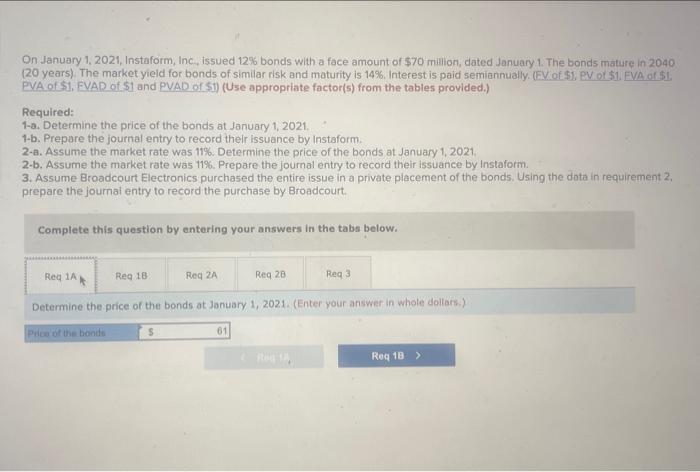

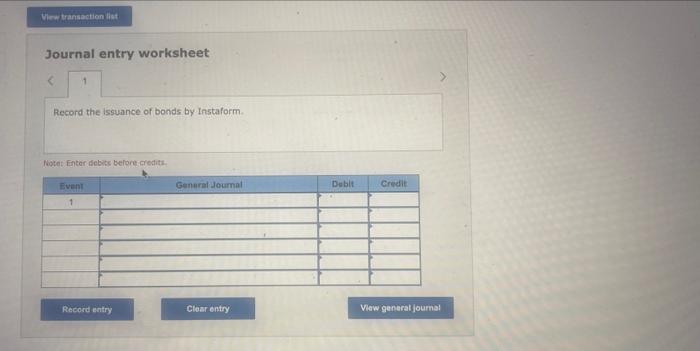

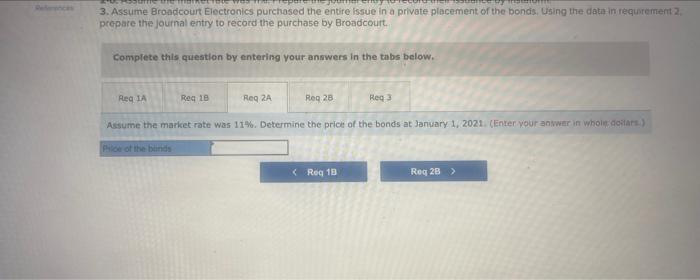

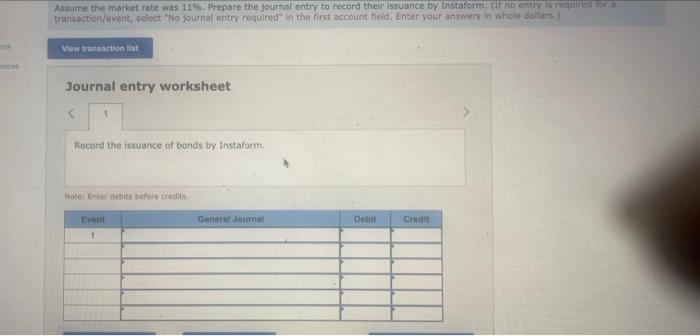

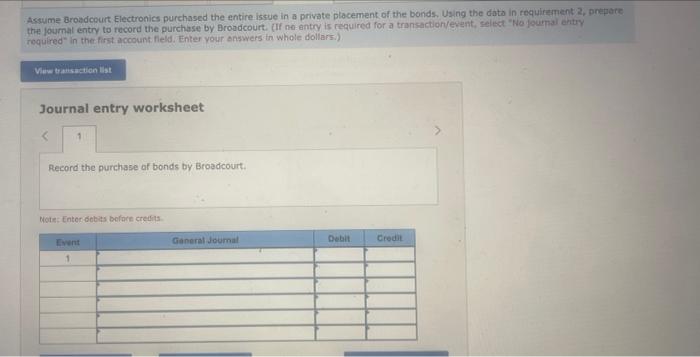

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $70 million dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (EV of $1. PV of $1. EVA of $1 PVA of $1. FVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021. 1-b. Prepare the journal entry to record their issuance by Instaform 2-a. Assume the market rate was 19%. Determine the price of the bonds at January 1, 2021 2-6. Assume the market rate was 11%. Prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt. Complete this question by entering your answers in the tabs below. Reg 2 Req1A Req 18 Reg 28 Req Determine the price of the bonds at January 1, 2021. (Enter your answer in whole dollars.) Piloo of the bondo 61 Roq 18 > View transaction lit Journal entry worksheet Record the issuance of bonds by Instaform Note Enter debit before credit General Journal Dubit Credit Event 1 Record entry Clear entry View general Journal 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2 prepare the journal entry to record the purchase by Broadcourt Complete this question by entering your answers in the tabs below. REQIA Reg 1B Reg 2A Reg 28 Reg 2 Assume the market rate was 11%. Determine the price of the bonds at January 1, 2021. (Enter your anwar in whol dors) Po of the blinds Assume the market rate was 11%. Prepare the journal entry to record their issuance by Instaform. (ll no entry is qui transaction/event, select "No journal entry required in the first account Meld. Enter your answers in whole dollars.) View transactionist Journal entry worksheet 1 Record the issuance of bonds by Instaform Note: Enter debit before credits Eva General Journal Dobit Credit 1 Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt. (If ne entry is required for a transaction/event, select "No journal entry required in the first account feld. Enter your answers in whole dollars.) View transaction ist Journal entry worksheet > 1 Record the purchase of bonds by Broadcourt. Not: Enter debits before credits Event General Journal Debit Credit 1