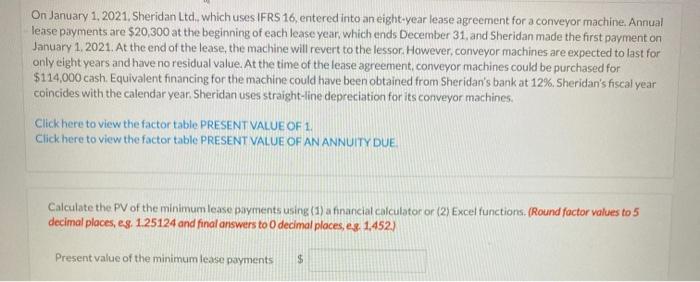

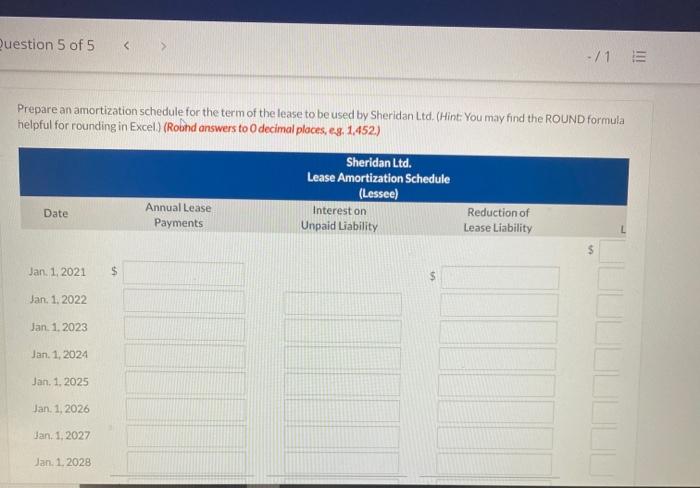

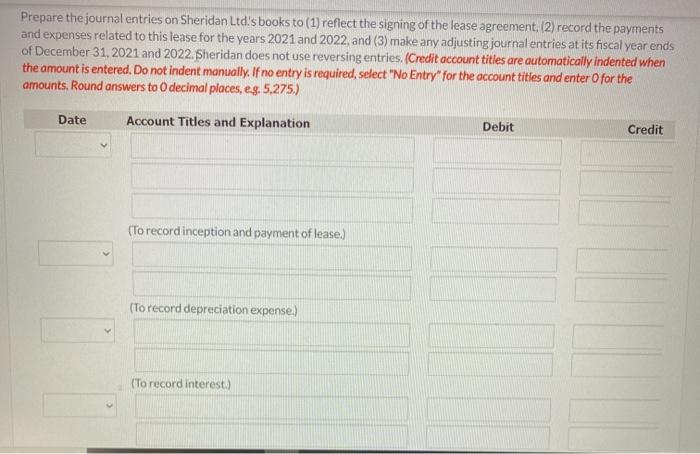

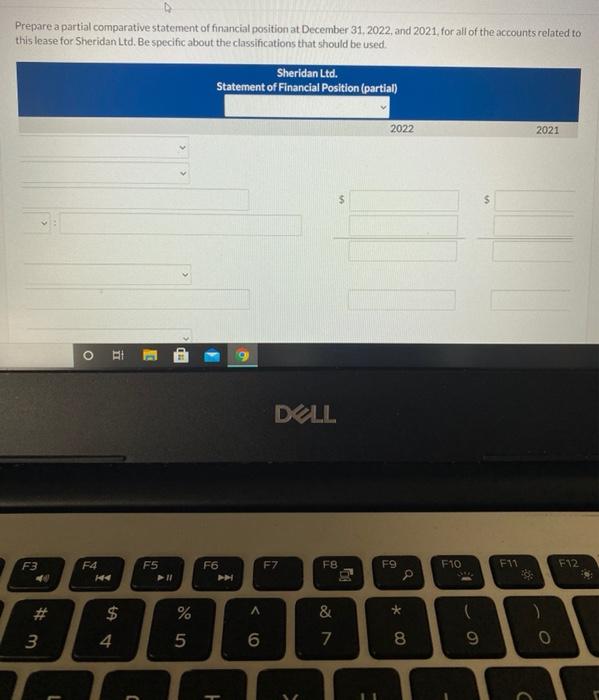

On January 1, 2021. Sheridan Ltd, which uses IFRS 16, entered into an eight-year lease agreement for a conveyor machine. Annual lease payments are $20,300 at the beginning of each lease year, which ends December 31, and Sheridan made the first payment on January 1, 2021. At the end of the lease, the machine will revert to the lessor. However, conveyor machines are expected to last for only eight years and have no residual value. At the time of the lease agreement, conveyor machines could be purchased for $114,000 cash Equivalent financing for the machine could have been obtained from Sheridan's bank at 12%. Sheridan's fiscal year coincides with the calendar year. Sheridan uses straight-line depreciation for its conveyor machines Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE Calculate the PV of the minimumlease payments using (1) a financial calculator or (2) Excel functions. (Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 1.452) Present value of the minimum lease payments $ Question 5 of 5 -/1 Prepare an amortization schedule for the term of the lease to be used by Sheridan Ltd. (Hint: You may find the ROUND formula helpful for rounding in Excel) (Round answers to decimal places, 68,1452) Sheridan Ltd. Lease Amortization Schedule (Lessee) Interest on Unpaid Liability Date Annual Lease Payments Reduction of Lease Liability Jan. 1. 2021 $ Jan. 1. 2022 Jan. 1.2023 Jan 1, 2024 Jan. 1. 2025 Jan. 1. 2026 jan. 1. 2027 Jan. 1. 2028 Prepare the journal entries on Sheridan Ltd's books to (1) reflect the signing of the lease agreement (2) record the payments and expenses related to this lease for the years 2021 and 2022, and (3) make any adjusting journal entries at its fiscal year ends of December 31, 2021 and 2022. Sheridan does not use reversing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to decimal places, eg,5,275.) Date Account Titles and Explanation Debit Credit (To record inception and payment of lease.) (To record depreciation expense) (To record interest.) Prepare a partial comparative statement of financial position at December 31, 2022, and 2021. for all of the accounts related to this lease for Sheridan Ltd. Be specific about the classifications that should be used. Sheridan Ltd. Statement of Financial Position (partial) 2022 2021 $ $ i DELL F3 F5 F6 F7 F8 F9 F10 F4 1 FM E12 a A * $ 4 % 5 & 7 3 0) 8 9 0 C