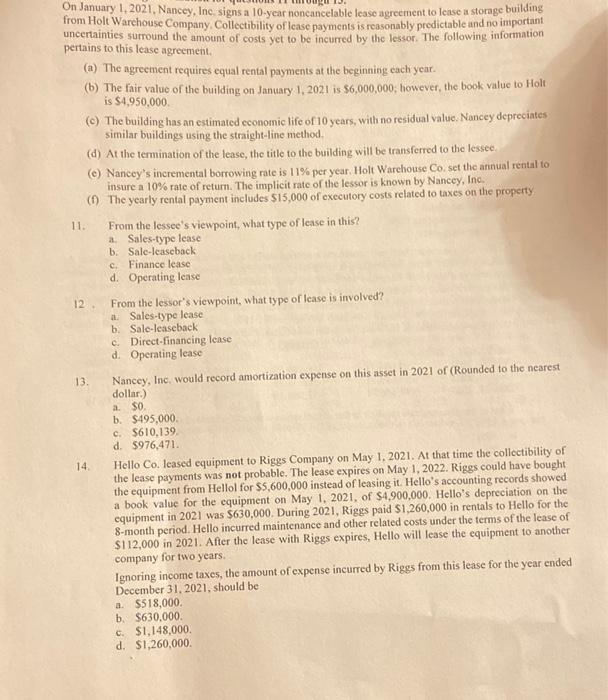

On January 1, 2021. Nancey, Ine, signs a 10-ycar noncancelable lease agreement to lease a storage building from Holt Warchouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement. (a) The agreement requires equal rental payments at the beginning each year. (b) The fair value of the building on January 1,2021 is $6,000,000, however, the book value to Holt is $4,950,000. (c) The building has an estimated cconomic life of 10 years, with no residual value. Nancey depreciates similar buildings using the stright-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (c) Nancey's incremental borrowing rate is 11% per year. Holt Warchouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Nancey, Inc. (f) The yearly rental payment includes $15,000 of executory costs related to taxes on the property 11. Erom the lessee's viewpoint, what type of lease in this? a. Sales-type lease b. Sale-leaseback c. Finance lease d. Operating lease 12. From the lessor's viewpoint, what type of lease is involved? a. Sales-type lease b. Sale-leaseback c. Direct-financing lease d. Operating lease 13. Nancey, Inc, would record amortization expense on this asset in 2021 of (Rounded to the nearest dollar.) a. 50 . b. $495,000. c. $610,139, d. $976,471. 14. Hello Co. leased equipment to Riggs Company on May 1, 2021. At that time the collectibility of the lease payments was not probable. The lease expires on May 1, 2022. Riggs could have bought the equipment from Hellol for $5,600,000 instead of leasing it. Hello's accounting records showed a book value for the equipment on May 1, 2021, of $4,900,000. Hello's depreciation on the equipment in 2021 was $630,000. During 2021, Riggs paid $1,260,000 in rentals to Hello for the 8 -month period. Hello incurred maintenance and other related costs under the terms of the lease of $112,000 in 2021. After the lease with Riggs expires, Hello will lease the equipment to another company for two years. Ignoring income taxes, the amount of expense incurred by Riggs from this lease for the year ended December 31, 2021, should be a. $518,000. b. $630.000 c. $1,148,000 d. $1,260,000