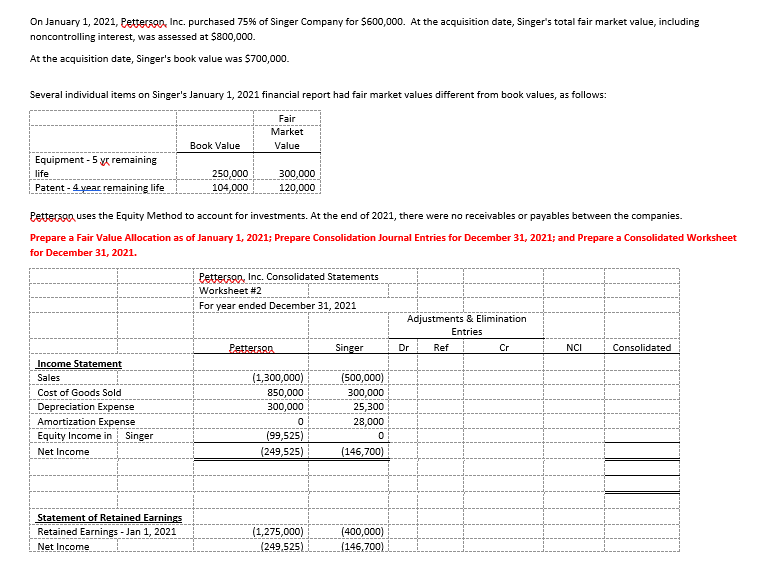

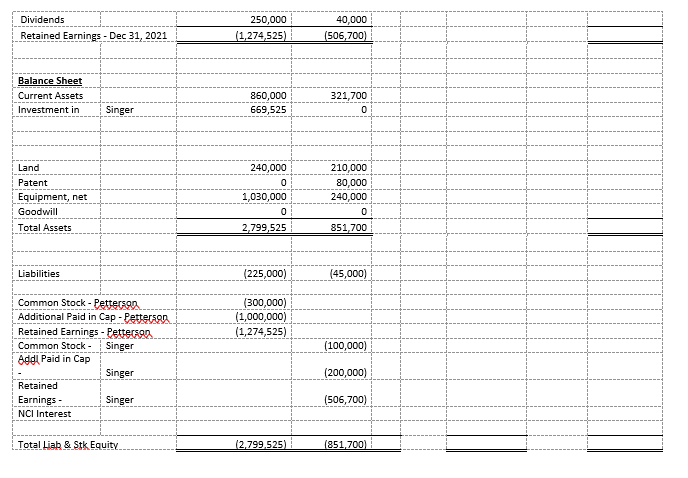

On January 1, 2021, Petterson, Inc. purchased 75% of Singer Company for $600,000. At the acquisition date, Singer's total fair market value, including noncontrolling interest, was assessed at $800,000. At the acquisition date, Singer's book value was $700,000. Several individual items on Singer's January 1, 2021 financial report had fair market values different from book values, as follows: Fair Market Value Book Value Equipment - 5 xe remaining life Patent - 4 year remaining life 250,000 104,000 300,000 120,000 Pettersea uses the Equity Method to account for investments. At the end of 2021, there were no receivables or payables between the companies. Prepare a Fair Value Allocation as of January 1, 2021; Prepare Consolidation Journal Entries for December 31, 2021; and Prepare a Consolidated Worksheet for December 31, 2021. Petterson, Inc. Consolidated Statements Worksheet #2 For year ended December 31, 2021 Adjustments & Elimination Entries Dr Ref Cr Petterson Singer NCI Consolidated Income Statement Sales Cost of Goods Sold Depreciation Expense Amortization Expense Equity Income in Singer Net Income (1,300,000) 850,000 300,000 0 (99,525) (249,525) (500,000) 300,000 25,300 28,000 0 (146,700) Statement of Retained Earnings Retained Earnings - Jan 1, 2021 Net Income (1,275,000) (249,525) (400,000) (146,7001 Dividends Retained Earnings - Dec 31, 2021 250,000 (1,274,525) 40,000 (506,700) Balance Sheet Current Assets Investment in 860,000 669,525 321,700 0 Singer Land Patent Equipment, net Goodwill Total Assets 240,000 0 1,030,000 0 2,799,525 210,000 80,000 240,000 0 851,700 Liabilities (225,000) (45,000) (300,000) (1,000,000) (1,274,525) (100,000) Common Stock - Pettersen Additional Paid in Cap - Pettersen Retained Earnings - Pettersen Common Stock- Singer Addl Paid in Cap Singer Retained Earnings - Singer NCI Interest (200,000) (506,700) Total Liab & Stk Equity (2,799,525) (851.700) On January 1, 2021, Petterson, Inc. purchased 75% of Singer Company for $600,000. At the acquisition date, Singer's total fair market value, including noncontrolling interest, was assessed at $800,000. At the acquisition date, Singer's book value was $700,000. Several individual items on Singer's January 1, 2021 financial report had fair market values different from book values, as follows: Fair Market Value Book Value Equipment - 5 xe remaining life Patent - 4 year remaining life 250,000 104,000 300,000 120,000 Pettersea uses the Equity Method to account for investments. At the end of 2021, there were no receivables or payables between the companies. Prepare a Fair Value Allocation as of January 1, 2021; Prepare Consolidation Journal Entries for December 31, 2021; and Prepare a Consolidated Worksheet for December 31, 2021. Petterson, Inc. Consolidated Statements Worksheet #2 For year ended December 31, 2021 Adjustments & Elimination Entries Dr Ref Cr Petterson Singer NCI Consolidated Income Statement Sales Cost of Goods Sold Depreciation Expense Amortization Expense Equity Income in Singer Net Income (1,300,000) 850,000 300,000 0 (99,525) (249,525) (500,000) 300,000 25,300 28,000 0 (146,700) Statement of Retained Earnings Retained Earnings - Jan 1, 2021 Net Income (1,275,000) (249,525) (400,000) (146,7001 Dividends Retained Earnings - Dec 31, 2021 250,000 (1,274,525) 40,000 (506,700) Balance Sheet Current Assets Investment in 860,000 669,525 321,700 0 Singer Land Patent Equipment, net Goodwill Total Assets 240,000 0 1,030,000 0 2,799,525 210,000 80,000 240,000 0 851,700 Liabilities (225,000) (45,000) (300,000) (1,000,000) (1,274,525) (100,000) Common Stock - Pettersen Additional Paid in Cap - Pettersen Retained Earnings - Pettersen Common Stock- Singer Addl Paid in Cap Singer Retained Earnings - Singer NCI Interest (200,000) (506,700) Total Liab & Stk Equity (2,799,525) (851.700)