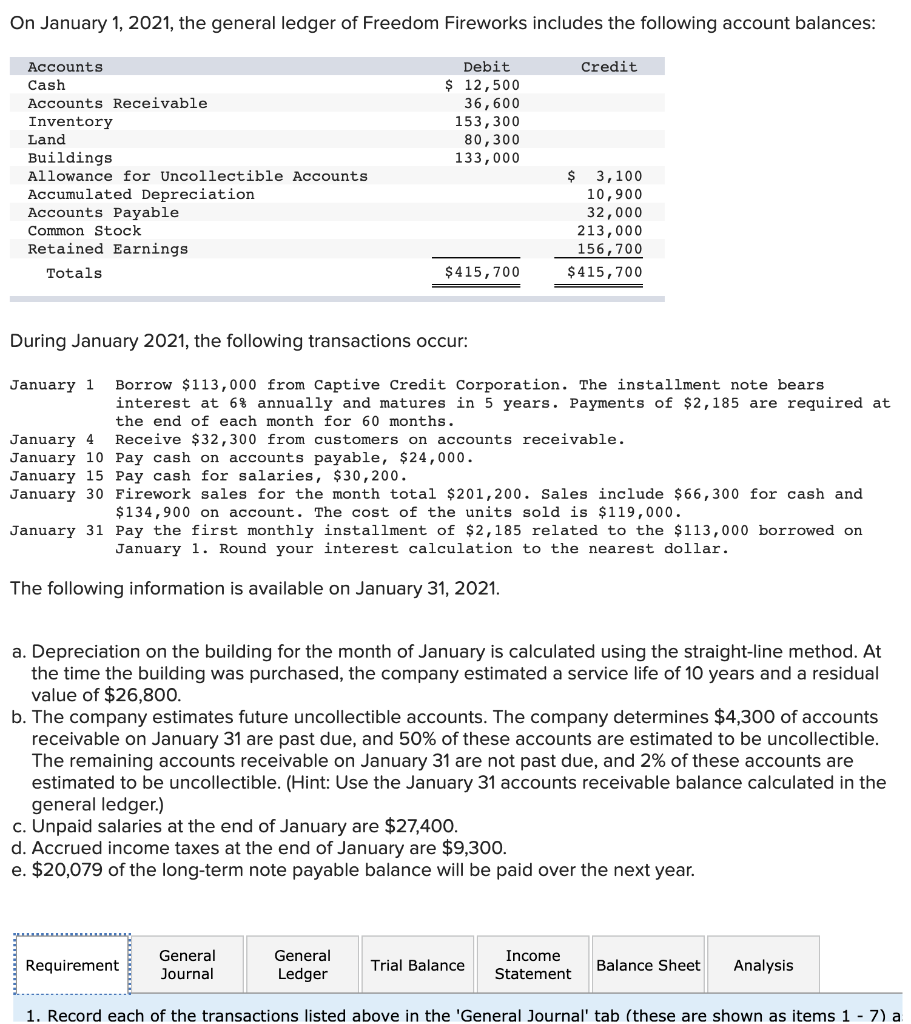

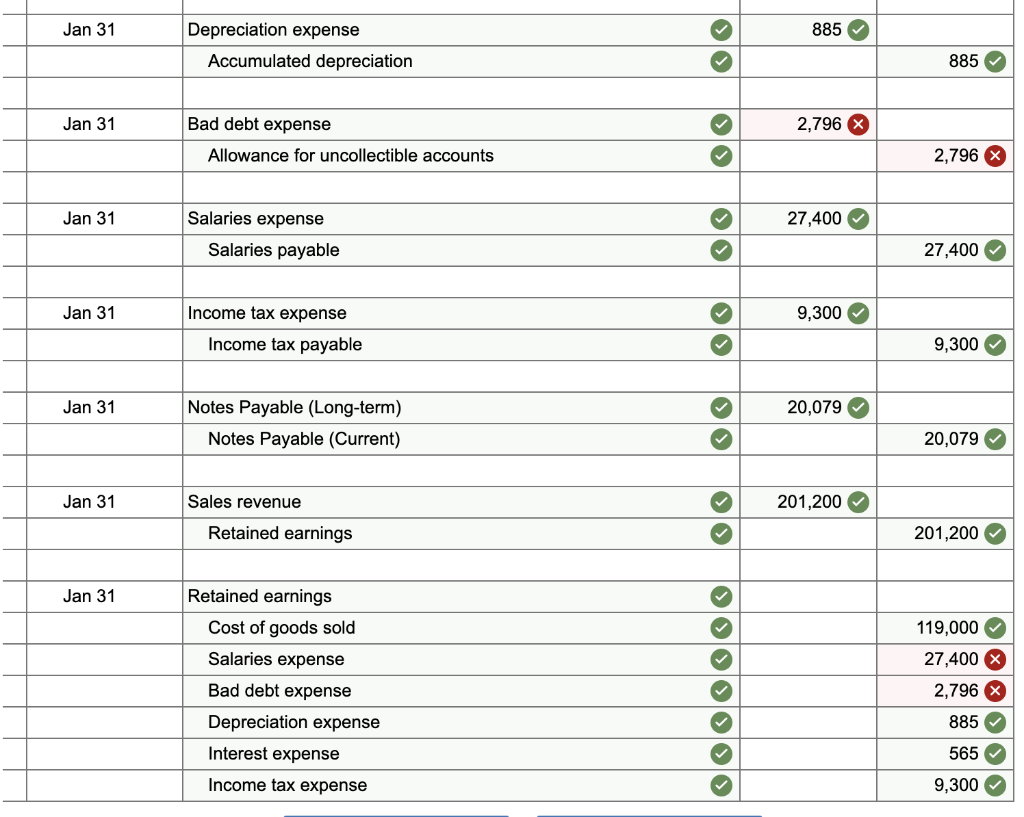

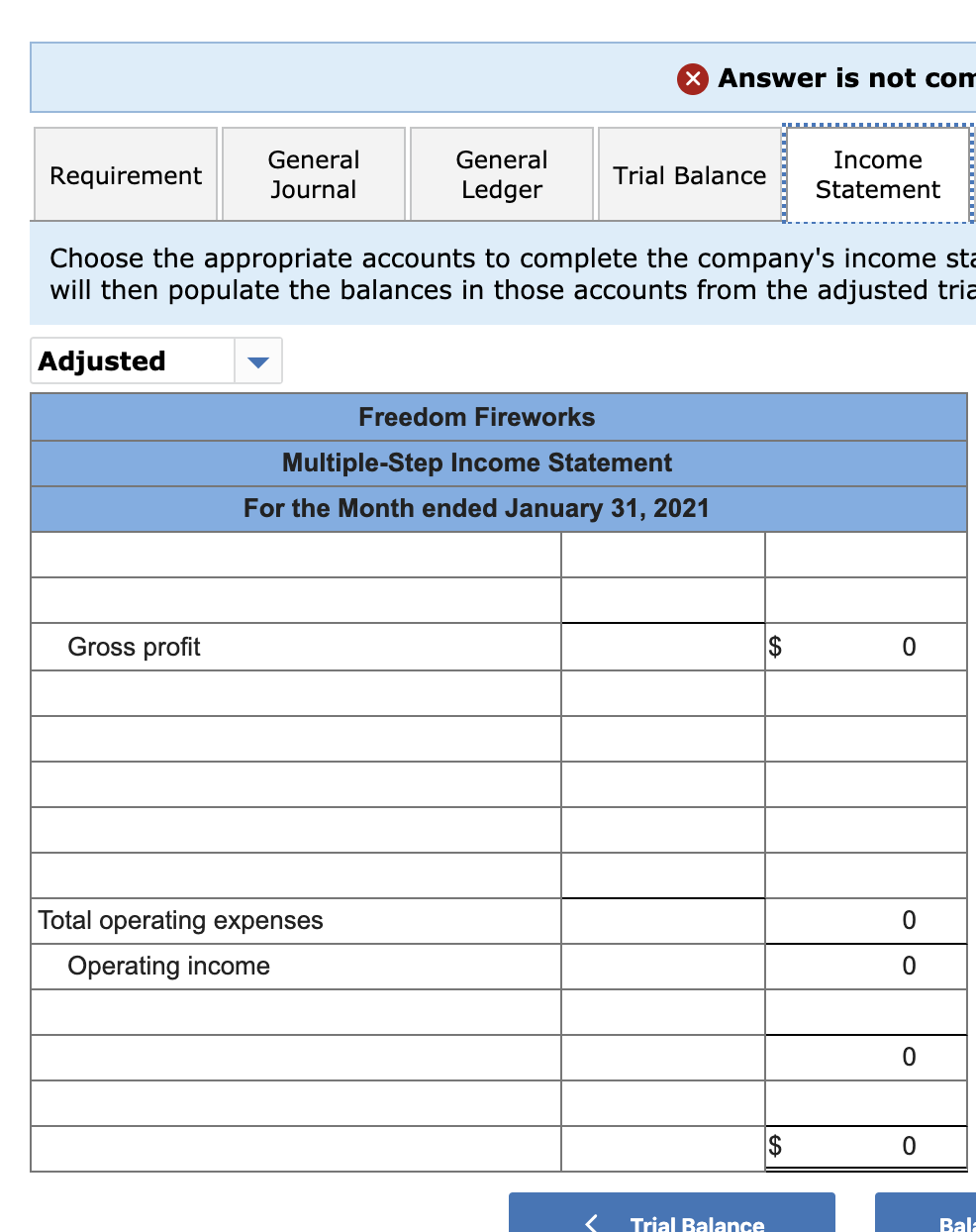

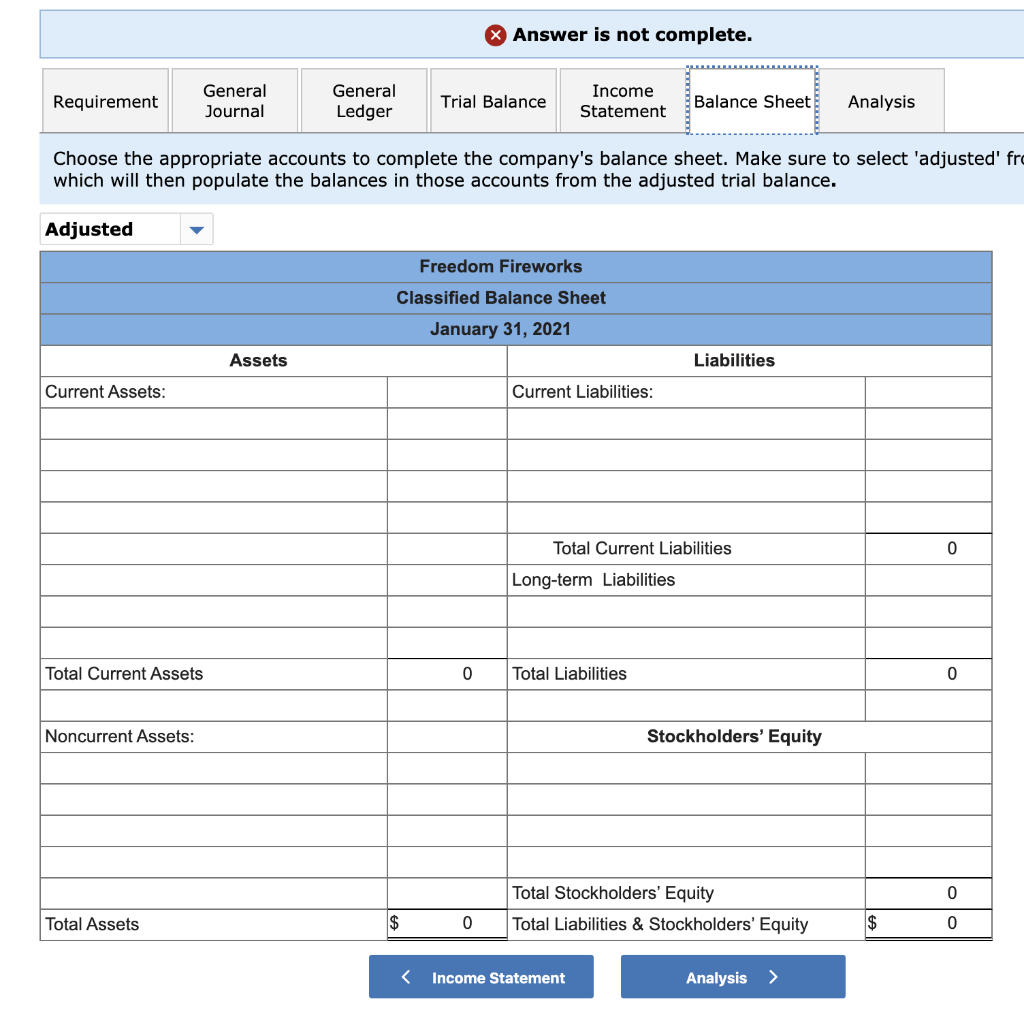

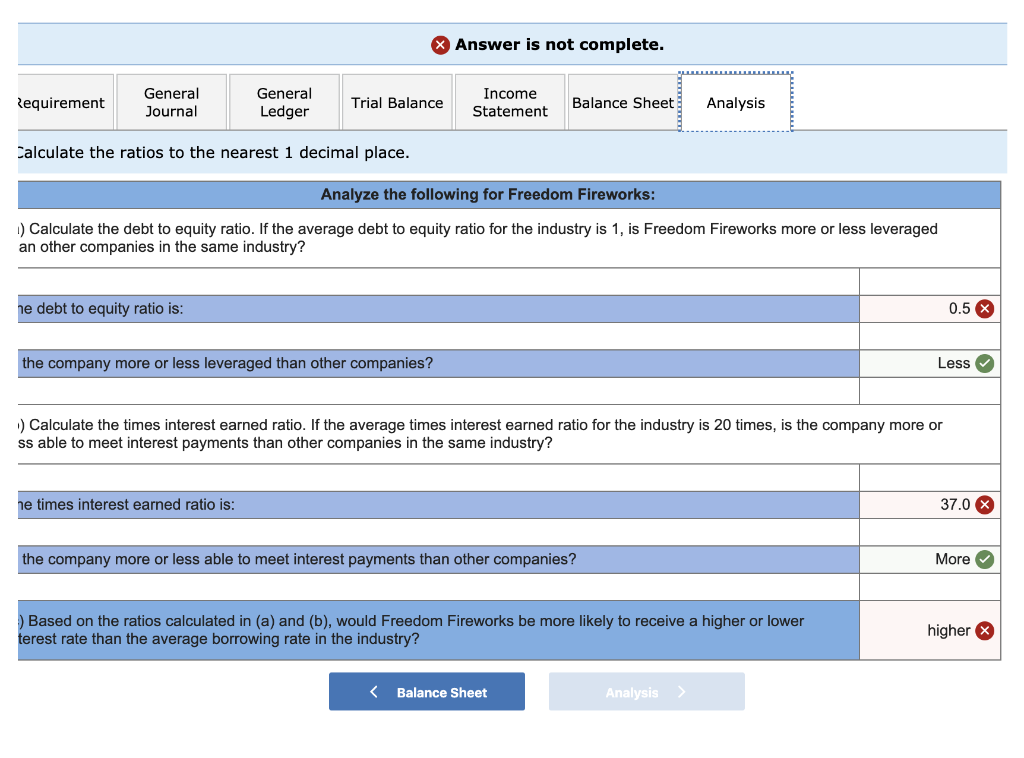

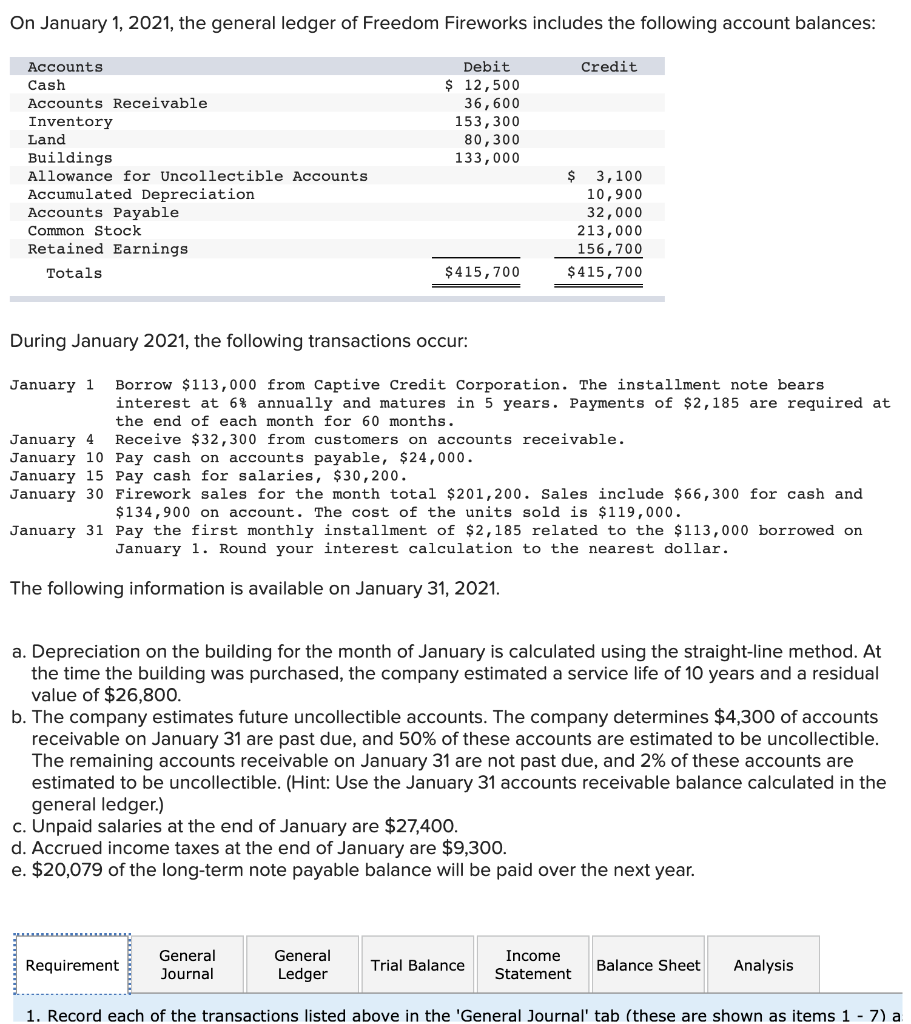

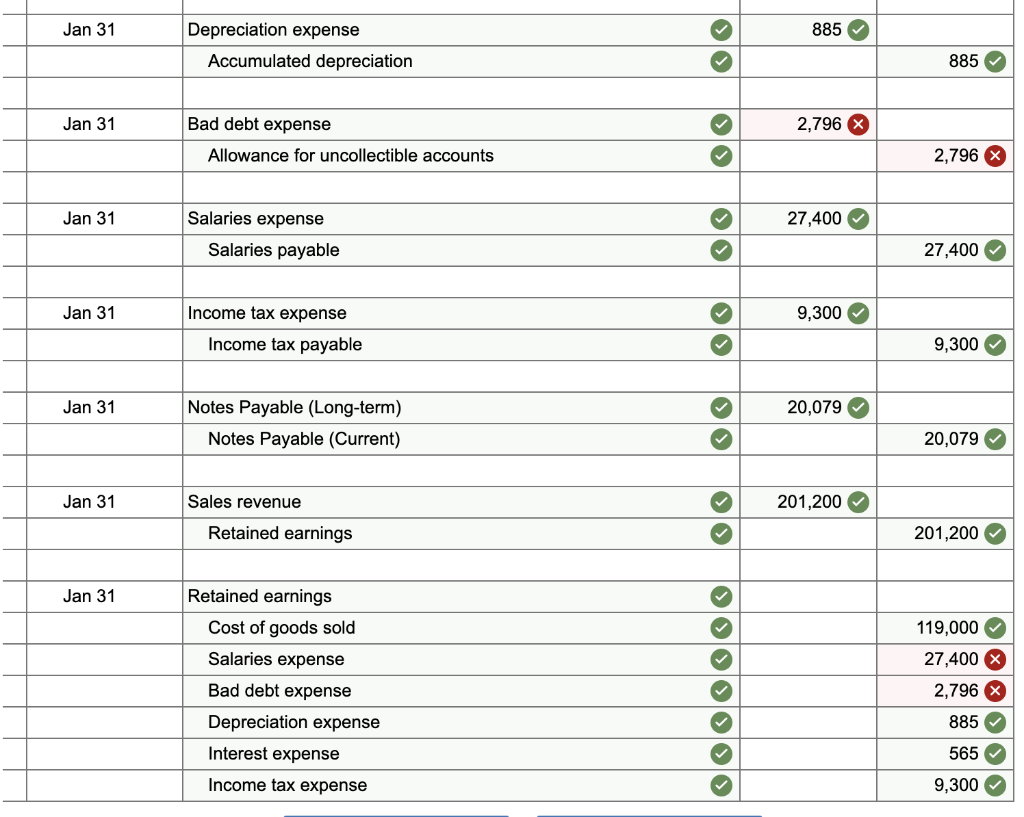

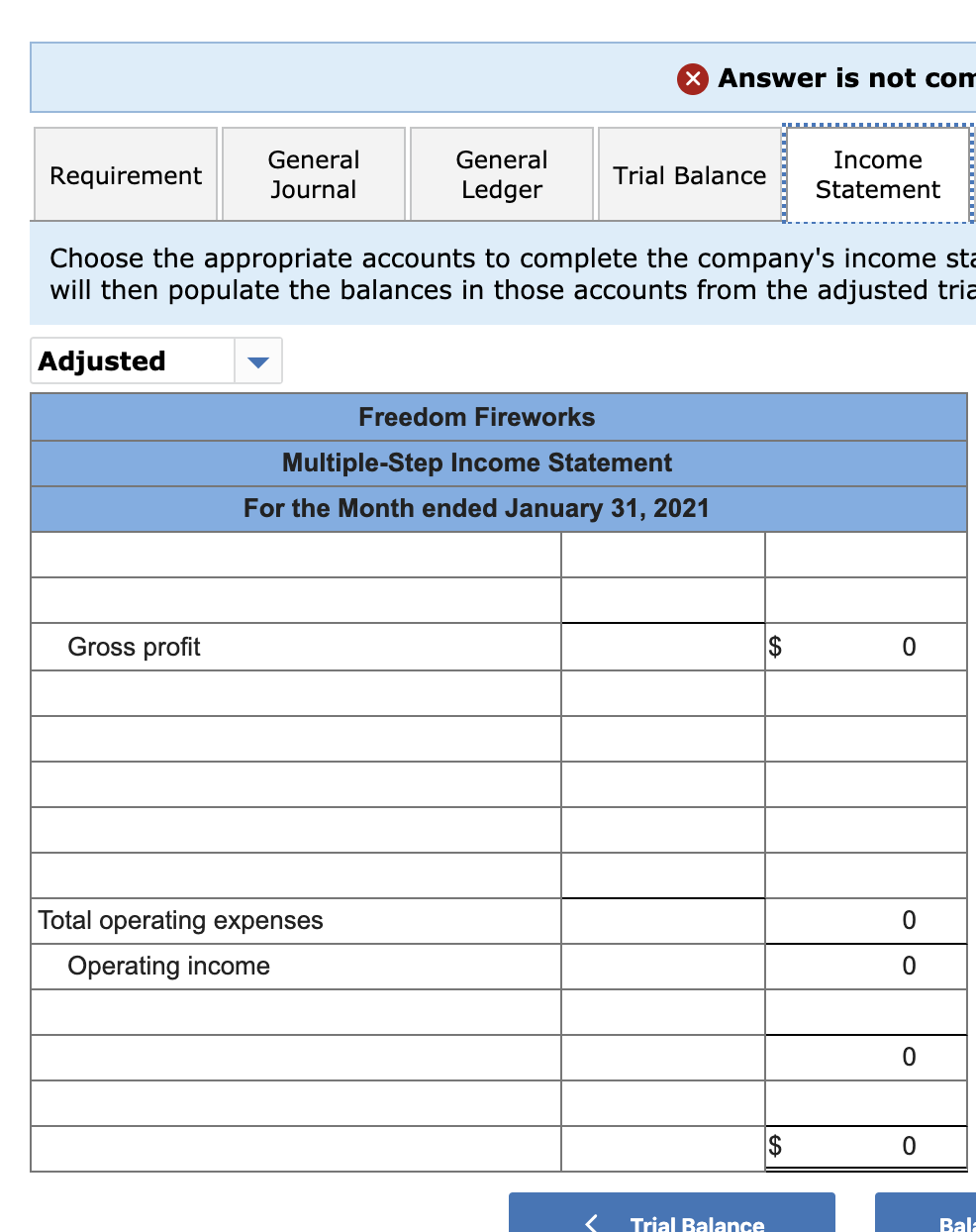

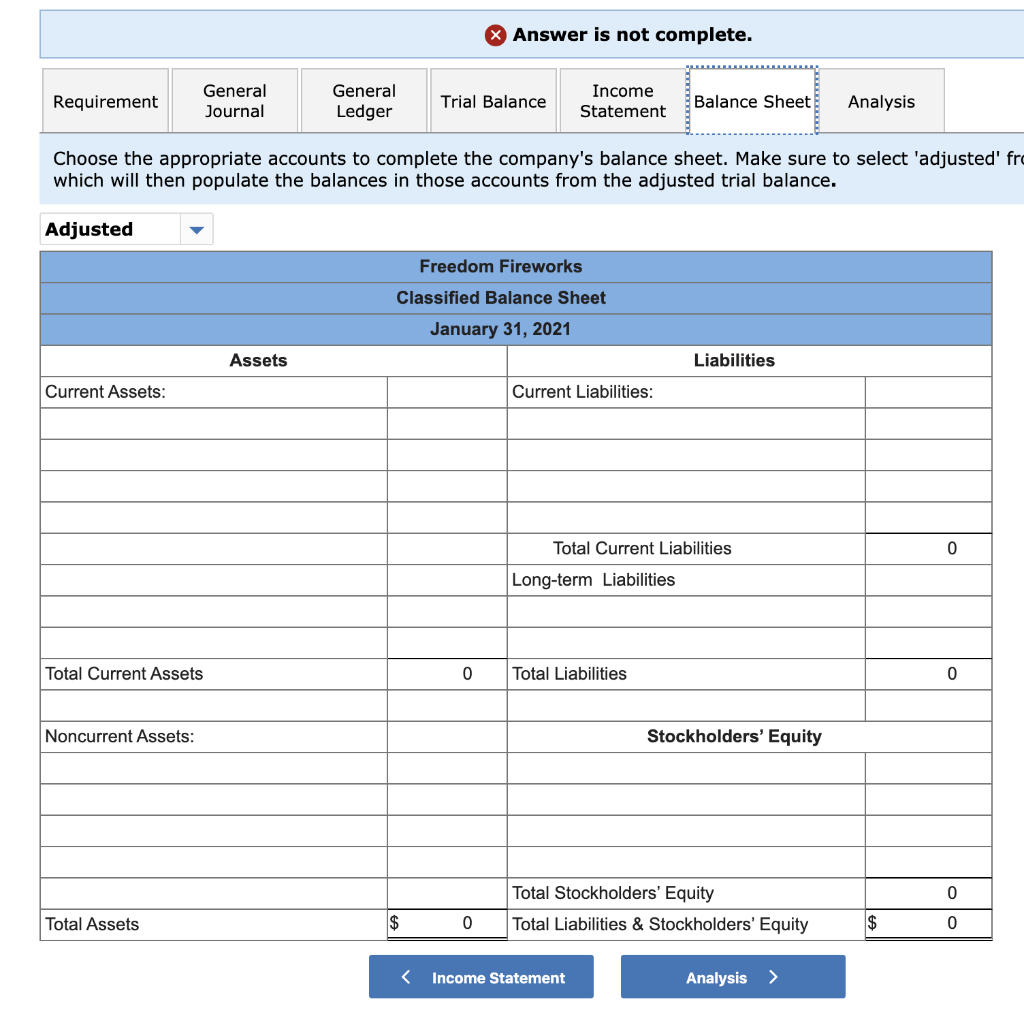

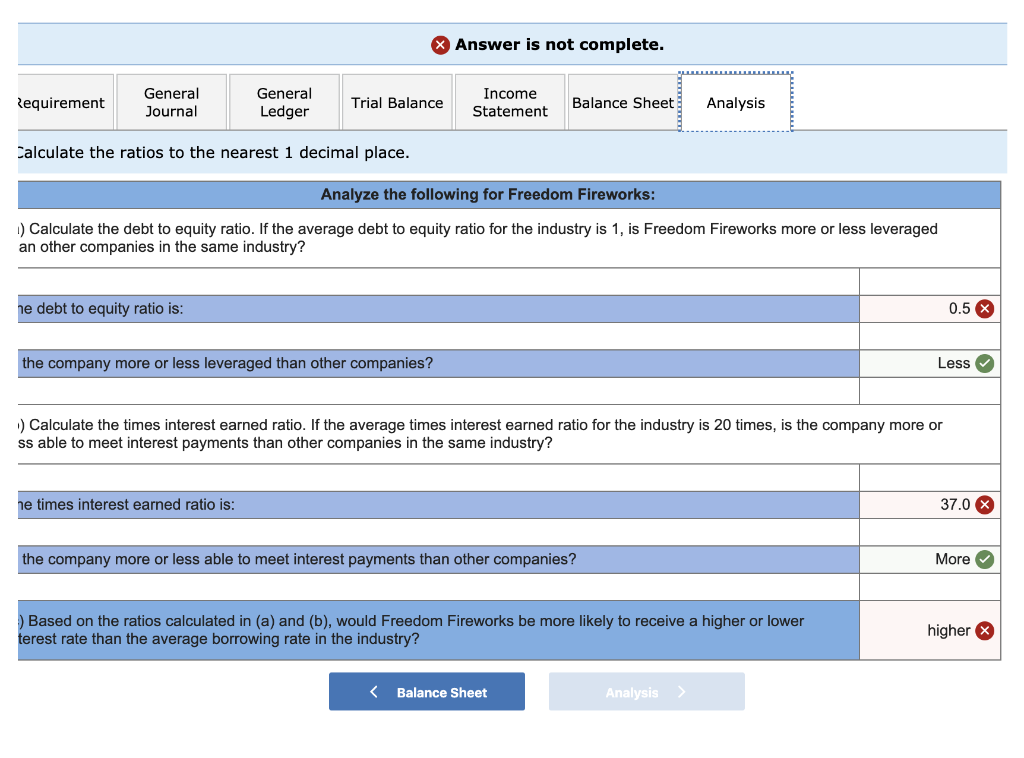

On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Credit Debit $ 12,500 36,600 153,300 80,300 133,000 Accounts Cash Accounts Receivable Inventory Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $ 3,100 10,900 32,000 213,000 156,700 $415, 700 $415,700 During January 2021, the following transactions occur: January 1 Borrow $113,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $2,185 are required at the end of each month for 60 months. January 4 Receive $32,300 from customers on accounts receivable. January 10 Pay cash on accounts payable, $24,000. January 15 Pay cash for salaries, $30, 200. January 30 Firework sales for the month total $201,200. Sales include $66, 300 for cash and $134,900 on account. The cost of the units sold is $119,000. January 31 Pay the first monthly installment of $2,185 related to the $113,000 borrowed on January 1. Round your interest calculation to the nearest dollar. The following information is available on January 31, 2021. a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $26,800. b. The company estimates future uncollectible accounts. The company determines $4,300 of accounts receivable on January 31 are past due, and 50% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 2% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Unpaid salaries at the end of January are $27,400. d. Accrued income taxes at the end of January are $9,300. e. $20,079 of the long-term note payable balance will be paid over the next year. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 7) a Jan 31 885 Depreciation expense Accumulated depreciation 885 Jan 31 Bad debt expense 2,796 Allowance for uncollectible accounts 2,796 X Jan 31 27,400 Salaries expense Salaries payable 27,400 Jan 31 9,300 Income tax expense Income tax payable 9,300 Jan 31 20,079 Notes Payable (Long-term) Notes Payable (Current) 20,079 Jan 31 201,200 Sales revenue Retained earnings 201,200 Jan 31 Retained earnings Cost of goods sold Salaries expense Bad debt expense Depreciation expense Interest expense Income tax expense 119,000 27,400 x 2,796 885 565 9,300 Answer is not con Requirement General Journal General Ledger Trial Balance Income Statement Choose the appropriate accounts to complete the company's income sta will then populate the balances in those accounts from the adjusted tria Adjusted Freedom Fireworks Multiple-Step Income Statement For the Month ended January 31, 2021 Gross profit Total operating expenses Operating income 0 $ 0 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Calculate the ratios to the nearest 1 decimal place. Analyze the following for Freedom Fireworks: 1) Calculate the debt to equity ratio. If the average debt to equity ratio for the industry is 1, is Freedom Fireworks more or less leveraged an other companies in the same industry? ne debt to equity ratio is: 0.5 X the company more or less leveraged than other companies? Less 1) Calculate the times interest earned ratio. If the average times interest earned ratio for the industry is 20 times, is the company more or ss able to meet interest payments than other companies in the same industry? ne times interest earned ratio is: 37.0 X the company more or less able to meet interest payments than other companies? More ) Based on the ratios calculated in (a) and (b), would Freedom Fireworks be more likely to receive a higher or lower terest rate than the average borrowing rate in the industry? higher