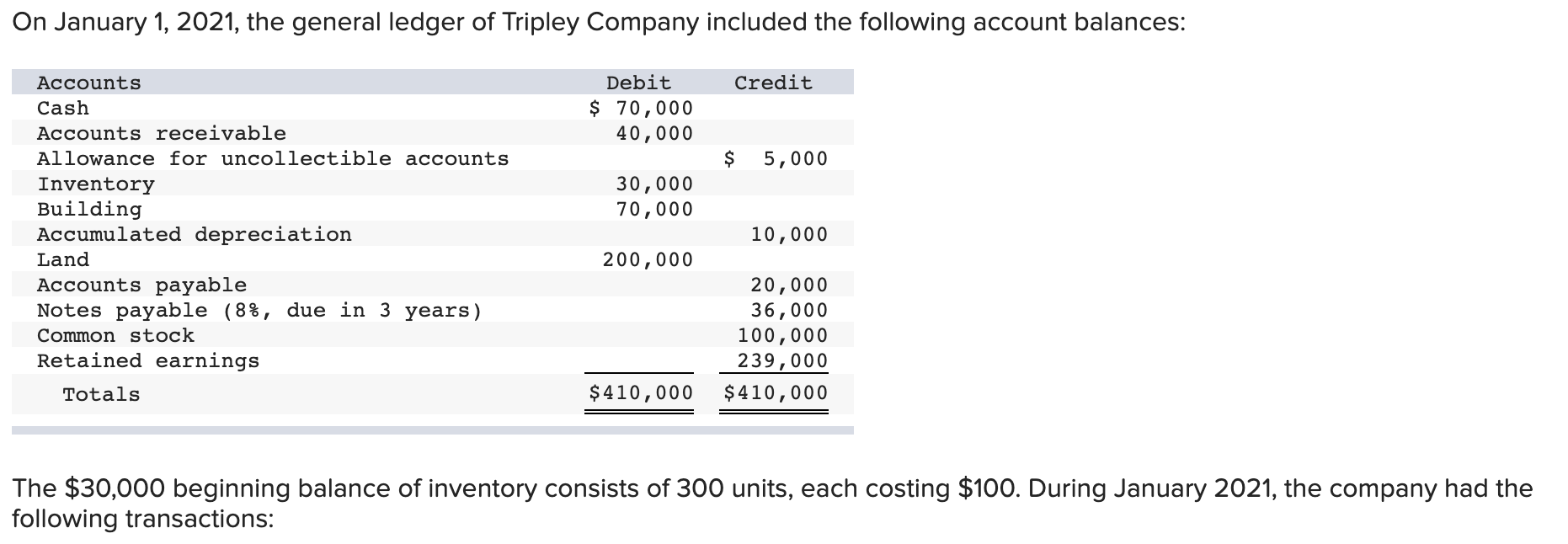

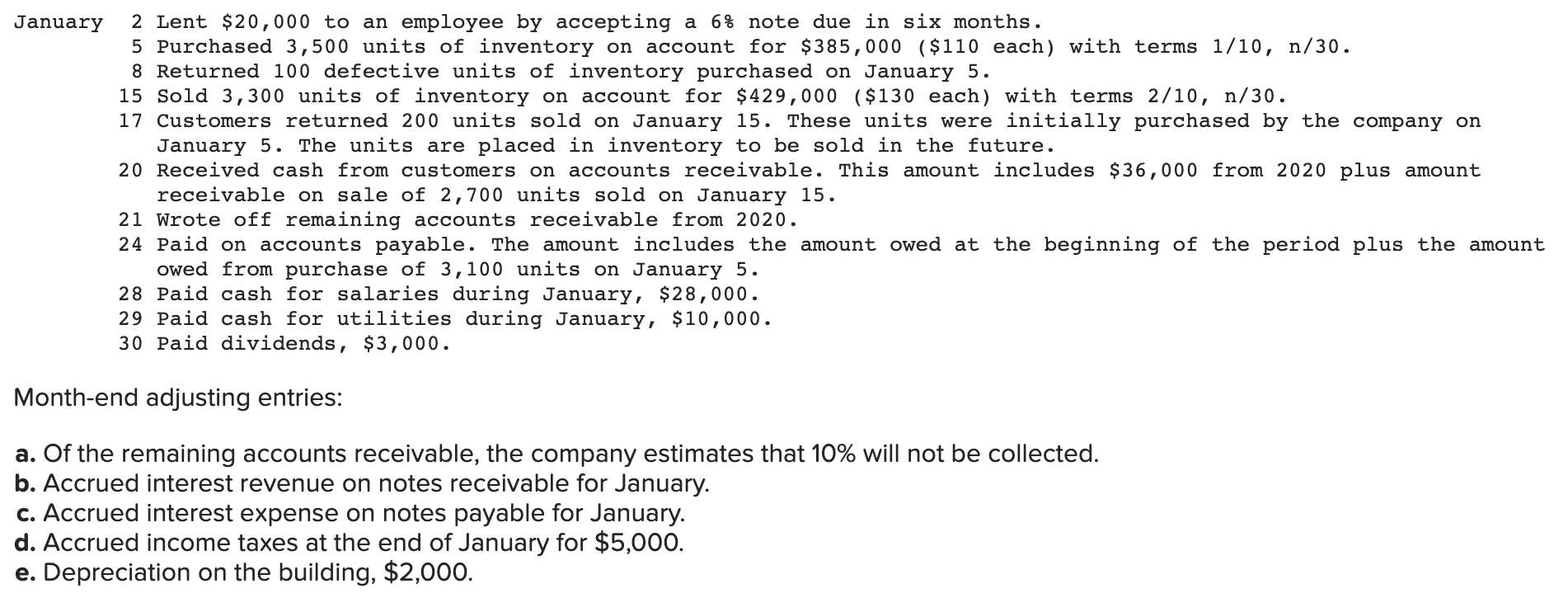

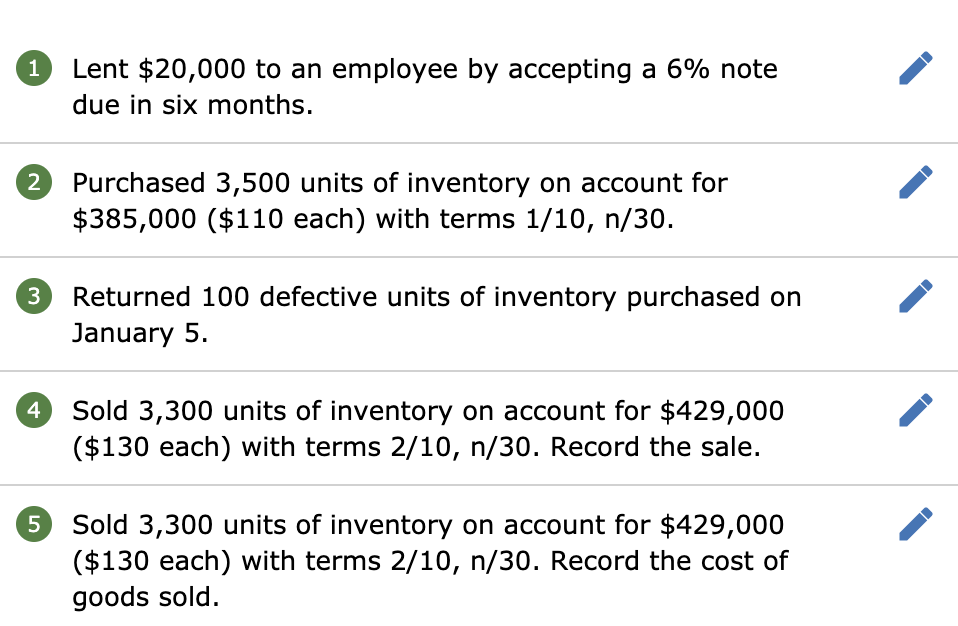

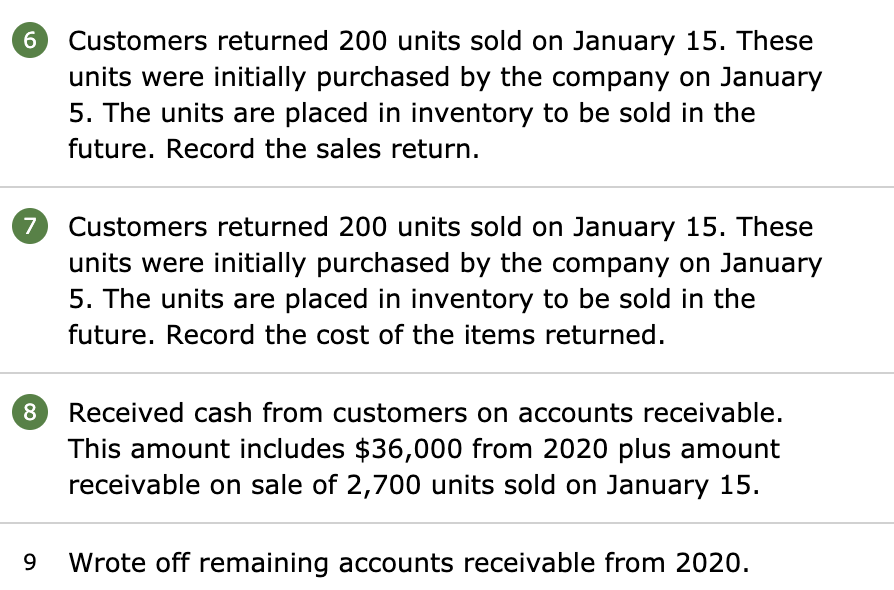

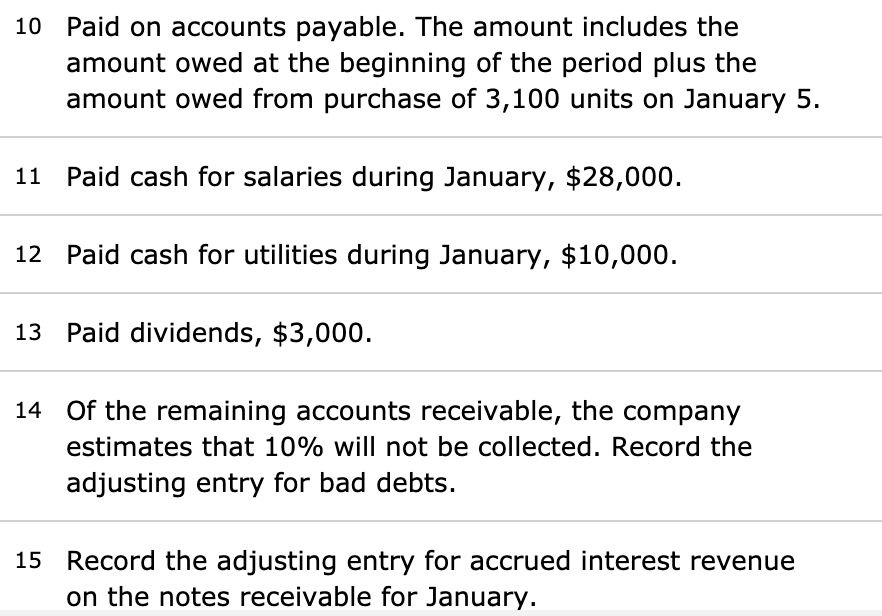

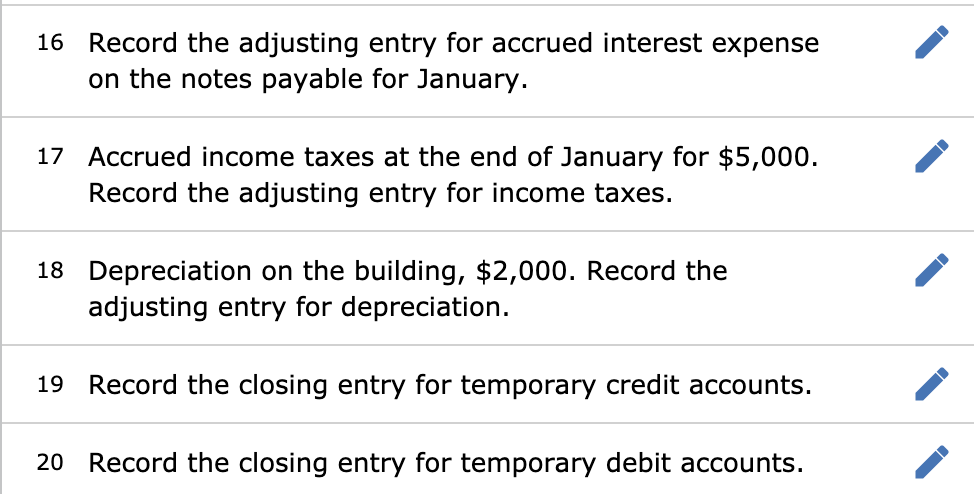

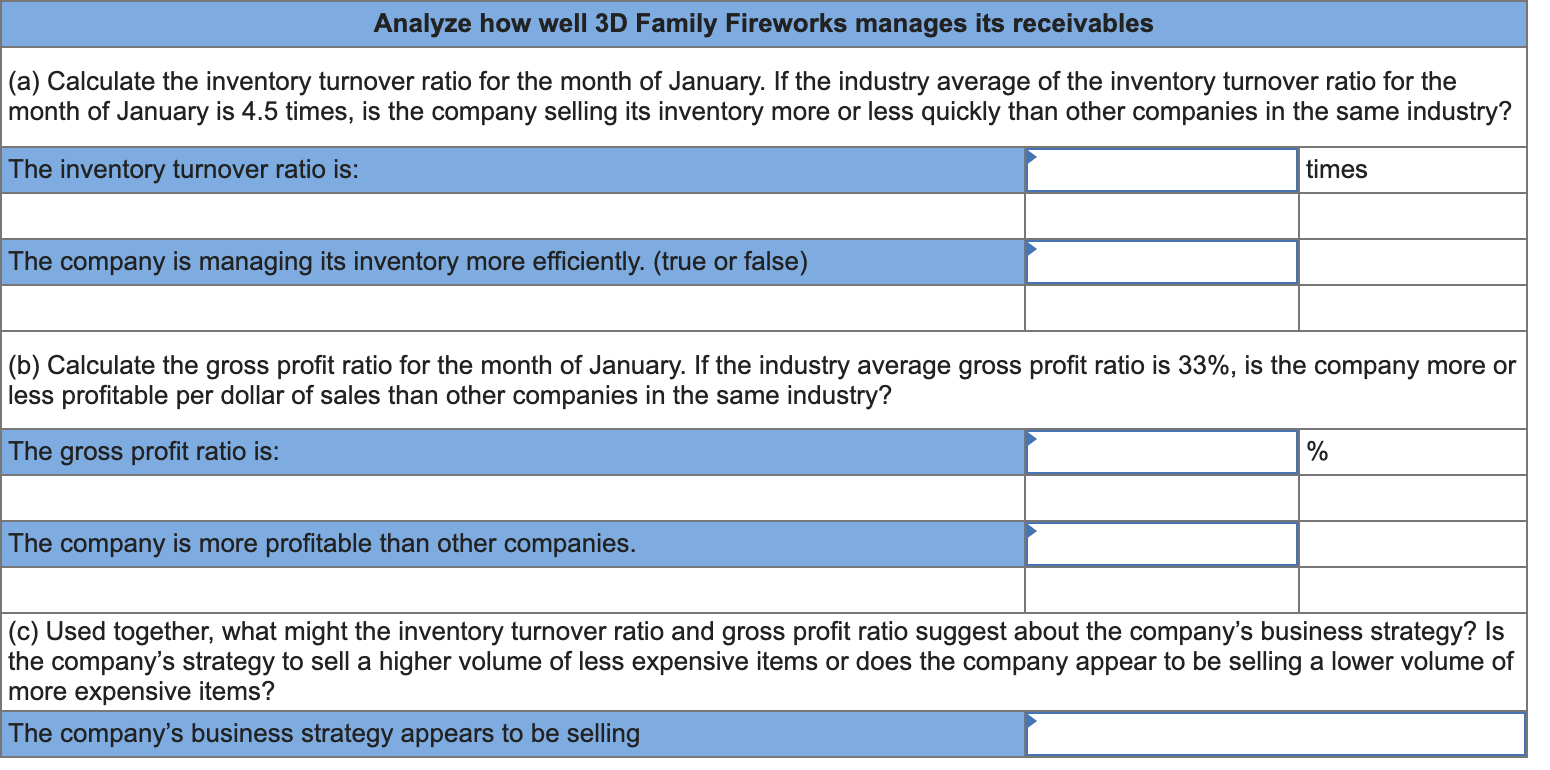

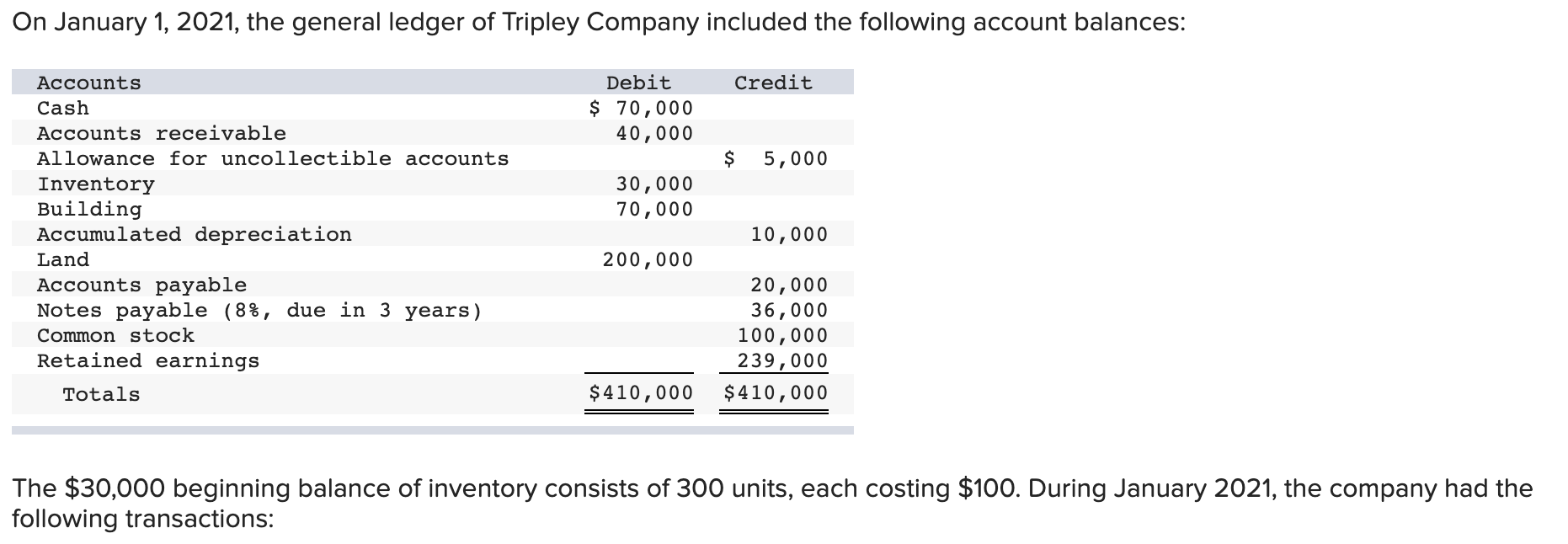

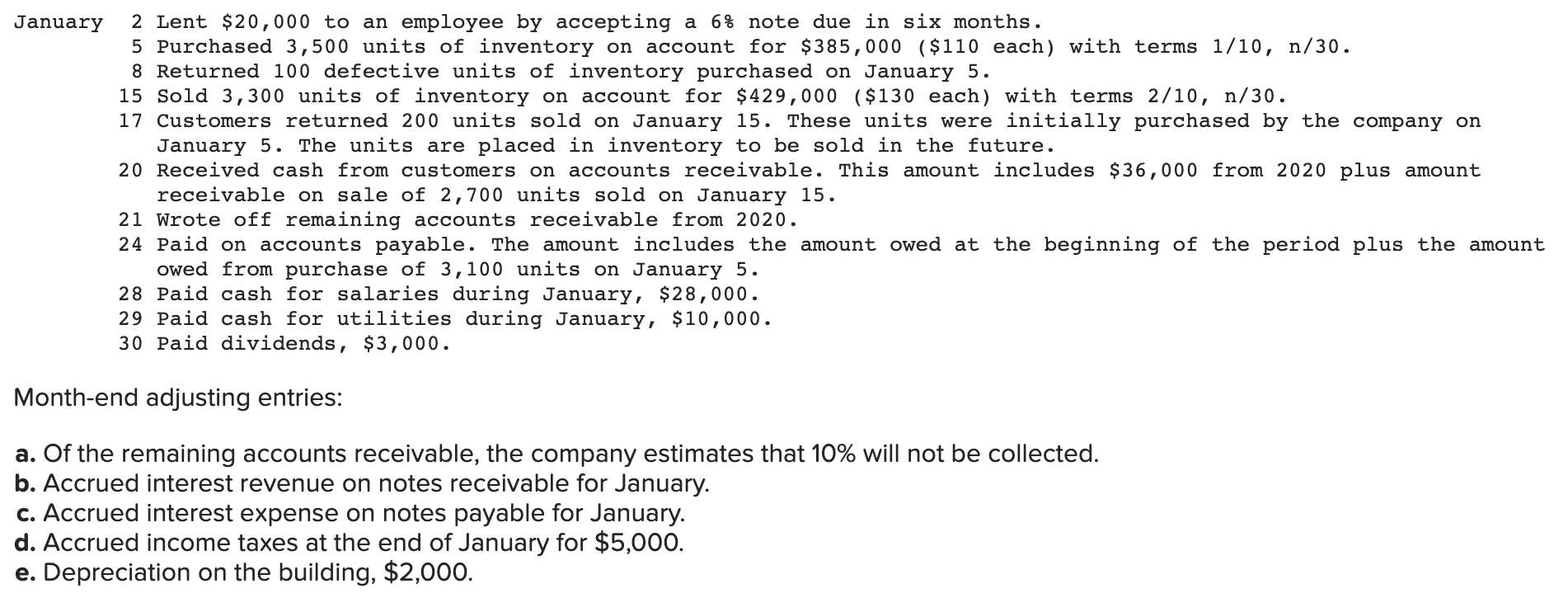

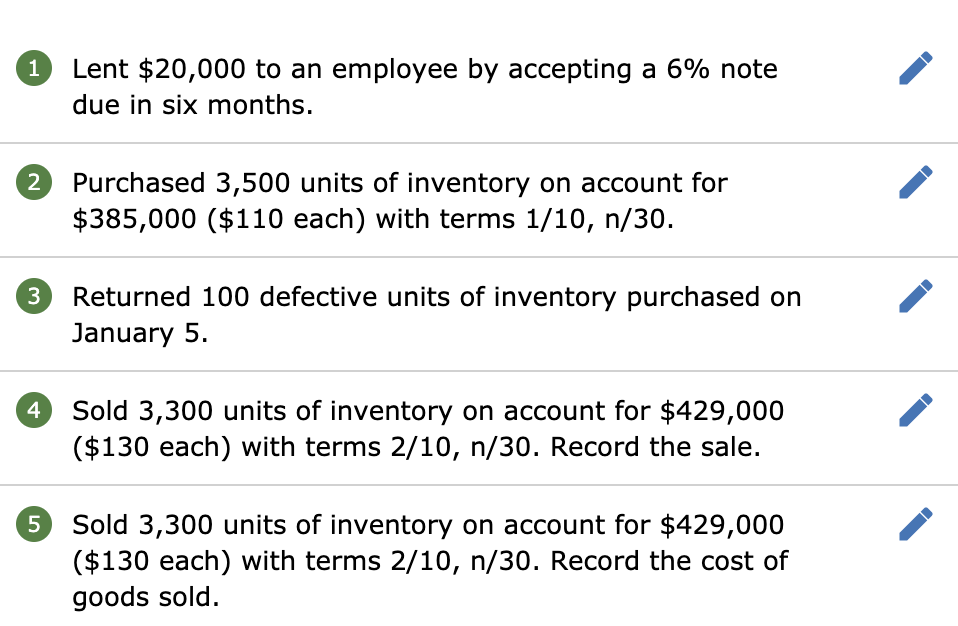

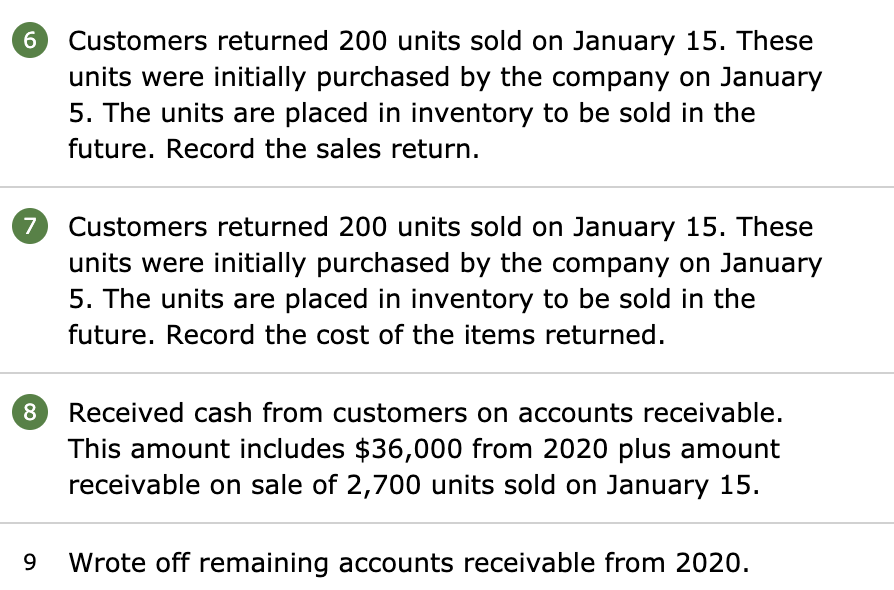

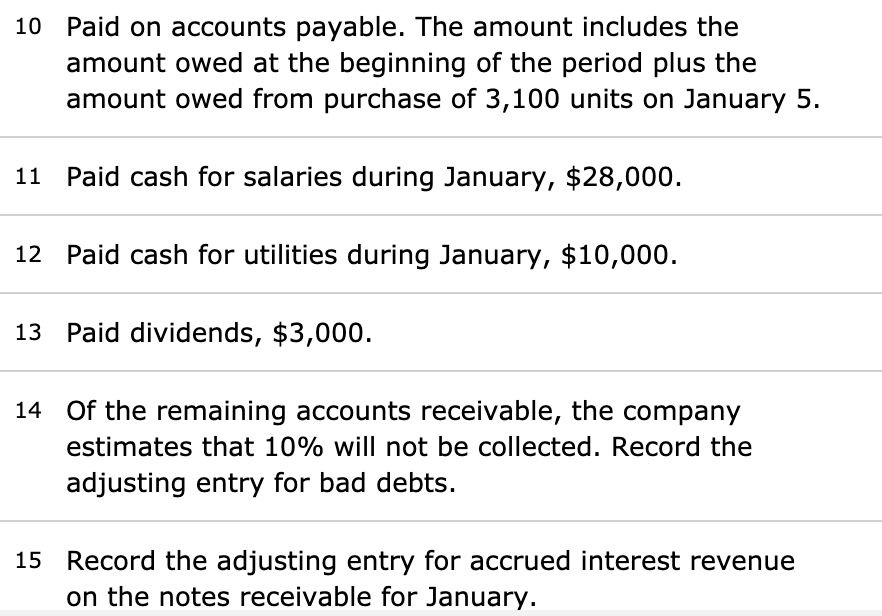

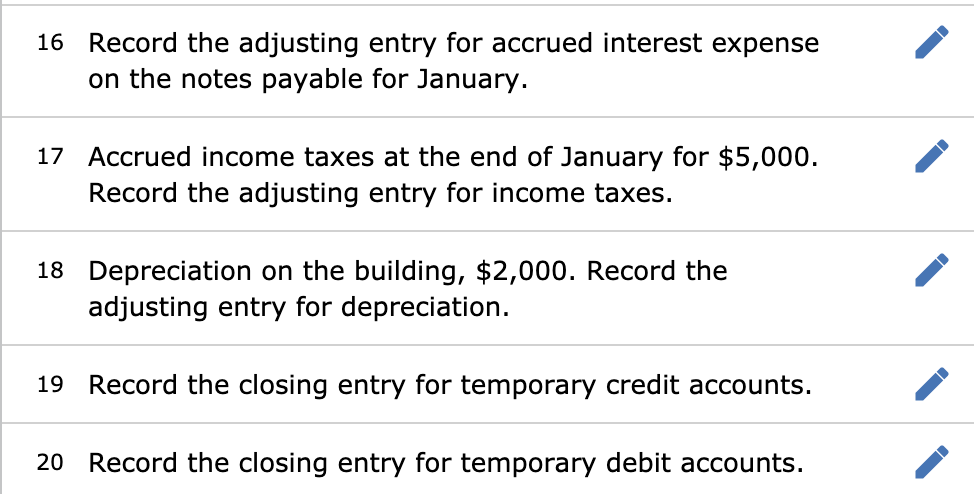

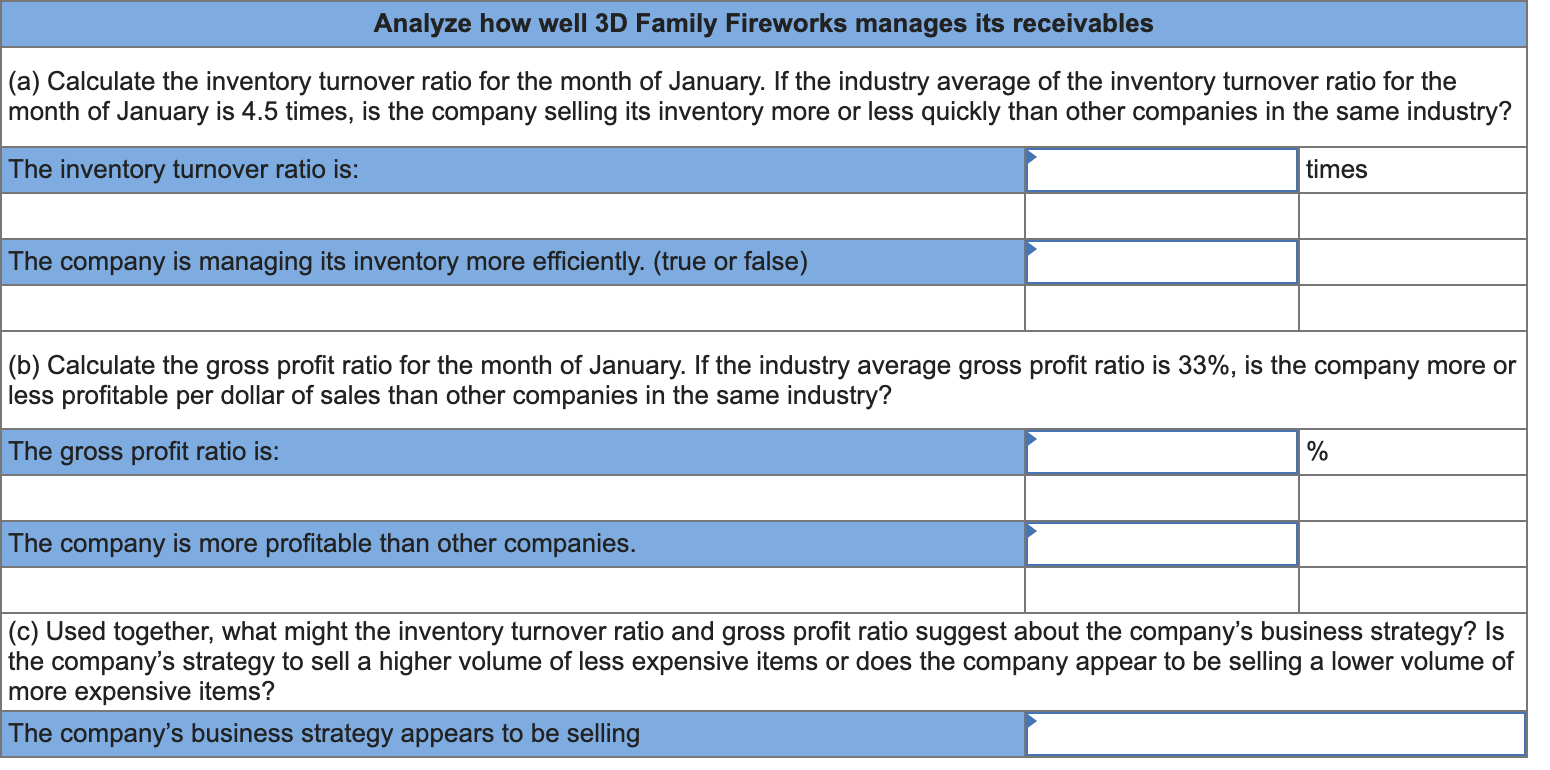

On January 1, 2021, the general ledger of Tripley Company included the following account balances: Credit Debit $ 70,000 40,000 $ 5,000 30,000 70,000 Accounts Cash Accounts receivable Allowance for uncollectible accounts Inventory Building Accumulated depreciation Land Accounts payable Notes payable (8%, due in 3 years) Common stock Retained earnings Totals 10,000 200,000 20,000 36,000 100,000 239,000 $410,000 $410,000 The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $20,000 to an employee by accepting a 6% note due in six months. 5 Purchased 3,500 units of inventory on account for $385,000 ($110 each) with terms 1/10, n/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold 3,300 units of inventory on account for $429,000 ($130 each) with terms 2/10, n/30. 17 Customers returned 200 units sold on January 15. These units were initially purchased by the company on January 5. The units are placed in inventory to be sold in the future. 20 Received cash from customers on accounts receivable. This amount includes $36,000 from 2020 plus amount receivable on sale of 2,700 units sold on January 15. 21 Wrote off remaining accounts receivable from 2020. 24 Paid on accounts payable. The amount includes the amount owed at the beginning of the period plus the amount owed from purchase of 3,100 units on January 5. 28 Paid cash for salaries during January, $28,000. 29 Paid cash for utilities during January, $10,000. 30 Paid dividends, $3,000. Month-end adjusting entries: a. Of the remaining accounts receivable, the company estimates that 10% will not be collected. b. Accrued interest revenue on notes receivable for January. c. Accrued interest expense on notes payable for January. d. Accrued income taxes at the end of January for $5,000. e. Depreciation on the building, $2,000. 1 Lent $20,000 to an employee by accepting a 6% note due in six months. N Purchased 3,500 units of inventory on account for $385,000 ($110 each) with terms 1/10, n/30. 3 Returned 100 defective units of inventory purchased on January 5. 4 Sold 3,300 units of inventory on account for $429,000 ($130 each) with terms 2/10, n/30. Record the sale. 5 Sold 3,300 units of inventory on account for $429,000 ($130 each) with terms 2/10, n/30. Record the cost of goods sold. 6 Customers returned 200 units sold on January 15. These units were initially purchased by the company on January 5. The units are placed in inventory to be sold in the future. Record the sales return. 7 Customers returned 200 units sold on January 15. These units were initially purchased by the company on January 5. The units are placed in inventory to be sold in the future. Record the cost of the items returned. 8 Received cash from customers on accounts receivable. This amount includes $36,000 from 2020 plus amount receivable on sale of 2,700 units sold on January 15. 9 Wrote off remaining accounts receivable from 2020. 10 Paid on accounts payable. The amount includes the amount owed at the beginning of the period plus the amount owed from purchase of 3,100 units on January 5. 11 Paid cash for salaries during January, $28,000. 12 Paid cash for utilities during January, $10,000. 13 Paid dividends, $3,000. 14 Of the remaining accounts receivable, the company estimates that 10% will not be collected. Record the adjusting entry for bad debts. 15 Record the adjusting entry for accrued interest revenue on the notes receivable for January. 16 Record the adjusting entry for accrued interest expense on the notes payable for January. 17 Accrued income taxes at the end of January for $5,000. Record the adjusting entry for income taxes. 18 Depreciation on the building, $2,000. Record the adjusting entry for depreciation. 19 Record the closing entry for temporary credit accounts. 20 Record the closing entry for temporary debit accounts. Analyze how well 3D Family Fireworks manages its receivables (a) Calculate the inventory turnover ratio for the month of January. If the industry average of the inventory turnover ratio for the month of January is 4.5 times, is the company selling its inventory more or less quickly than other companies in the same industry? The inventory turnover ratio is: times The company is managing its inventory more efficiently. (true or false) (b) Calculate the gross profit ratio for the month of January. If the industry average gross profit ratio is 33%, is the company more or less profitable per dollar of sales than other companies in the same industry? The gross profit ratio is: % The company is more profitable than other companies. (c) Used together, what might the inventory turnover ratio and gross profit ratio suggest about the company's business strategy? Is the company's strategy to sell a higher volume of less expensive items or does the company appear to be selling a lower volume of more expensive items? The company's business strategy appears to be selling