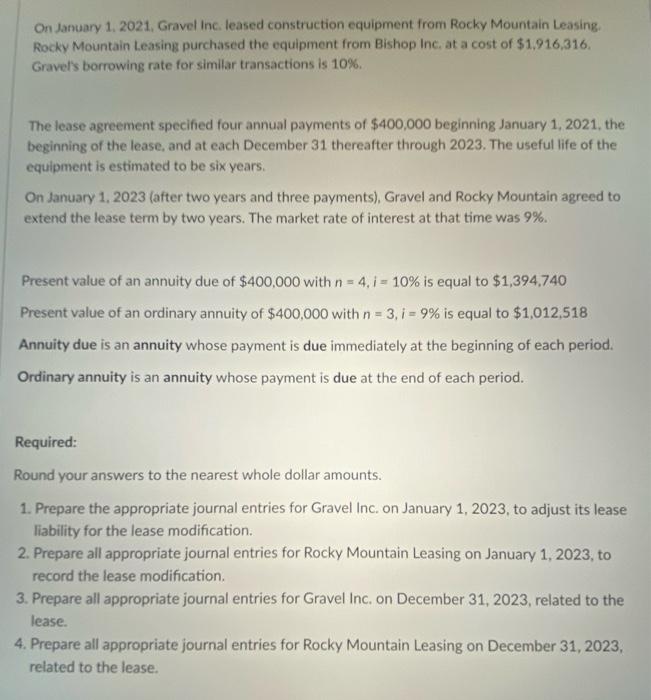

On January 1, 2021. Gravel Inc leased construction equipment from Rocky Mountain Leasing Rocky Mountain Leasing purchased the equipment from Bishop Inc, at a cost of $1.916,316. Gravel's borrowing rate for similar transactions is 10% The lease agreement specified four annual payments of $400,000 beginning January 1, 2021. the beginning of the lease, and at each December 31 thereafter through 2023. The useful life of the equipment is estimated to be six years. On January 1, 2023 (after two years and three payments), Gravel and Rocky Mountain agreed to extend the lease term by two years. The market rate of interest at that time was 9%. Present value of an annuity due of $400,000 with n = 4, i = 10% is equal to $1,394,740 Present value of an ordinary annuity of $400,000 with n = 3, i = 9% is equal to $1,012,518 Annuity due is an annuity whose payment is due immediately at the beginning of each period. Ordinary annuity is an annuity whose payment is due at the end of each period. Required: Round your answers to the nearest whole dollar amounts. 1. Prepare the appropriate journal entries for Gravel Inc. on January 1, 2023, to adjust its lease liability for the lease modification. 2. Prepare all appropriate journal entries for Rocky Mountain Leasing on January 1, 2023, to record the lease modification. 3. Prepare all appropriate journal entries for Gravel Inc. on December 31, 2023, related to the lease. 4. Prepare all appropriate journal entries for Rocky Mountain Leasing on December 31, 2023, related to the lease. On January 1, 2021. Gravel Inc leased construction equipment from Rocky Mountain Leasing Rocky Mountain Leasing purchased the equipment from Bishop Inc, at a cost of $1.916,316. Gravel's borrowing rate for similar transactions is 10% The lease agreement specified four annual payments of $400,000 beginning January 1, 2021. the beginning of the lease, and at each December 31 thereafter through 2023. The useful life of the equipment is estimated to be six years. On January 1, 2023 (after two years and three payments), Gravel and Rocky Mountain agreed to extend the lease term by two years. The market rate of interest at that time was 9%. Present value of an annuity due of $400,000 with n = 4, i = 10% is equal to $1,394,740 Present value of an ordinary annuity of $400,000 with n = 3, i = 9% is equal to $1,012,518 Annuity due is an annuity whose payment is due immediately at the beginning of each period. Ordinary annuity is an annuity whose payment is due at the end of each period. Required: Round your answers to the nearest whole dollar amounts. 1. Prepare the appropriate journal entries for Gravel Inc. on January 1, 2023, to adjust its lease liability for the lease modification. 2. Prepare all appropriate journal entries for Rocky Mountain Leasing on January 1, 2023, to record the lease modification. 3. Prepare all appropriate journal entries for Gravel Inc. on December 31, 2023, related to the lease. 4. Prepare all appropriate journal entries for Rocky Mountain Leasing on December 31, 2023, related to the lease