Question

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $75 million, dated January 1. The bonds mature in 2040 (20

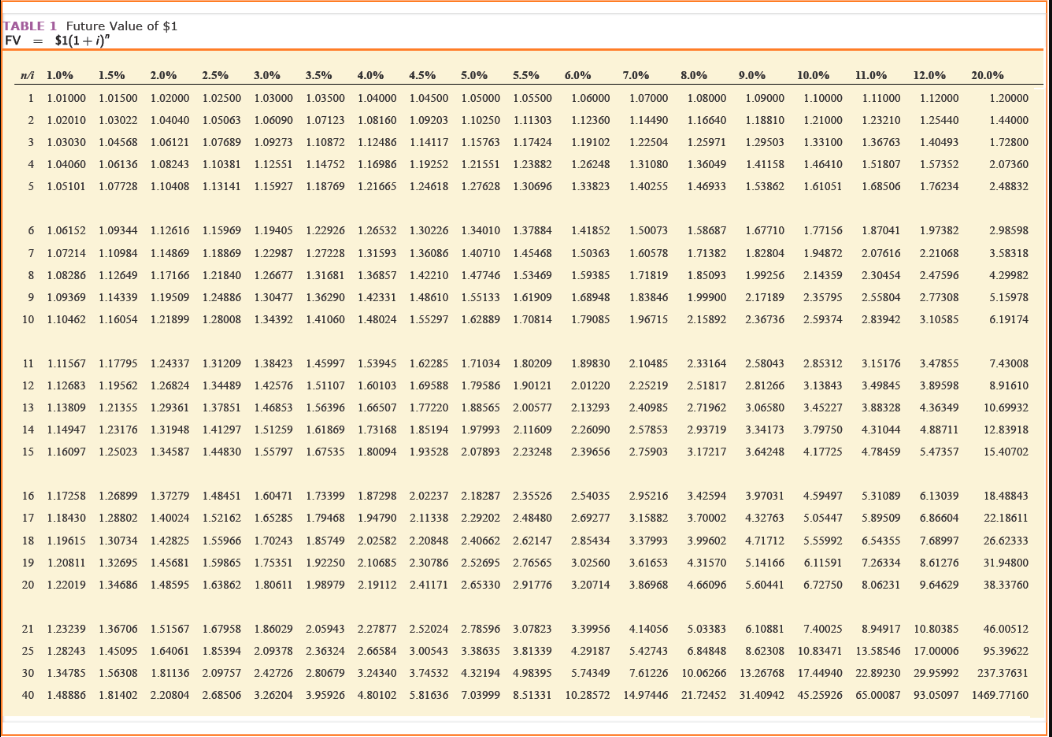

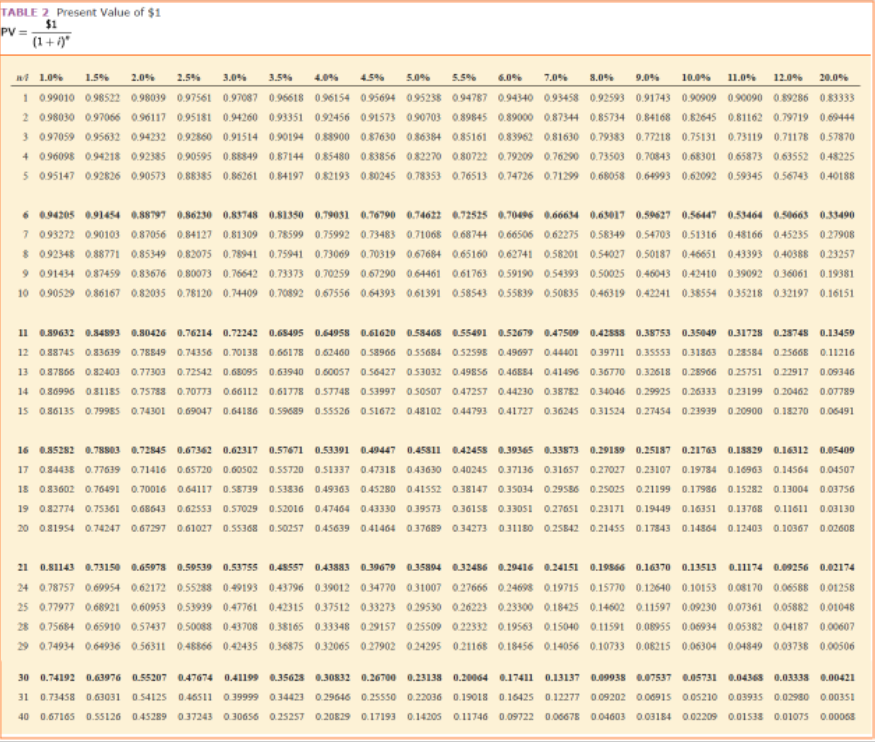

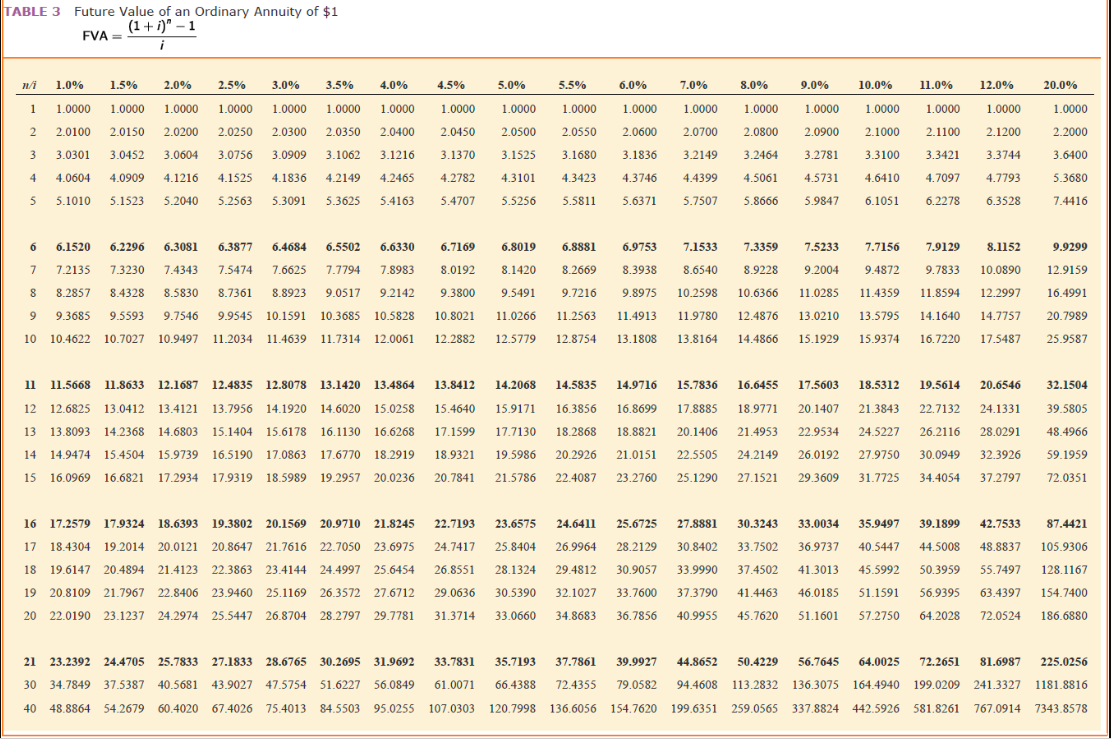

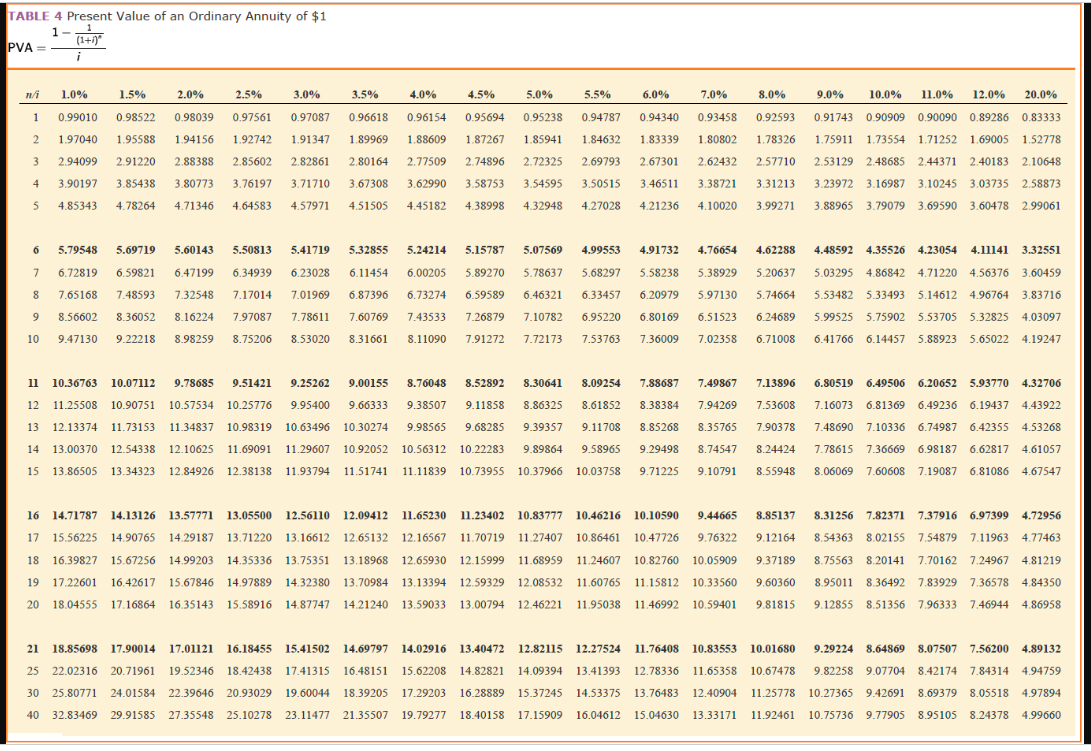

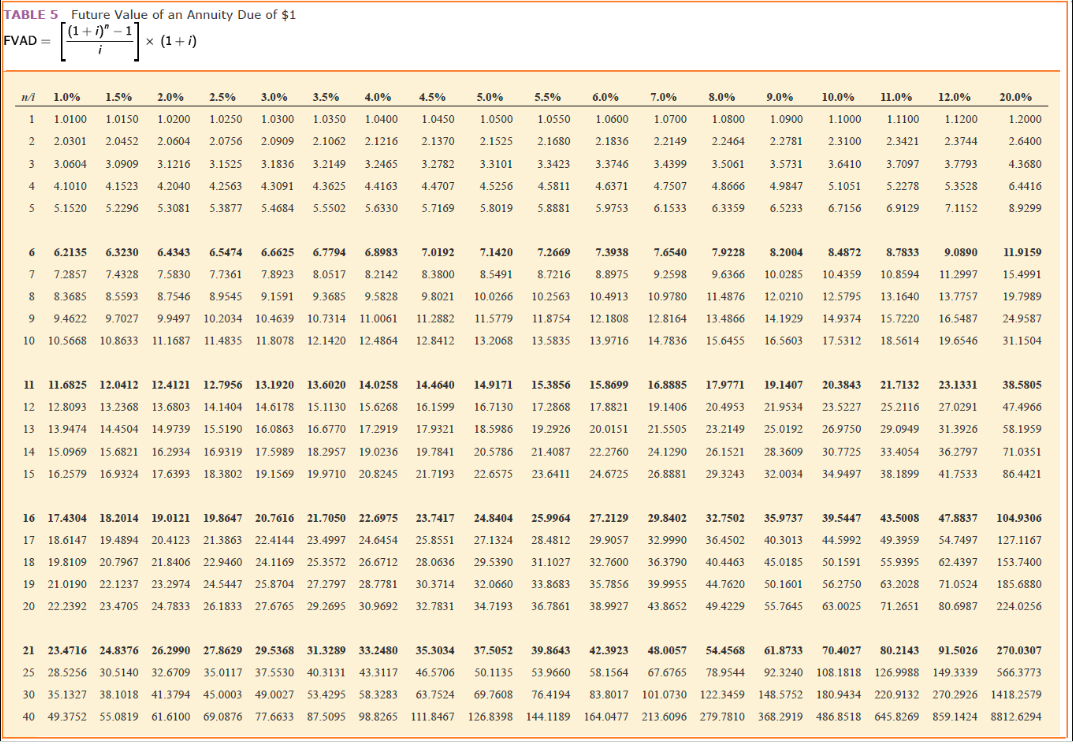

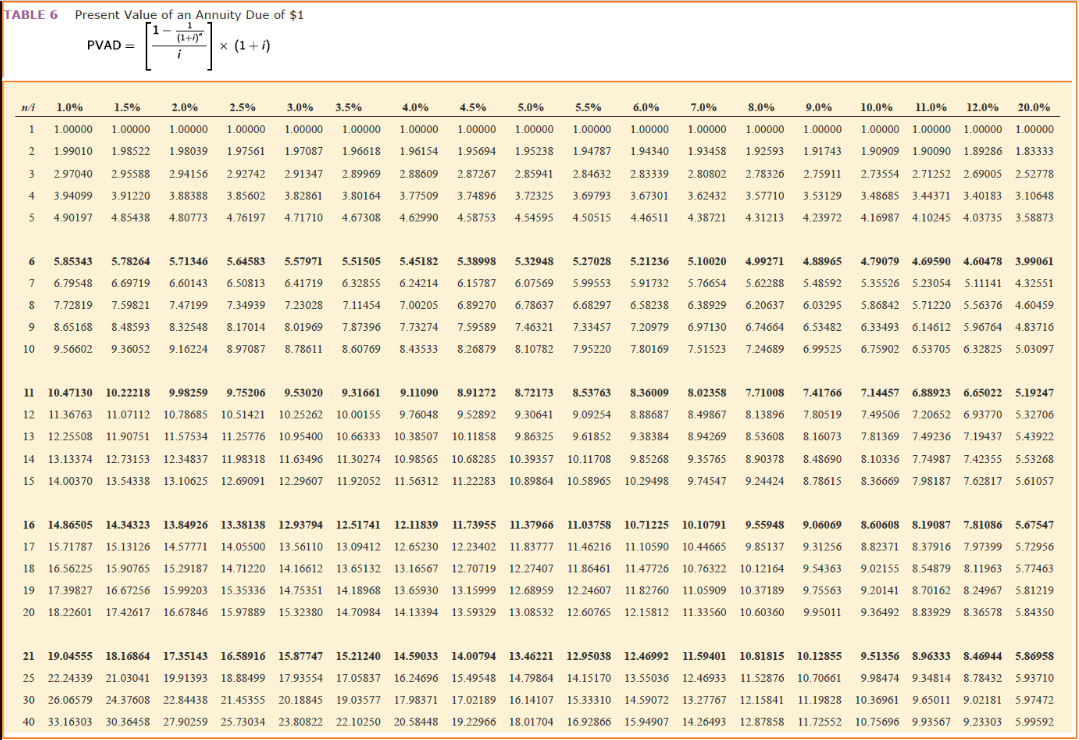

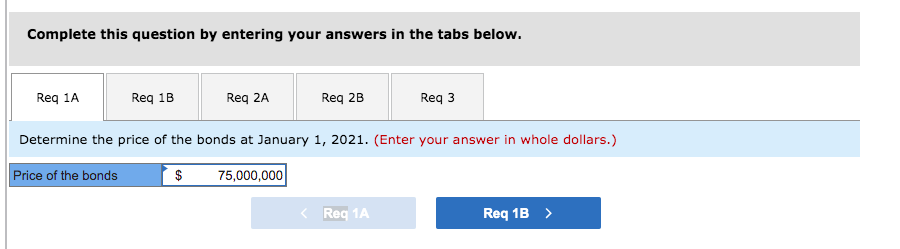

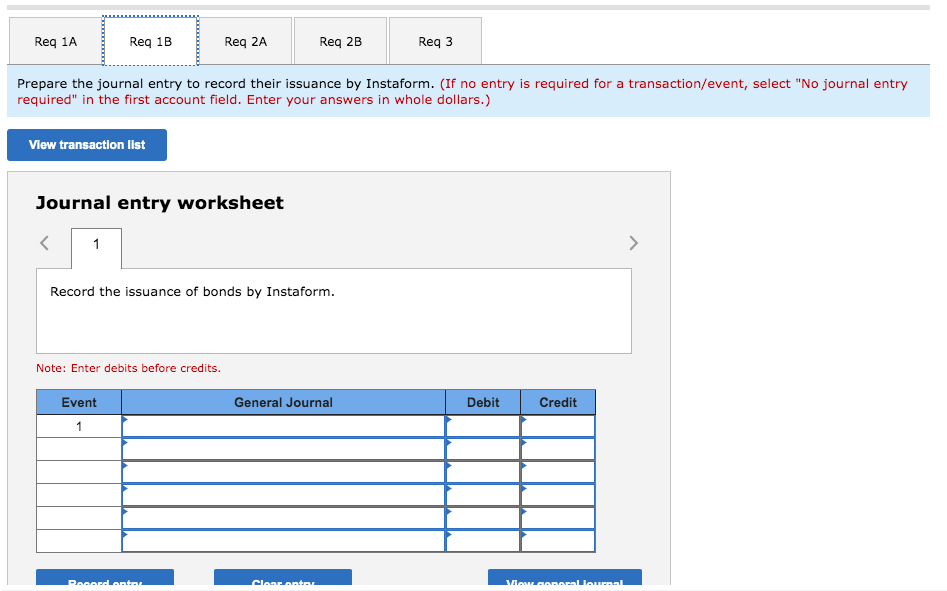

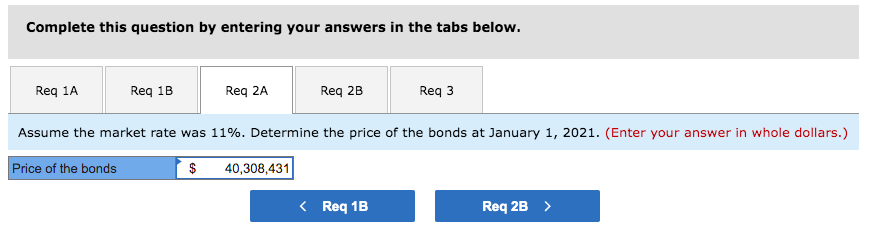

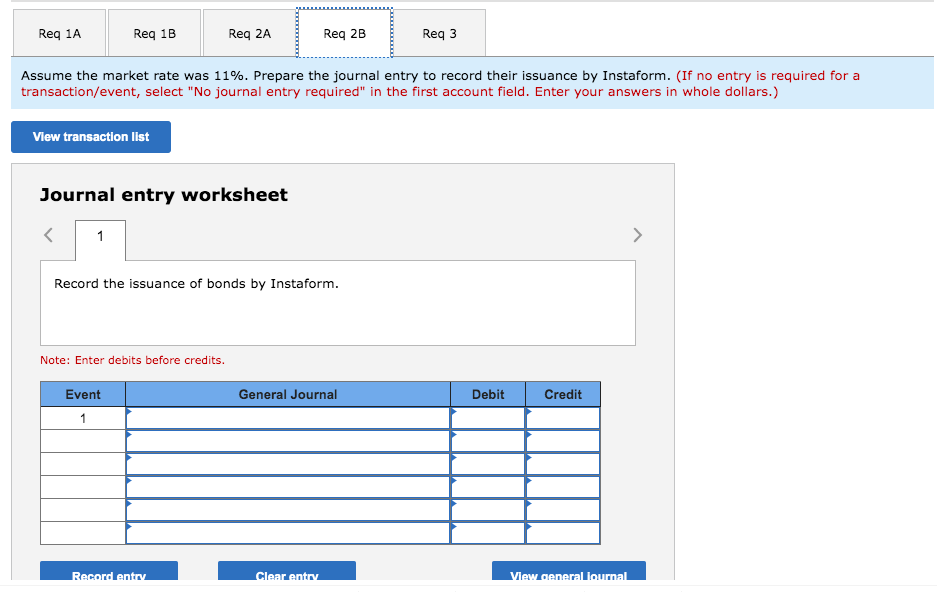

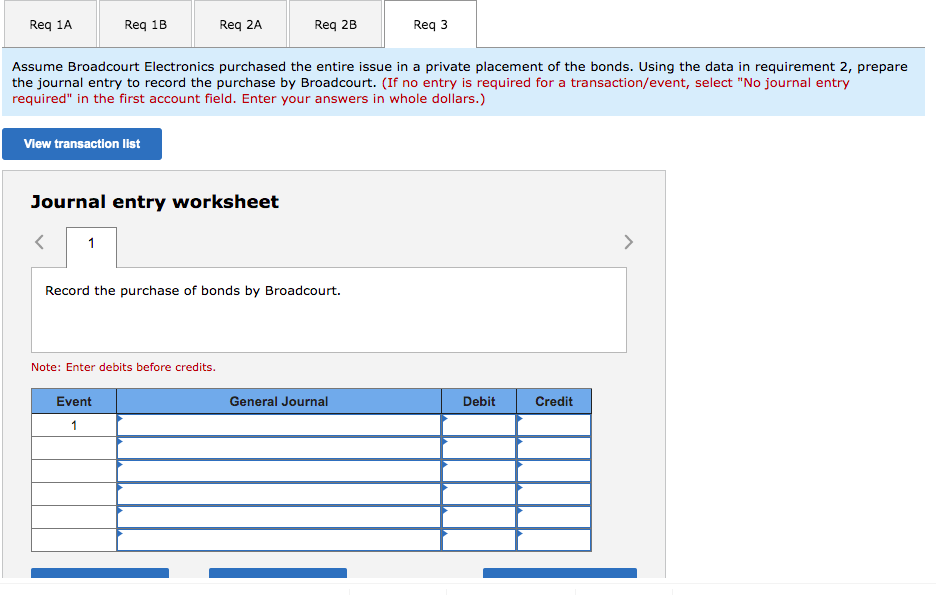

On January 1, 2021, Instaform, Inc., issued 12% bonds with a face amount of $75 million, dated January 1. The bonds mature in 2040 (20 years). The market yield for bonds of similar risk and maturity is 14%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Determine the price of the bonds at January 1, 2021. 1-b. Prepare the journal entry to record their issuance by Instaform. 2-a. Assume the market rate was 11%. Determine the price of the bonds at January 1, 2021. 2-b. Assume the market rate was 11%. Prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started