Question

On January 1, 2021, Red Flash Photography had the following balances: Cash, $15,000; Supplies, $8,300; Land, $63,000; Deferred Revenue, $5,300; Common Stock $53,000; and Retained

On January 1, 2021, Red Flash Photography had the following balances: Cash, $15,000; Supplies, $8,300; Land, $63,000; Deferred Revenue, $5,300; Common Stock $53,000; and Retained Earnings, $28,000. During 2021, the company had the following transactions:

The following information is available on December 31, 2021: 1. Employees are owed an additional $4,300 in salaries. 2. Three months of the rental space has expired. 3. Supplies of $5,300 remain on hand. 4. All of the services associated with the beginning deferred revenue have been performed. 1. Record the transactions that occurred during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 2. Record the adjusting entries at the end of the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) 3. Prepare an adjusted trial balance. 4. Prepare an income statement, statement of stockholders equity, and classified balance sheet. 5. Prepare closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

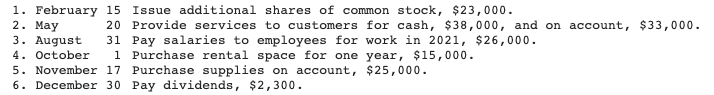

1. February 15 Issue additional shares of common stock, $23,000. 2. May 20 Provide services to customers for cash, $38,000, and on account, $33,000. 3. August 31 Pay salaries to employees for work in 2021, $26,000. 4. October 1 Purchase rental space for one year, $15,000. 5. November 17 Purchase supplies on account, $25,000. 6. December 30 Pay dividends, $2,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started