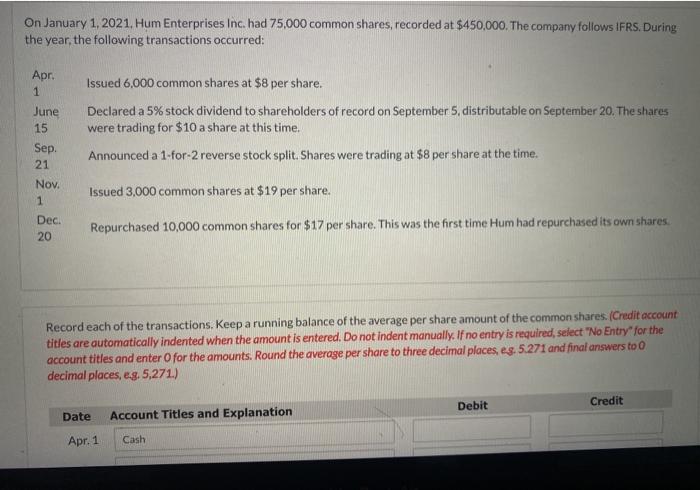

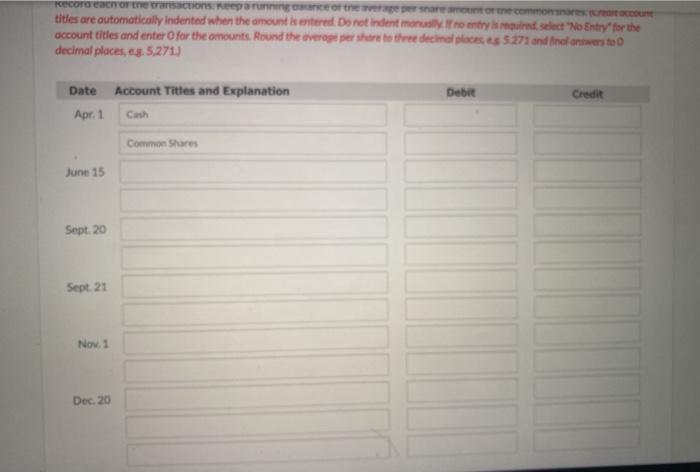

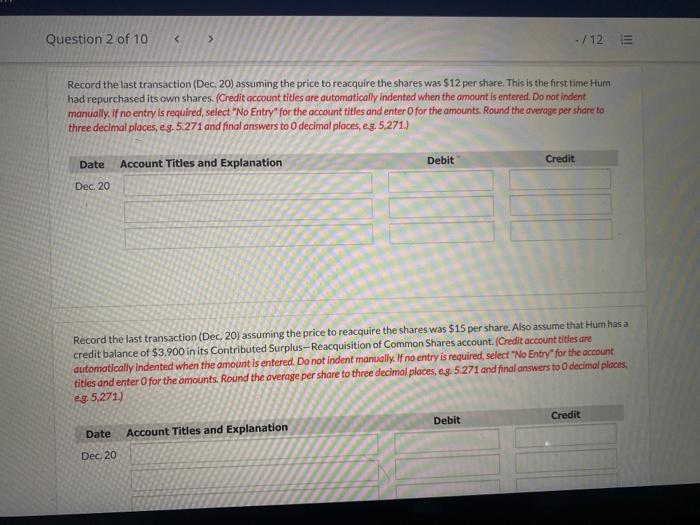

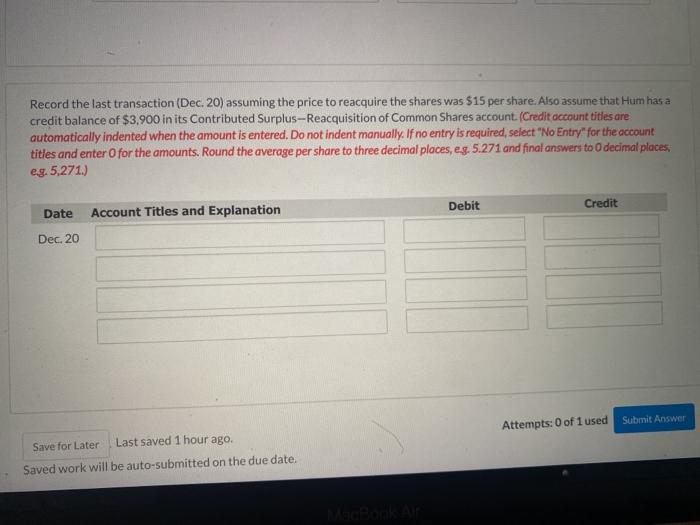

On January 1, 2021. Hum Enterprises Inc. had 75,000 common shares, recorded at $450,000. The company follows IFRS. During the year, the following transactions occurred: Issued 6,000 common shares at $8 per share. Apr. 1 June 15 Sep Declared a 5% stock dividend to shareholders of record on September 5, distributable on September 20. The shares were trading for $10 a share at this time. Announced a 1-for-2 reverse stock split. Shares were trading at $8 per share at the time. 21 Issued 3,000 common shares at $19 per share. Nov. 1 Dec. 20 Repurchased 10,000 common shares for $17 per share. This was the first time Hum had repurchased its own shares. Record each of the transactions, Keep a running balance of the average per share amount of the common shares. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round the average per share to three decimal places, es. 5.271 and final answers to o decimal places, e.g. 5,271.) Debit Credit Date Account Titles and Explanation Apr. 1 Cash Record Coreansactions, reparere pero me common tities are automatically indented when the amount is entered De not indentmond entry und select "No Entry for the account titles and enter for the amounts. Round the average per share to three decinelles 5271 and final onweto decimal places, s. 5.271) Date Account Titles and Explanation Debit Credit Apr. 1 Common Shares June 15 Sept. 20 Sept. 21 Nov. 1 Dec. 20 Question 2 of 10 > -/12 E Record the last transaction (Dec. 20) assuming the price to reacquire the shares was $12 per share. This is the first time Hum had repurchased its own shares (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round the average per share to three decimal places, eg. 5.271 and final answers to decimal places, e.g. 5,271.) Debit Credit Date Account Titles and Explanation Dec. 20 Record the last transaction (Dec. 20) assuming the price to reacquire the shares was $15 per share. Also assume that Hum has a credit balance of $3.900 in its Contributed Surplus-Reacquisition of Common Shares account. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round the average per share to three decimal places, eg: 5.271 and final answers to decimal places 29.5.271) Debit Credit Date Account Titles and Explanation Dec 20 Record the last transaction (Dec. 20) assuming the price to reacquire the shares was $15 per share. Also assume that Hum has a credit balance of $3,900 in its Contributed Surplus-Reacquisition of Common Shares account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round the average per share to three decimal places, e.g. 5.271 and final answers to decimal places, eg. 5,271.) Debit Credit Date Account Titles and Explanation Dec. 20 Submit Answer Attempts: 0 of 1 used Save for Later Last saved 1 hour ago. Saved work will be auto-submitted on the due date