Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, A-Aron Company acquired Cardinal Corporation by issuing 33,420 shares of its $5 par common stock with a market value of $50

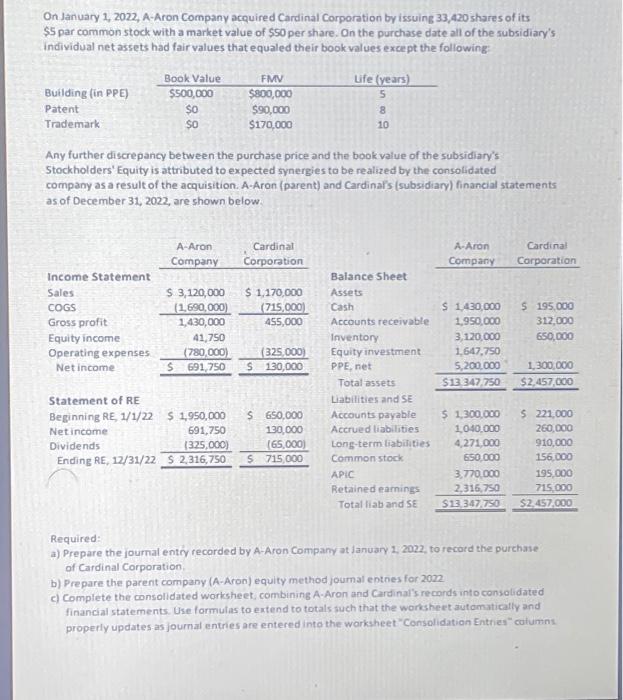

On January 1, 2022, A-Aron Company acquired Cardinal Corporation by issuing 33,420 shares of its $5 par common stock with a market value of $50 per share. On the purchase date all of the subsidiary's individual net assets had fair values that equaled their book values except the following: Building (in PPE) Patent Trademark Book Value $500,000 $0 $0 Income Statement Sales COGS Gross profit Equity income Operating expenses Net income Any further discrepancy between the purchase price and the book value of the subsidiary's Stockholders' Equity is attributed to expected synergies to be realized by the consolidated company as a result of the acquisition. A-Aron (parent) and Cardinal's (subsidiary) financial statements as of December 31, 2022, are shown below. A-Aran Company $ 3,120,000 (1,690,000) 1,430,000 41,750 (780,000) $ 691,750 Statement of RE Beginning RE, 1/1/22 Net income Dividends Ending RE, 12/31/22 $2,316,750 FMV $800,000 $90,000 $170,000 691,750 (325,000) Cardinal Corporation $ 1,170,000 (715,000) 455,000 (325,000) $ 130,000 $ 1,950,000 $ 650,000 130,000 (65,000) $ 715,000 Life (years) 5 8 10 Balance Sheet Assets Cash Accounts receivable Inventory Equity investment PPE, net Total assets Liabilities and SE Accounts payable Accrued liabilities Long-term liabilities Common stock APIC Retained earnings Total liab and SE A-Aron Cardinal Company Corporation $ 1,430,000 $ 195,000 1,950,000 312,000 650,000 3,120,000 1,647,750 5,200,000 $13,347,750 $ 1,300,000 1,040,000 4,271,000 650,000 3,770,000 2,316,750 $13,347,750 1,300,000 $2,457,000 $ 221,000 260,000 910,000 156,000 195,000 715,000 $2,457,000 Required: a) Prepare the journal entry recorded by A-Aron Company at January 1, 2022, to record the purchase of Cardinal Corporation. b) Prepare the parent company (A-Aron) equity method journal entries for 2022 c) Complete the consolidated worksheet, combining A-Aron and Cardinal's records into consolidated financial statements. Use formulas to extend to totals such that the worksheet automatically and properly updates as journal entries are entered into the worksheet "Consolidation Entries" columns

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started