Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year , 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds

On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds is payable on April 30th, August 31st, and December 31st. Bunks fiscal year is the calendar year. Any discount or premium is amortized using the straight-line method.

Required:

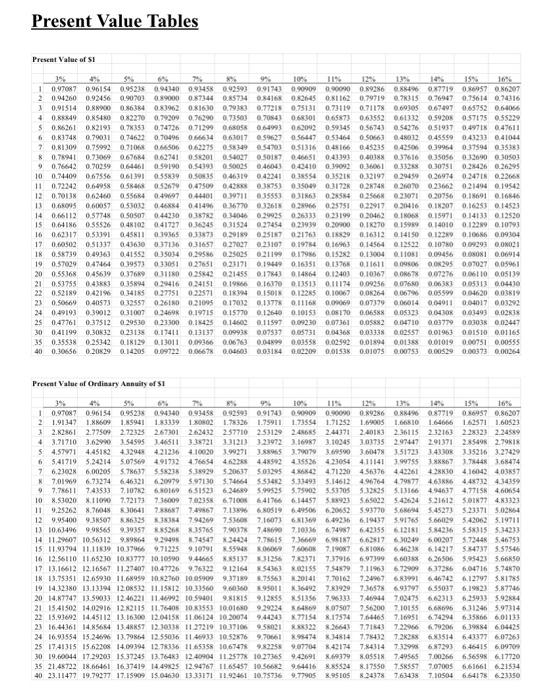

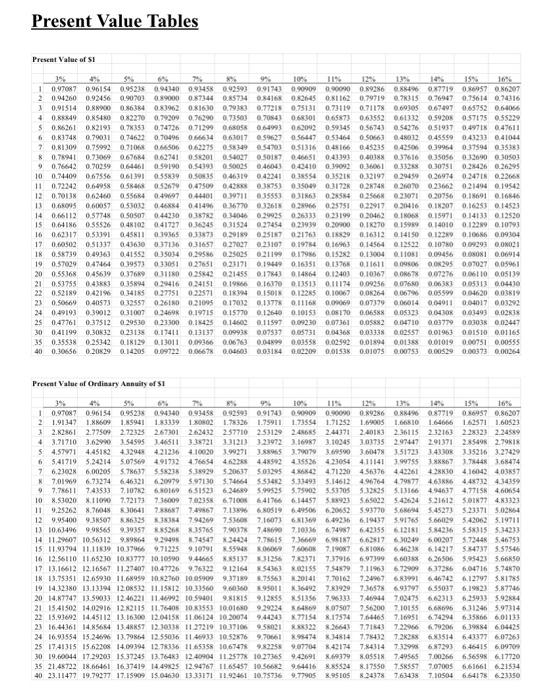

1. Prepare a detailed calculation of the present value of the bond using the present value tables on the next page. Do not round the table factors.

2. Prepare a detailed calculation of the price of the bond.Round answer to nearest whole dollar.

3. Prepare the journal entry to record the issuance of the bond. Journal entry description is not required.

4. Prepare the balance sheet presentation of the bond on December 31, 2023.  Present Value Tables Present Value of $1 3% 45 5% 65 85% 9% 10% 11% 12% 13% 14% 15% 16% 0.88496 087719 0.86957 0.86207 0.78315 076947 0.75614 0.74316 10.97087 0.96154 0.95238 094340 0.93458 0.92593 0.91743 090909 090090 0.89286 2 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 081162 079719 30.91514 0.88900 0.86384 083962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0.67497 065752 0.64066 4 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 068301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 5 0.86261 0.82193 07x353 0.74726 071299 0.68058 0.64993 062092 0.59345 0.56743 0.54276 0.51937 0.49718 0.47611 6 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 059627 0.56447 0.53464 0.50663 0.48032 0.45559 043233 041044 7 0.81309 0.75992 0.71068 0.66506 062275 0.58349 054703 051316 0,45166 0.45235 042506 0.39964 0.37594 0.35383 8 0.78941 0.73069 0.67684 062741 058201 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 035056 0.32690 030503 9 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 042410 0.39092 0.36061 0.33288 030751 0.28426 0.26295 10 0.74409 0.67556 0.61391 055839 0.50835 046319 0.42241 038554 0.35218 0.32197 0.29459 0.26974 0.24718 0.22668 11 0.72242 0.64958 0.58468 0.52679 0.47509 04288 0.38753 0.35049 0.31728 0.28748 0.26070 0.23662 021494 0.19542 12 0.70138 062460 055684 0.49697 0.44401 0.39711 035553 031863 0.28584 0.25668 0.23071 0.20756 0.18691 0.16846 13 0.68095 0.60057 0.53032 0.46884 041496 036770 0.32618 0.28966 0.25751 0.22917 020416 0.18207 0.16253 0.14523 14 0.66112 0.57748 0.50507 044230 0.38782 0.34046 0.29925 0.26333 023199 0.20462 0.18068 0.15971 0.14133 0.12520 15 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 014010 0.12289 0.10793 16 062317 0.53391 045811 0.39365 0.33873 0,29189 025187 021763 0.18829 0.16312 0.14150 0.12289 0.10686 0.09304 17 0.60502 051337 0.43630 037136 0.31657 0.27027 023107 0.19784 016963 0.14564 012522 0.10780 009293 0.0021 18 0.58739 0.49363 0.41552 035034 0.29586 0.25025 021199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 19 0.57029 047464 0.39573 033051 0.27651 0,23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0,05961 20 0.55368 0.45639 0.37689 031180 0.25842 021455 0.17843 0.14864 0.12403 0,10367 0.08678 0.07276 0.06110 0.05139 21 0.53755 0.43883 0.35894 0.29416 024151 0.19866 0.16370 013513 0.11174 0.09256 0.07680 0.06383 0.05313 0.04430 22 0.52189 0.42196 034185 0.27751 0.22571 0.18394 0.15018 0.12285 0.10067 0.08264 0.06796 0.05599 0.04620 0.03819 23 0.50669 0.40573 032557 026180 021095 017032 0.13778 0.11168 0.00069 0.07379 0.06014 0.04911 0.04017 0,03292 24 0.49193 0.39012 031007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 25 0.47761 0.37512 0.29530 023300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 30 0.41199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 001510 0.01165 35 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 40 0.30656 0.20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 0.00373 0.00264 Present Value of Ordinary Annuity of $1 9% 10% 11% 12% -14% 15% 596 10.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.66810 1.64666 1.62571 1.60523 3 2.82861 277509 272325 267301 2.62432 257710 253129 2.48685 2.44371 240183 2.36115 232163 228323 2.24589 4 3.71710 3.62990 3.54595 346511 3.38721 331213 323972 3.16987 3.10245 303735 297447 291371 285498 279818 54.57971 4.45182 4.32948 421236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.51723 3.43308 335216 3.27429 6 541719 5.24214 5.07569 491732 476654 462288 448592 4.35526 423054 431141 3.99755 3.88867 3.78448 3.68474 7 6.23028 6.00205 5.78637 5.58238 5.38929 520637 503295 486842 4.71220 456376 442261 428830 4,16042 4.03857 8 7,01969 6.73274 6.46321 620979 5.97130 5.74664 553482 5.33493 5.14612 496764 4.79677 4.63886 4,48732 4.34359 9 7.78611 743533 7,10782 6.80169 651523 6.24689 5.99525 5.75902 5.53705 5.32825 5.13166 494637 4.77158 4.60654 10 8.53020 8.11090 7.72173 7.36009 7.02358 671008 6417666.14457 5.38923 5.65022 542624 5.21612 501877 4.83323 11 9.25262 8.76048 830641 788687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.68694 5.45273 5.23371 5.02864 12 9.95400 9.38507 8.86325 838384 794269 7.53608 7.16073 6.81369 6.49236 6.19437 5.91765 5.66029 542062 519711 13 10.63496 9.98565 9.39357 885268 8.35765 7.90378 748690 7.10336 6.74987 642355 612181 5.84236 558315 5.34233 14 11.29607 10.56312 9.89864 9.29498 8.74547 X24424 7.76615 7.36669 6.98187 6.62817 630249 6.00207 5.72448 5.46753 15 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 806069 7.60608 7.19087 6.81086 6.46238 614217 534737 5.57546 16 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 697399 6.60383 6.26506 595423 5.66850 17 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 x54363 802155 7.54879 7.11963 6.72909 637286 6.04716 5,74870 18 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 $.75563 20141 7.70162 7.24967 6.83991 6.46742 6.12797 5.81785 19 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 *95011 K.36492 7.83929 736578 6.93797 6.55037 6.19823 5.87746 20 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 851356 7.96333 7.46944 7.02475 6.62313 6.25933 5.92884 21 1541502 14.02916 1282115 11.76408 10.83553 10.01680 929224 864869 807507 7.56200 7.10155 6.68696 631246 5.97314 22 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 9.44243 8.77154 8.17574 7.64465 7.16951 6.74294 6.35866 601133 23 16.44361 14.85684 13.48857 12.30338 11.27219 10.37106 9.58021 888322 8.26643 7.71843 7.22966 6.79206 6.39884 6.04425 24 16.93554 15.24696 13.79864 12.55036 1146933 10.52876 9.70661 8.95474 8.34814 7.78432 7.28288 6.83514 6.43377 6.07263 25 1741315 15.62208 14.09394 1278336 11.65358 10,67478 9.82258 907704 842174784314 7.32998 6.87293 646415 609709 30 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 10.27365 942691 8.69379 8.05518 7.49565 7.00266 656598 6.17720 35 21 48722 18.66461 1637419 14.49825 12.94767 11.65457 10.56682 9.64416 8.85524 8.17550 7.58557 7.07005 6.61661 621534 40 23.11477 19.79277 17.15909 15.04630 13.33171 11.92461 10.75736 9.77905 8.95105 8.24378 7.63438 7.10504 6.64178 6.23350

Present Value Tables Present Value of $1 3% 45 5% 65 85% 9% 10% 11% 12% 13% 14% 15% 16% 0.88496 087719 0.86957 0.86207 0.78315 076947 0.75614 0.74316 10.97087 0.96154 0.95238 094340 0.93458 0.92593 0.91743 090909 090090 0.89286 2 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 081162 079719 30.91514 0.88900 0.86384 083962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0.67497 065752 0.64066 4 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 068301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 5 0.86261 0.82193 07x353 0.74726 071299 0.68058 0.64993 062092 0.59345 0.56743 0.54276 0.51937 0.49718 0.47611 6 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 059627 0.56447 0.53464 0.50663 0.48032 0.45559 043233 041044 7 0.81309 0.75992 0.71068 0.66506 062275 0.58349 054703 051316 0,45166 0.45235 042506 0.39964 0.37594 0.35383 8 0.78941 0.73069 0.67684 062741 058201 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 035056 0.32690 030503 9 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 042410 0.39092 0.36061 0.33288 030751 0.28426 0.26295 10 0.74409 0.67556 0.61391 055839 0.50835 046319 0.42241 038554 0.35218 0.32197 0.29459 0.26974 0.24718 0.22668 11 0.72242 0.64958 0.58468 0.52679 0.47509 04288 0.38753 0.35049 0.31728 0.28748 0.26070 0.23662 021494 0.19542 12 0.70138 062460 055684 0.49697 0.44401 0.39711 035553 031863 0.28584 0.25668 0.23071 0.20756 0.18691 0.16846 13 0.68095 0.60057 0.53032 0.46884 041496 036770 0.32618 0.28966 0.25751 0.22917 020416 0.18207 0.16253 0.14523 14 0.66112 0.57748 0.50507 044230 0.38782 0.34046 0.29925 0.26333 023199 0.20462 0.18068 0.15971 0.14133 0.12520 15 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 014010 0.12289 0.10793 16 062317 0.53391 045811 0.39365 0.33873 0,29189 025187 021763 0.18829 0.16312 0.14150 0.12289 0.10686 0.09304 17 0.60502 051337 0.43630 037136 0.31657 0.27027 023107 0.19784 016963 0.14564 012522 0.10780 009293 0.0021 18 0.58739 0.49363 0.41552 035034 0.29586 0.25025 021199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 19 0.57029 047464 0.39573 033051 0.27651 0,23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0,05961 20 0.55368 0.45639 0.37689 031180 0.25842 021455 0.17843 0.14864 0.12403 0,10367 0.08678 0.07276 0.06110 0.05139 21 0.53755 0.43883 0.35894 0.29416 024151 0.19866 0.16370 013513 0.11174 0.09256 0.07680 0.06383 0.05313 0.04430 22 0.52189 0.42196 034185 0.27751 0.22571 0.18394 0.15018 0.12285 0.10067 0.08264 0.06796 0.05599 0.04620 0.03819 23 0.50669 0.40573 032557 026180 021095 017032 0.13778 0.11168 0.00069 0.07379 0.06014 0.04911 0.04017 0,03292 24 0.49193 0.39012 031007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 25 0.47761 0.37512 0.29530 023300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 30 0.41199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 001510 0.01165 35 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 40 0.30656 0.20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 0.00373 0.00264 Present Value of Ordinary Annuity of $1 9% 10% 11% 12% -14% 15% 596 10.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.66810 1.64666 1.62571 1.60523 3 2.82861 277509 272325 267301 2.62432 257710 253129 2.48685 2.44371 240183 2.36115 232163 228323 2.24589 4 3.71710 3.62990 3.54595 346511 3.38721 331213 323972 3.16987 3.10245 303735 297447 291371 285498 279818 54.57971 4.45182 4.32948 421236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.51723 3.43308 335216 3.27429 6 541719 5.24214 5.07569 491732 476654 462288 448592 4.35526 423054 431141 3.99755 3.88867 3.78448 3.68474 7 6.23028 6.00205 5.78637 5.58238 5.38929 520637 503295 486842 4.71220 456376 442261 428830 4,16042 4.03857 8 7,01969 6.73274 6.46321 620979 5.97130 5.74664 553482 5.33493 5.14612 496764 4.79677 4.63886 4,48732 4.34359 9 7.78611 743533 7,10782 6.80169 651523 6.24689 5.99525 5.75902 5.53705 5.32825 5.13166 494637 4.77158 4.60654 10 8.53020 8.11090 7.72173 7.36009 7.02358 671008 6417666.14457 5.38923 5.65022 542624 5.21612 501877 4.83323 11 9.25262 8.76048 830641 788687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.68694 5.45273 5.23371 5.02864 12 9.95400 9.38507 8.86325 838384 794269 7.53608 7.16073 6.81369 6.49236 6.19437 5.91765 5.66029 542062 519711 13 10.63496 9.98565 9.39357 885268 8.35765 7.90378 748690 7.10336 6.74987 642355 612181 5.84236 558315 5.34233 14 11.29607 10.56312 9.89864 9.29498 8.74547 X24424 7.76615 7.36669 6.98187 6.62817 630249 6.00207 5.72448 5.46753 15 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 806069 7.60608 7.19087 6.81086 6.46238 614217 534737 5.57546 16 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 697399 6.60383 6.26506 595423 5.66850 17 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 x54363 802155 7.54879 7.11963 6.72909 637286 6.04716 5,74870 18 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 $.75563 20141 7.70162 7.24967 6.83991 6.46742 6.12797 5.81785 19 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 *95011 K.36492 7.83929 736578 6.93797 6.55037 6.19823 5.87746 20 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 851356 7.96333 7.46944 7.02475 6.62313 6.25933 5.92884 21 1541502 14.02916 1282115 11.76408 10.83553 10.01680 929224 864869 807507 7.56200 7.10155 6.68696 631246 5.97314 22 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 9.44243 8.77154 8.17574 7.64465 7.16951 6.74294 6.35866 601133 23 16.44361 14.85684 13.48857 12.30338 11.27219 10.37106 9.58021 888322 8.26643 7.71843 7.22966 6.79206 6.39884 6.04425 24 16.93554 15.24696 13.79864 12.55036 1146933 10.52876 9.70661 8.95474 8.34814 7.78432 7.28288 6.83514 6.43377 6.07263 25 1741315 15.62208 14.09394 1278336 11.65358 10,67478 9.82258 907704 842174784314 7.32998 6.87293 646415 609709 30 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 10.27365 942691 8.69379 8.05518 7.49565 7.00266 656598 6.17720 35 21 48722 18.66461 1637419 14.49825 12.94767 11.65457 10.56682 9.64416 8.85524 8.17550 7.58557 7.07005 6.61661 621534 40 23.11477 19.79277 17.15909 15.04630 13.33171 11.92461 10.75736 9.77905 8.95105 8.24378 7.63438 7.10504 6.64178 6.23350

On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds is payable on April 30th, August 31st, and December 31st. Bunks fiscal year is the calendar year. Any discount or premium is amortized using the straight-line method.

Required:

1. Prepare a detailed calculation of the present value of the bond using the present value tables on the next page. Do not round the table factors.

2. Prepare a detailed calculation of the price of the bond.Round answer to nearest whole dollar.

3. Prepare the journal entry to record the issuance of the bond. Journal entry description is not required.

4. Prepare the balance sheet presentation of the bond on December 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started