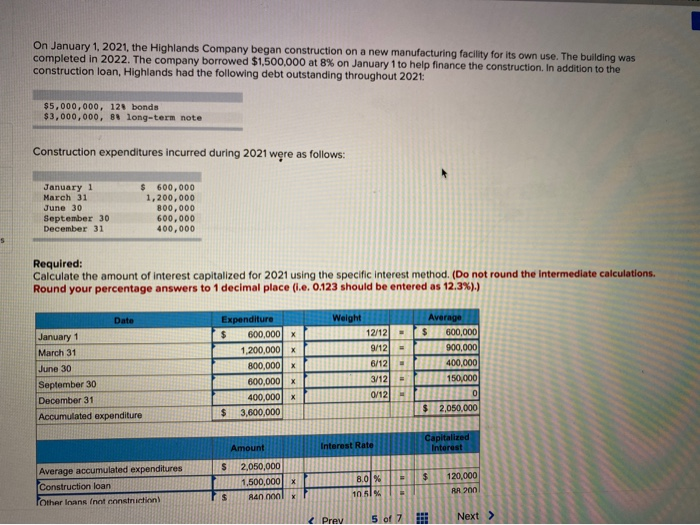

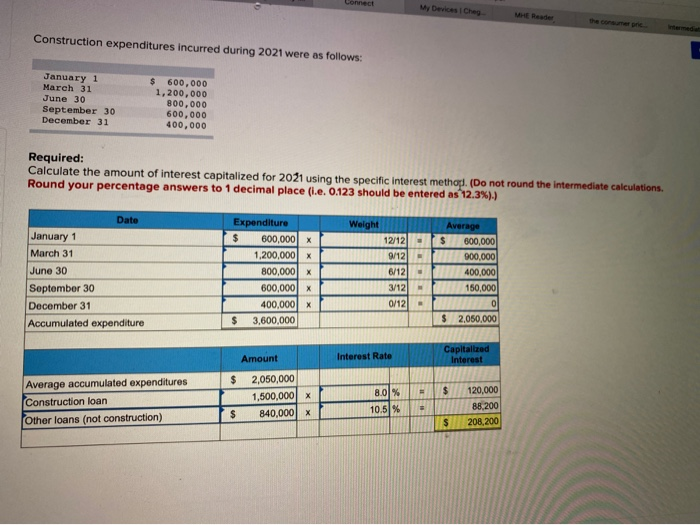

On January 1, 2021, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2022. The company borrowed $1,500,000 at 8% on January 1 to help finance the construction. In addition to the construction loan, Highlands had the following debt outstanding throughout 2021: $5,000,000, 128 bonds $3,000,000, 88 long-term note Construction expenditures incurred during 2021 were as follows: January 1 March 31 June 30 September 30 December 31 $ 600,000 1,200,000 800,000 600,000 400,000 5 Required: Calculate the amount of Interest capitalized for 2021 using the specific interest method. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (I.e. 0.123 should be entered as 12.3%).) Weight Date January 1 March 31 June 30 September 30 December 31 Accumulated expenditure Expenditure $ 600,000 x 1,200,000 800,000 X 600,000 x 400,000 X $ 3,600,000 12/12 9/12 6/12 - 3/12 - 0/12 Average $ 600,000 900,000 400,000 150,000 0 $ 2,050,000 Capitalized Interest Amount Interest Rate S $ 2,050,000 1,500,000 Ran non Average accumulated expenditures Construction loan fother loans (not construction X 8.01% 1n 51% 120,000 RU 200 $ Connect My Devices Ches Construction expenditures incurred during 2021 were as follows: January 1 March 31 June 30 September 30 December 31 $ 600,000 1,200,000 800,000 600,000 400,000 Required: Calculate the amount of interest capitalized for 2021 using the specific interest method. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (.e. 0.123 should be entered as 12.3%).) Weight Date January 1 March 31 June 30 September 30 December 31 Accumulated expenditure Expenditure $ 600,000 x 1.200,000 x 800,000 x 600,000 x 400,000 x $ 3,600,000 12/12 - 9/12 - 6/12 - 3/12 0/12 Average $ 800,000 900,000 400,000 150,000 0 $ 2,050,000 Amount Interest Rate Capitalized Interest $ - $ Average accumulated expenditures Construction loan Other loans (not construction) 2,050,000 1,500,000 x 840,000 x 8.01% 10.5% 120,000 88,200 208,200 $ $