On January 1, 2021, Ithaca Corp. purchases Cortland Inc. bonds that have a face value of $290,000. The Cortland bonds have a stated interest rate of 6%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds of similar risk and maturity, the market yield on particular dates is as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.):

| | | |

| January 1, 2021 | 7.0 | % |

| June 30, 2021 | 8.0 | % |

| December 31, 2021 | 9.0 | % |

| |

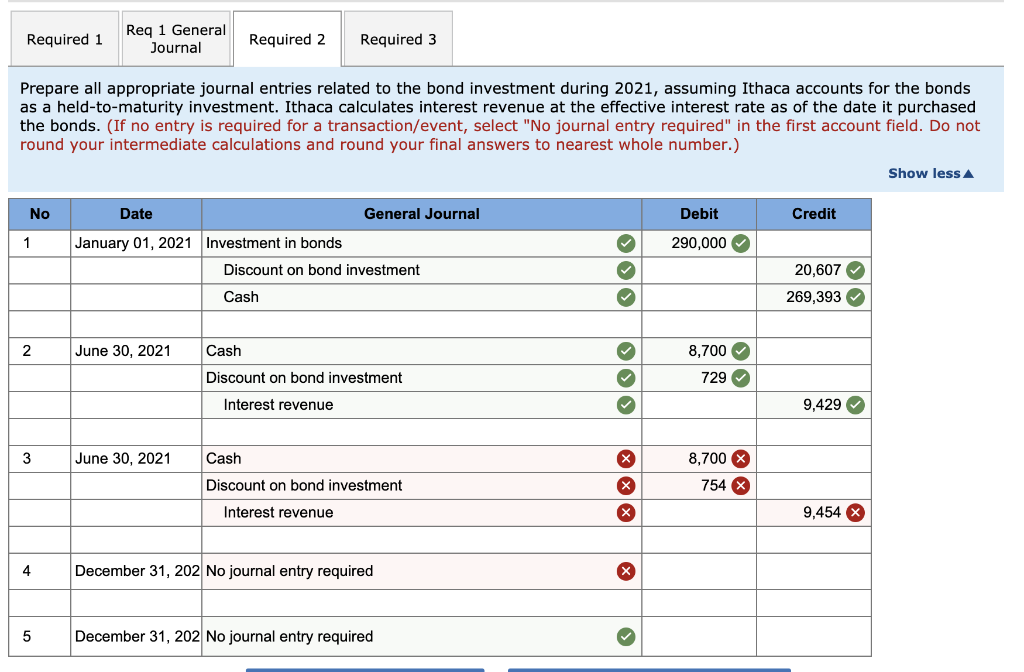

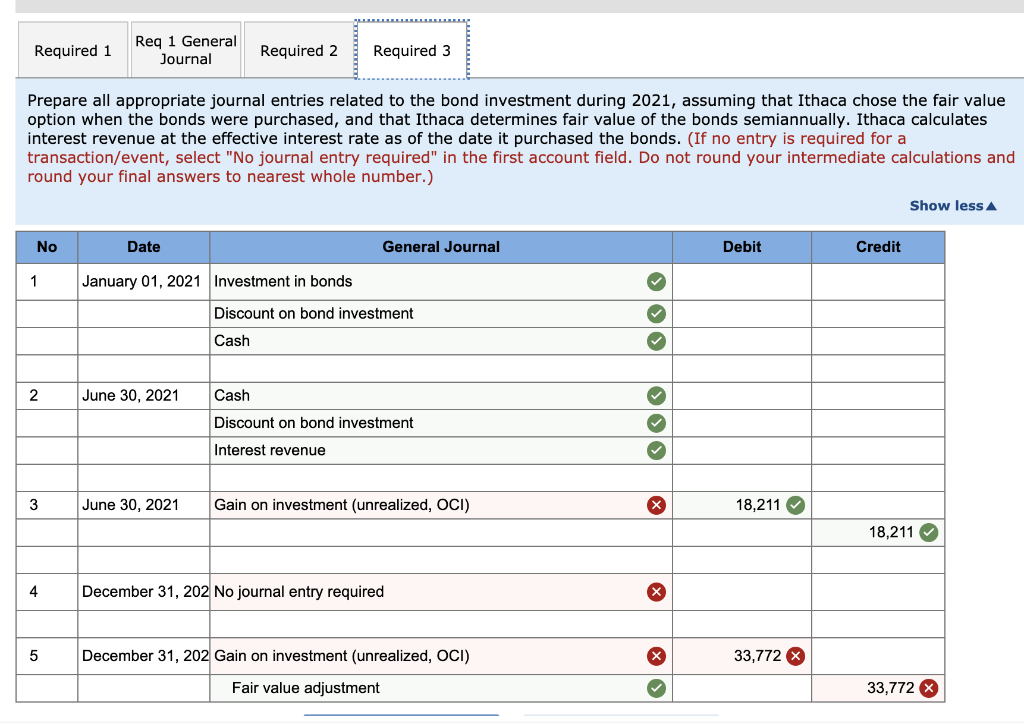

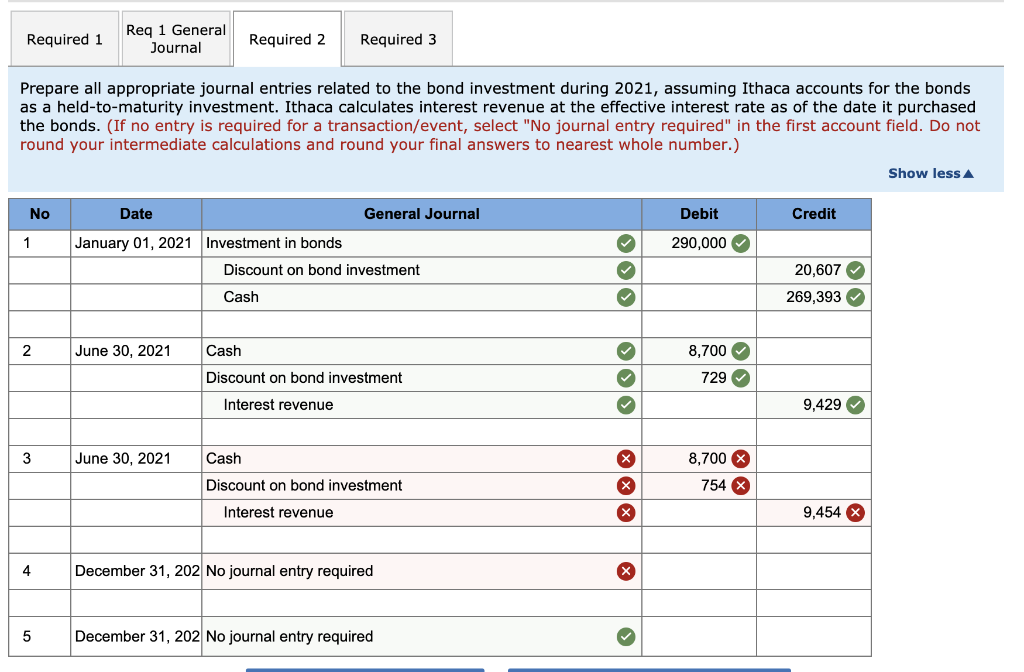

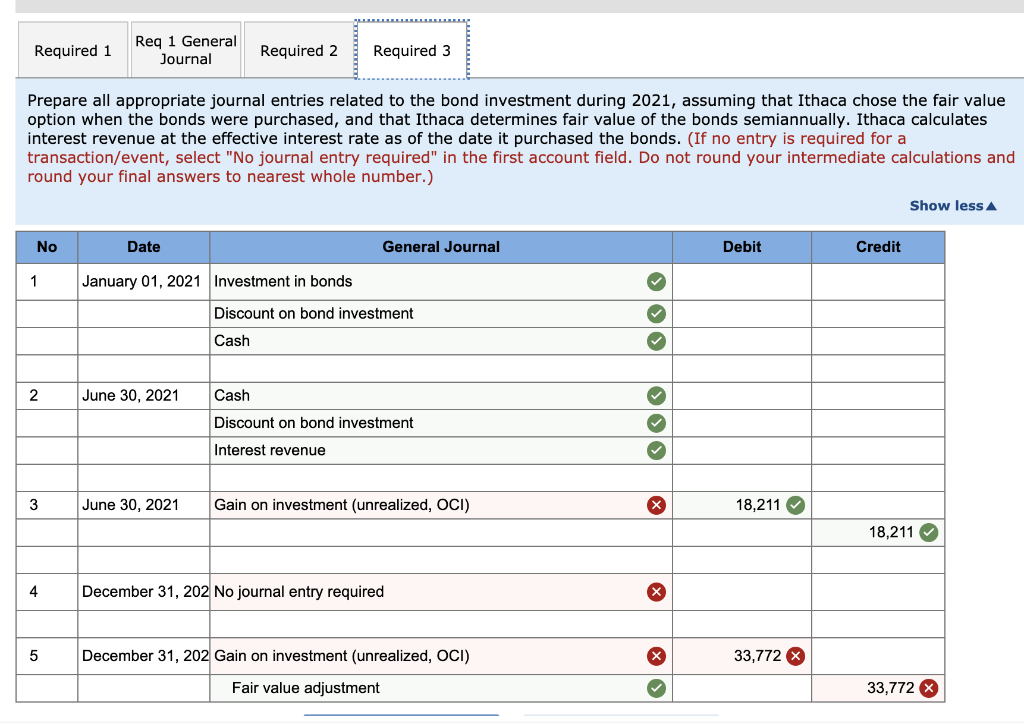

Required: 1. Calculate the price Ithaca would have paid for the Cortland bonds on January 1, 2021 (ignoring brokerage fees), and prepare a journal entry to record the purchase. 2. Prepare all appropriate journal entries related to the bond investment during 2021, assuming Ithaca accounts for the bonds as a held-to-maturity investment. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. 3. Prepare all appropriate journal entries related to the bond investment during 2021, assuming that Ithaca chose the fair value option when the bonds were purchased, and that Ithaca determines fair value of the bonds semiannually. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds.

Required 1 Req 1 General Journal Required 2 Required 3 Prepare all appropriate journal entries related to the bond investment during 2021, assuming Ithaca accounts for the bonds as a held-to-maturity investment. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations and round your final answers to nearest whole number.) Show less No Date General Journal Debit Credit 1 January 01, 2021 Investment in bonds 290,000 Discount on bond investment 20,607 Cash 269,393 2 June 30, 2021 Cash 8,700 00 Discount on bond investment 729 Interest revenue 9,429 3 June 30, 2021 x Cash Discount on bond investment 8,700 X 754 Interest revenue 9,454 X 4 December 31, 202 No journal entry required 5 December 31, 202 No journal entry required Required 1 Reg 1 General Journal Required 2 Required 3 Prepare all appropriate journal entries related to the bond investment during 2021, assuming that Ithaca chose the fair value option when the bonds were purchased, and that Ithaca determines fair value of the bonds semiannually. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations and round your final answers to nearest whole number.) Show less No Date General Journal Debit Credit 1 January 01, 2021 Investment in bonds Discount on bond investment Cash 2 June 30, 2021 Cash Discount on bond investment Interest revenue 3 June 30, 2021 Gain on investment (unrealized, OCI) x 18,211 18,211 4 December 31, 202 No journal entry required 5 December 31, 202 Gain on investment (unrealized, OCI) 33,772 Fair value adjustment 33,772 X Required 1 Req 1 General Journal Required 2 Required 3 Prepare all appropriate journal entries related to the bond investment during 2021, assuming Ithaca accounts for the bonds as a held-to-maturity investment. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations and round your final answers to nearest whole number.) Show less No Date General Journal Debit Credit 1 January 01, 2021 Investment in bonds 290,000 Discount on bond investment 20,607 Cash 269,393 2 June 30, 2021 Cash 8,700 00 Discount on bond investment 729 Interest revenue 9,429 3 June 30, 2021 x Cash Discount on bond investment 8,700 X 754 Interest revenue 9,454 X 4 December 31, 202 No journal entry required 5 December 31, 202 No journal entry required Required 1 Reg 1 General Journal Required 2 Required 3 Prepare all appropriate journal entries related to the bond investment during 2021, assuming that Ithaca chose the fair value option when the bonds were purchased, and that Ithaca determines fair value of the bonds semiannually. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations and round your final answers to nearest whole number.) Show less No Date General Journal Debit Credit 1 January 01, 2021 Investment in bonds Discount on bond investment Cash 2 June 30, 2021 Cash Discount on bond investment Interest revenue 3 June 30, 2021 Gain on investment (unrealized, OCI) x 18,211 18,211 4 December 31, 202 No journal entry required 5 December 31, 202 Gain on investment (unrealized, OCI) 33,772 Fair value adjustment 33,772 X