Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Gravy Corporation purchased a machine having an invoice price of $19,000. On January 3rd, the company incurred transportation and installation

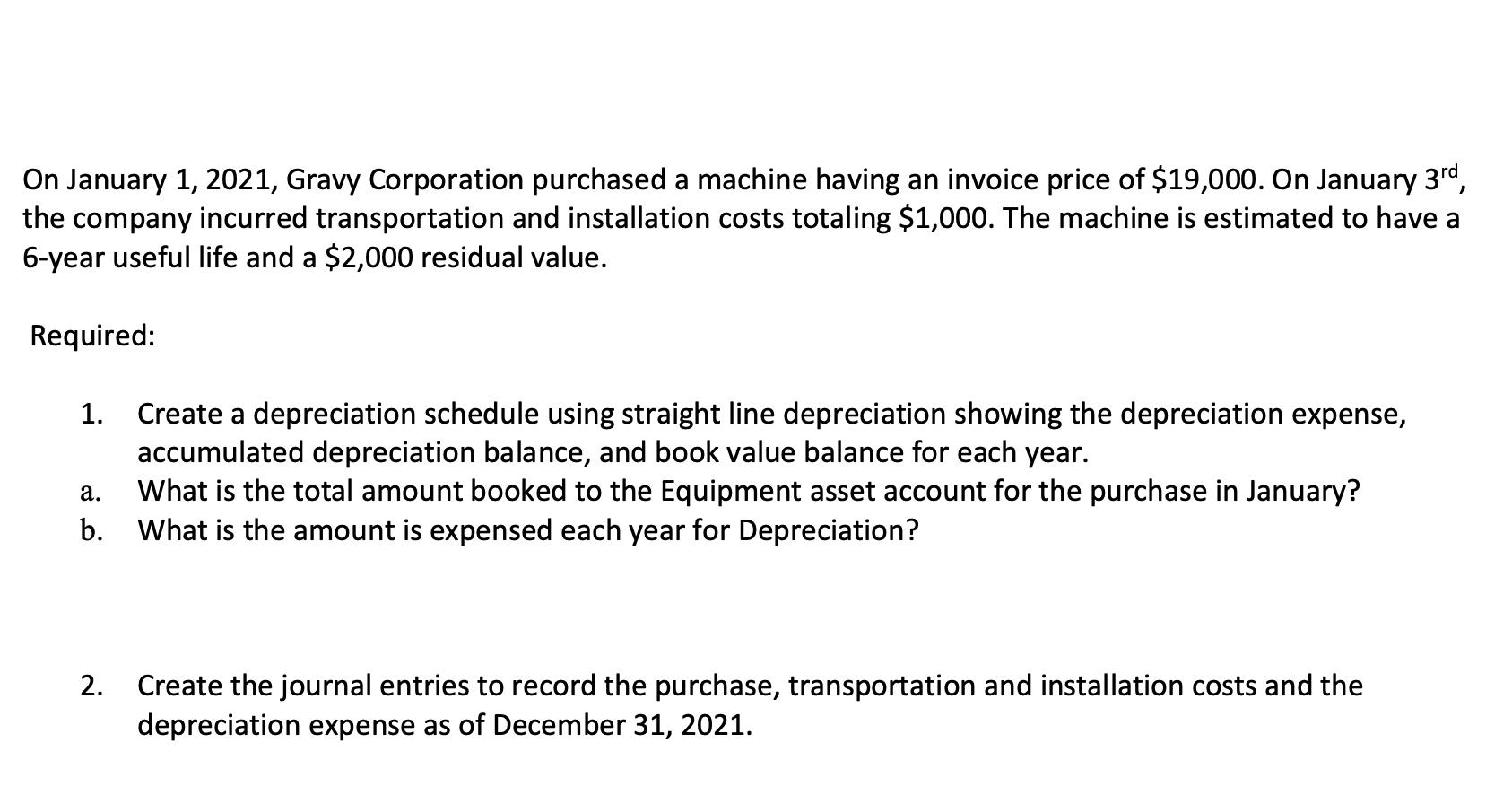

On January 1, 2021, Gravy Corporation purchased a machine having an invoice price of $19,000. On January 3rd, the company incurred transportation and installation costs totaling $1,000. The machine is estimated to have a 6-year useful life and a $2,000 residual value. Required: 1. Create a depreciation schedule using straight line depreciation showing the depreciation expense, accumulated depreciation balance, and book value balance for each year. a. What is the total amount booked to the Equipment asset account for the purchase in January? b. What is the amount is expensed each year for Depreciation? 2. Create the journal entries to record the purchase, transportation and installation costs and the depreciation expense as of December 31, 2021.

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cost of Machine 19000 Add Installation costs 1000 Total cost of machine 20000 Less Salvah...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started