On January 1, 2021, Sweet Acacia Ltd. issued bonds with a maturity value of $5.35 million for $5,132,790, when the market rate of interest was 8%. The bonds have a contractual interest rate of 7% and mature on January 1, 2026. Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2021, Sheridan Company, a public company, purchased Sweet Acacia Ltd. bonds with a maturity value of $1.07 million to earn interest. On December 31, 2021, the bonds were trading at 99. Both companies year end is December 31.

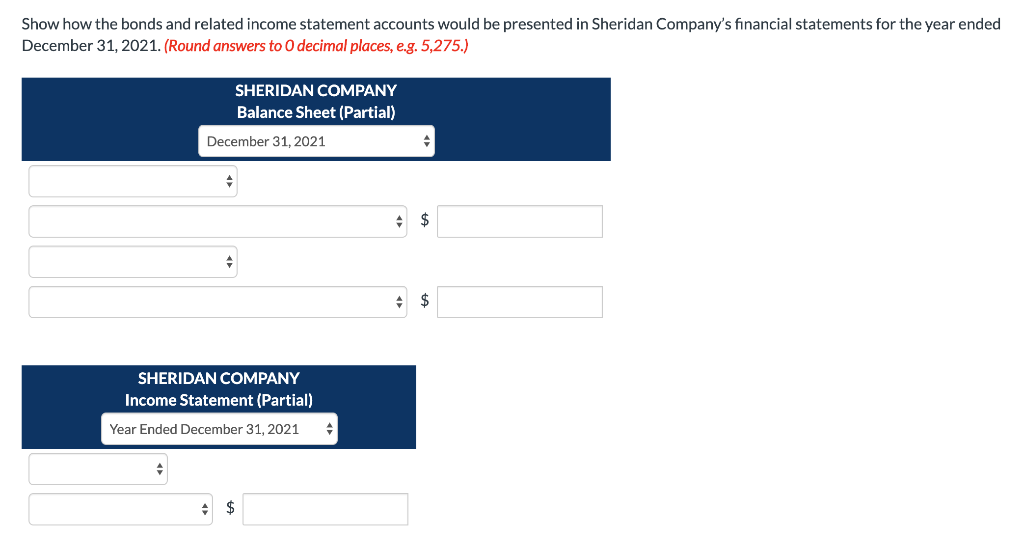

[I need help with the Balance sheet and income statement section of the question.]

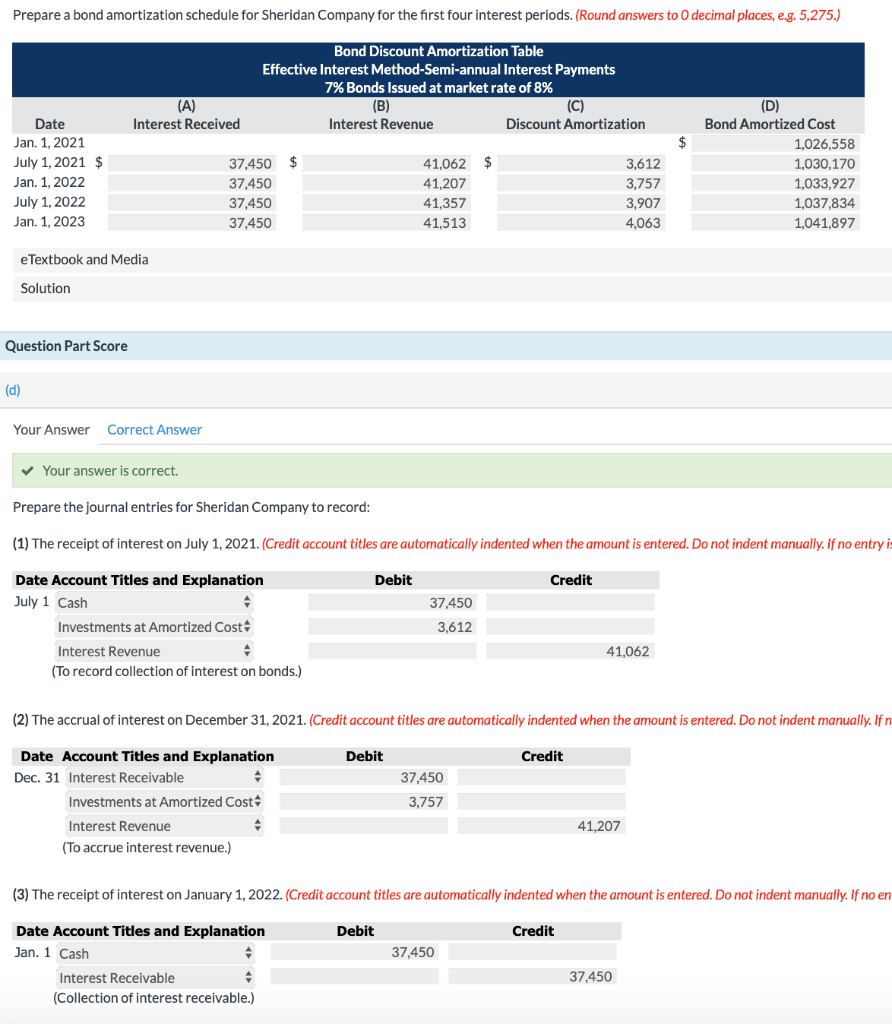

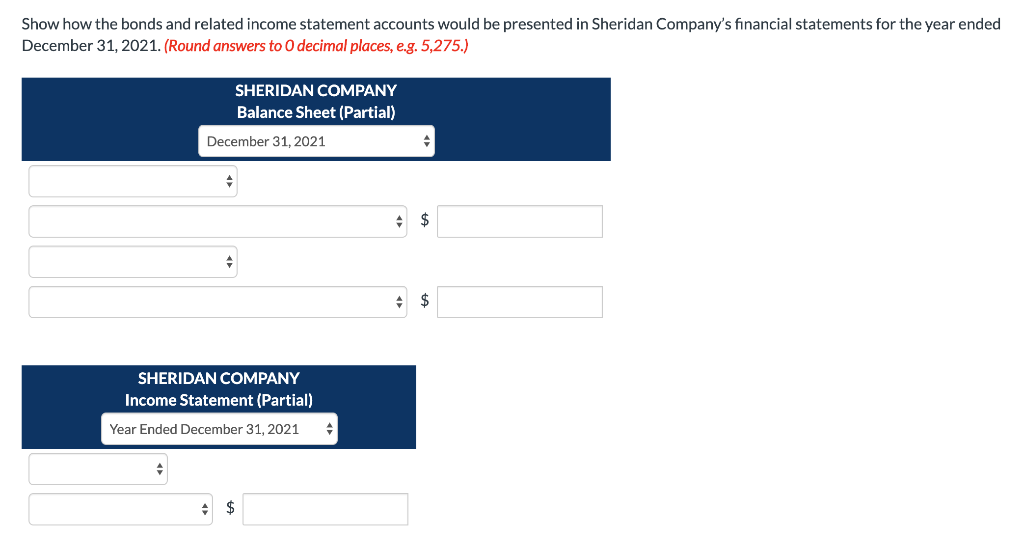

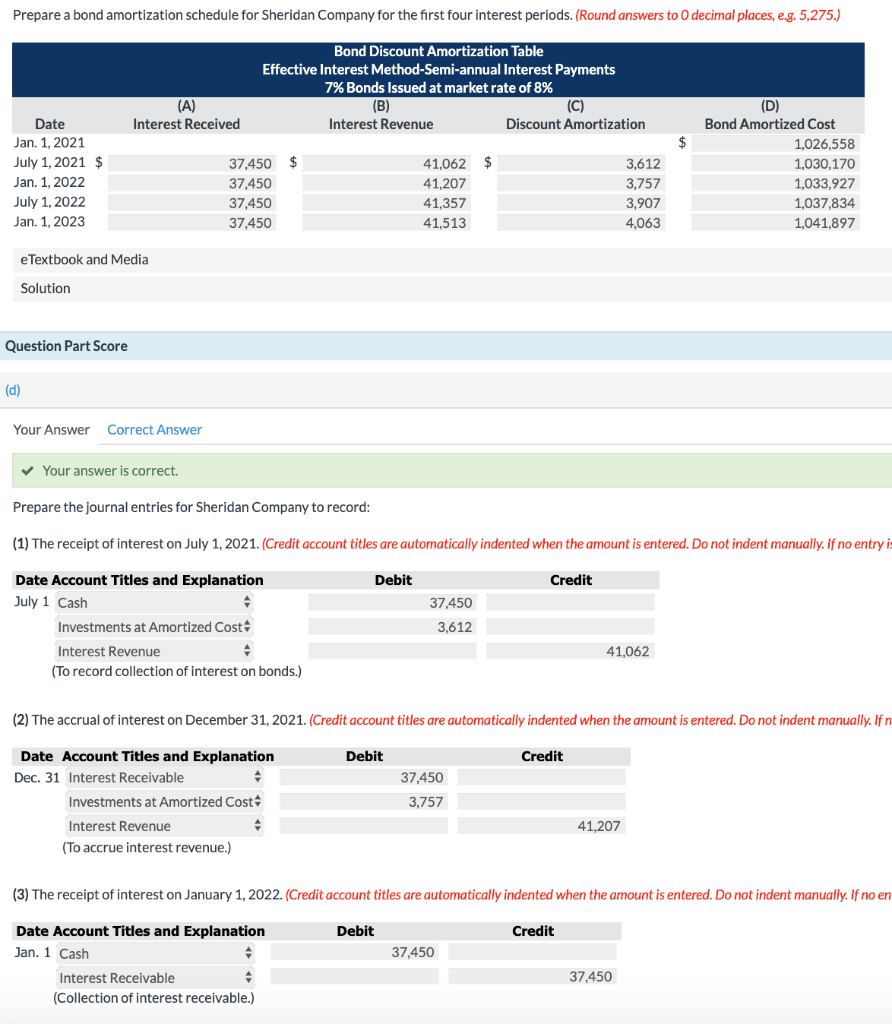

Prepare a bond amortization schedule for Sheridan Company for the first four interest periods. (Round answers to decimal places, e.g. 5,275.) Bond Discount Amortization Table Effective Interest Method-Semi-annual Interest Payments 7% Bonds Issued at market rate of 8% (B) (C) Interest Revenue Discount Amortization (A) Interest Received $ $ Date Jan. 1, 2021 July 1, 2021 $ Jan. 1, 2022 July 1, 2022 Jan. 1, 2023 37,450 37,450 37,450 37,450 41,062 41,207 41,357 41,513 3,612 3,757 3,907 4,063 (D) Bond Amortized Cost 1,026,558 1,030,170 1,033,927 1,037,834 1,041,897 e Textbook and Media Solution Question Part Score (d) Your Answer Correct Answer Your answer is correct. Prepare the journal entries for Sheridan Company to record: (1) The receipt of interest on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is Debit Credit Date Account Titles and Explanation July 1 Cash Investments at Amortized Cost Interest Revenue (To record collection of interest on bonds.) 37,450 3,612 41,062 (2) The accrual of interest on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If n Debit Credit Date Account Titles and Explanation Dec. 31 Interest Receivable Investments at Amortized Cost Interest Revenue (To accrue interest revenue.) 37,450 3,757 41,207 (3) The receipt of interest on January 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no en Debit Credit 37,450 Date Account Titles and Explanation Jan. 1 Cash Interest Receivable (Collection of interest receivable.) 37,450 Show how the bonds and related income statement accounts would be presented in Sheridan Company's financial statements for the year ended December 31, 2021. (Round answers to 0 decimal places, e.g. 5,275.) SHERIDAN COMPANY Balance Sheet (Partial) December 31, 2021 $ SHERIDAN COMPANY Income Statement (Partial) Year Ended December 31, 2021