Question

On January 1, 2021, Patterson Corporation exchanged $3,200,000 cash for 100 percent of the outstanding voting stock of Shapiro Corporation. On the acquisition date, Shapiro

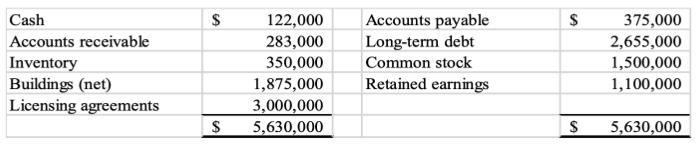

On January 1, 2021, Patterson Corporation exchanged $3,200,000 cash for 100 percent of the outstanding voting stock of Shapiro Corporation. On the acquisition date, Shapiro had the following balance sheet:

On the acquisition date, a building with a 10-year remaining life was undervalued (i.e., book value is lower than fair value) on Shapiro’s financial records by $300,000. Licensing agreements, due to expire in 5 years, were overvalued (i.e., book value is higher than fair value) on Shapiro’s records by $100,000. Any remaining excess fair value over book value was attributed to goodwill.

On December 31, 2022, Shapiro's accounts payable included an $85,000 current liability owed to Patterson. Shapiro Corporation continues its separate legal existence as a wholly-owned subsidiary of Patterson with independent accounting records.

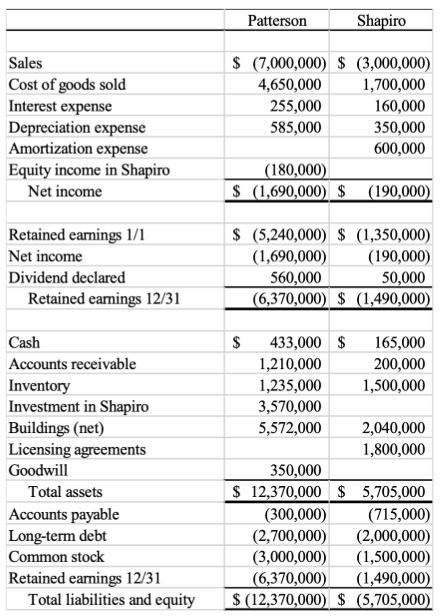

The separate financial statements for the two companies for the year ending December 31, 2022, are presented below and in the first three columns of the consolidation, worksheet provided.

Credit balances are indicated by parentheses.

Required:

1. Prepare Patterson's acquisition-date fair-value allocation for its investment in Shapiro. Calculate the excess value of net assets, the annual excess amortization, and the goodwill created if any.

2. Given the information provided, determine all entries made to Investment in Shapiro in Patterson’s book during 2022. Show the t-account, the beginning Investment balance on January 1, 2022, all entries posted during 2022, and the ending balance on December 31, 2022. (Hint: Work backward from the Investment balance on 12.31.22 to obtain the Investment balance on 1.1.22.)

3. Complete the provided consolidation worksheet (in Excel) as of December 31, 2022, by:

Preparing the consolidation entries. (Show the list of entries before posting them into the worksheet.)

Determining the consolidated totals

Cash Accounts receivable Inventory Buildings (net) Licensing agreements $ $ 122,000 283,000 350,000 1,875,000 3,000,000 5,630,000 Accounts payable Long-term debt Common stock Retained earnings $ $ 375,000 2,655,000 1,500,000 1,100,000 5,630,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Excess value of net assets 3000000 2630000 370000 Annual exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started