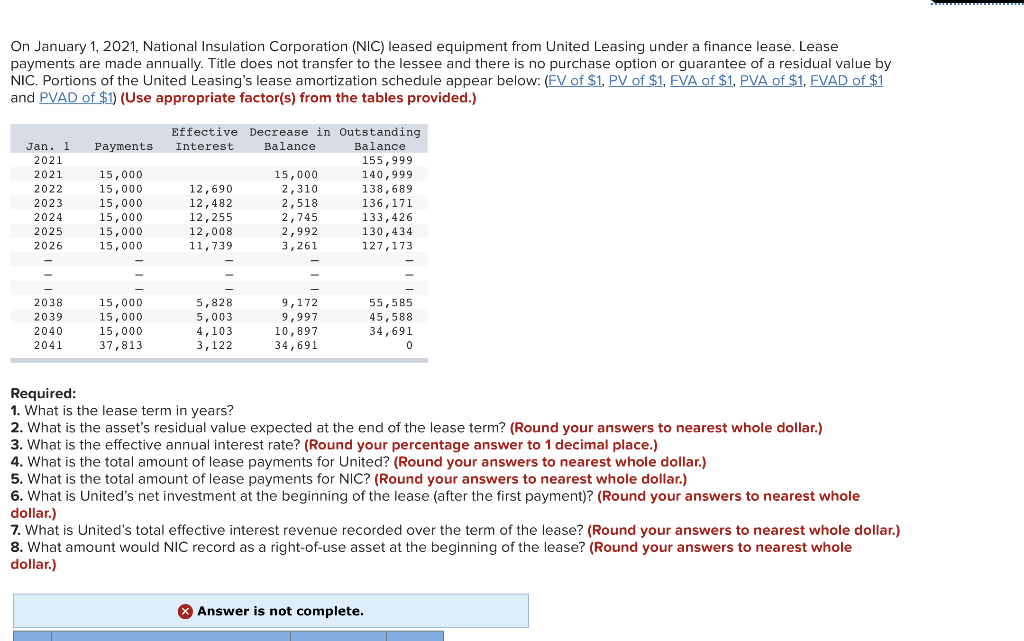

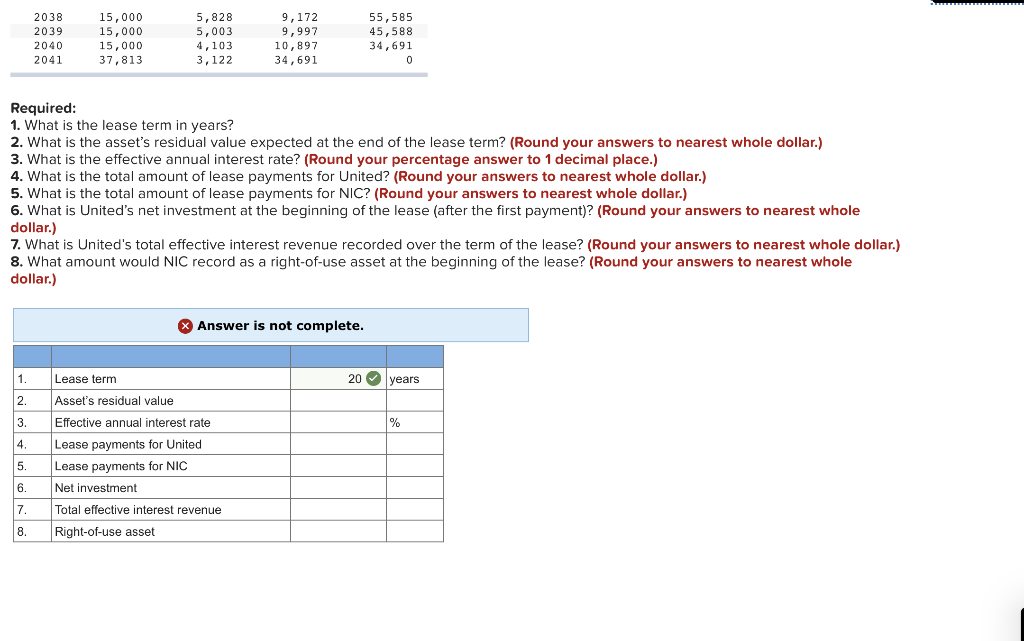

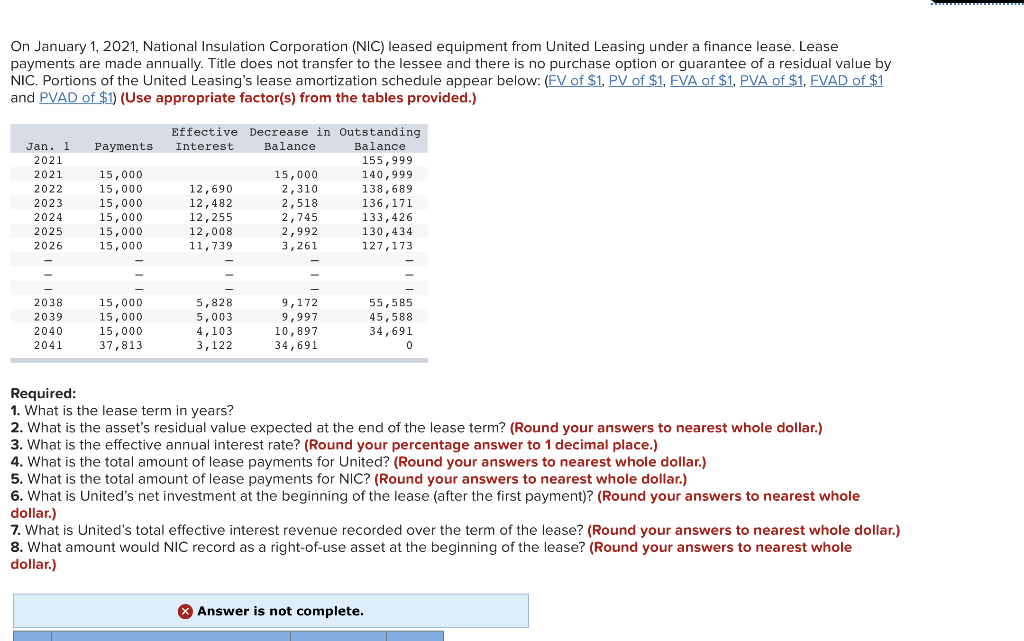

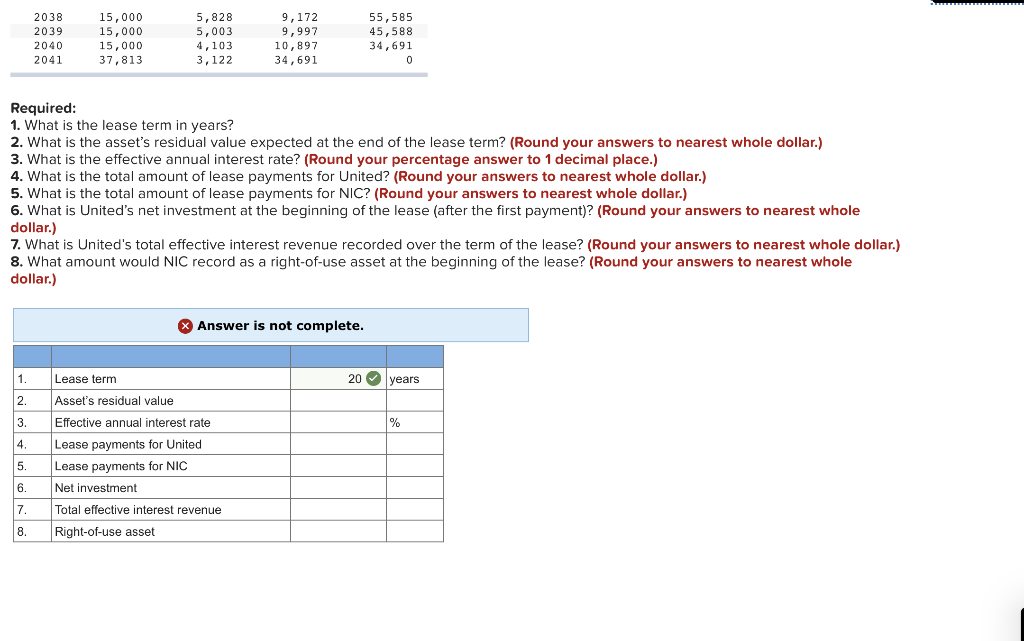

On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Payments Jan. 1 2021 2021 2022 2023 2024 2025 2026 15,000 15,000 15,000 15,000 15,000 15,000 Effective Decrease in Outstanding Interest Balance Balance 155,999 15,000 140,999 12,690 2,310 138,689 12,482 2,518 136,171 12,255 2,745 133,426 12,008 2,992 130, 434 11,739 3,261 127,173 2038 2039 2040 2041 15,000 15,000 15,000 37,813 5,828 5,003 4,103 3,122 9,172 9,997 10,897 34,691 55,585 45,588 34,691 Required: 1. What is the lease term in years? 2. What is the asset's residual value expected at the end of the lease term? (Round your answers to nearest whole dollar.) 3. What is the effective annual interest rate? (Round your percentage answer to 1 decimal place.) 4. What is the total amount of lease payments for United? (Round your answers to nearest whole dollar.) 5. What is the total amount of lease payments for NIC? (Round your answers to nearest whole dollar.) 6. What is United's net investment at the beginning of the lease (after the first payment)? (Round your answers to nearest whole dollar.) 7. What is United's total effective interest revenue recorded over the term of the lease? (Round your answers to nearest whole dollar.) 8. What amount would NIC record as a right-of-use asset at the beginning of the lease? (Round your answers to nearest whole dollar.) Answer is not complete. 2038 15,000 203915,000 2040 15,000 2041 37,813 5,828 5,003 9,172 9,997 10,897 34,691 55,585 45,588 34,691 4,103 3,122 Required: 1. What is the lease term in years? 2. What is the asset's residual value expected at the end of the lease term? (Round your answers to nearest whole dollar.) 3. What is the effective annual interest rate? (Round your percentage answer to 1 decimal place.) 4. What is the total amount of lease payments for United? (Round your answers to nearest whole dollar.) 5. What is the total amount of lease payments for NIC? (Round your answers to nearest whole dollar.) 6. What is United's net investment at the beginning of the lease (after the first payment)? (Round your answers to nearest whole dollar.) 7. What is United's total effective interest revenue recorded over the term of the lease? (Round your answers to nearest whole dollar.) 8. What amount would NIC record as a right-of-use asset at the beginning of the lease? (Round your answers to nearest whole dollar.) X Answer is not complete. 1. 20 years 3. Lease term Asset's residual value Effective annual interest rate Lease payments for United Lease payments for NIC Net investment Total effective interest revenue Right-of-use asset 8. On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Payments Jan. 1 2021 2021 2022 2023 2024 2025 2026 15,000 15,000 15,000 15,000 15,000 15,000 Effective Decrease in Outstanding Interest Balance Balance 155,999 15,000 140,999 12,690 2,310 138,689 12,482 2,518 136,171 12,255 2,745 133,426 12,008 2,992 130, 434 11,739 3,261 127,173 2038 2039 2040 2041 15,000 15,000 15,000 37,813 5,828 5,003 4,103 3,122 9,172 9,997 10,897 34,691 55,585 45,588 34,691 Required: 1. What is the lease term in years? 2. What is the asset's residual value expected at the end of the lease term? (Round your answers to nearest whole dollar.) 3. What is the effective annual interest rate? (Round your percentage answer to 1 decimal place.) 4. What is the total amount of lease payments for United? (Round your answers to nearest whole dollar.) 5. What is the total amount of lease payments for NIC? (Round your answers to nearest whole dollar.) 6. What is United's net investment at the beginning of the lease (after the first payment)? (Round your answers to nearest whole dollar.) 7. What is United's total effective interest revenue recorded over the term of the lease? (Round your answers to nearest whole dollar.) 8. What amount would NIC record as a right-of-use asset at the beginning of the lease? (Round your answers to nearest whole dollar.) Answer is not complete. 2038 15,000 203915,000 2040 15,000 2041 37,813 5,828 5,003 9,172 9,997 10,897 34,691 55,585 45,588 34,691 4,103 3,122 Required: 1. What is the lease term in years? 2. What is the asset's residual value expected at the end of the lease term? (Round your answers to nearest whole dollar.) 3. What is the effective annual interest rate? (Round your percentage answer to 1 decimal place.) 4. What is the total amount of lease payments for United? (Round your answers to nearest whole dollar.) 5. What is the total amount of lease payments for NIC? (Round your answers to nearest whole dollar.) 6. What is United's net investment at the beginning of the lease (after the first payment)? (Round your answers to nearest whole dollar.) 7. What is United's total effective interest revenue recorded over the term of the lease? (Round your answers to nearest whole dollar.) 8. What amount would NIC record as a right-of-use asset at the beginning of the lease? (Round your answers to nearest whole dollar.) X Answer is not complete. 1. 20 years 3. Lease term Asset's residual value Effective annual interest rate Lease payments for United Lease payments for NIC Net investment Total effective interest revenue Right-of-use asset 8