Answered step by step

Verified Expert Solution

Question

1 Approved Answer

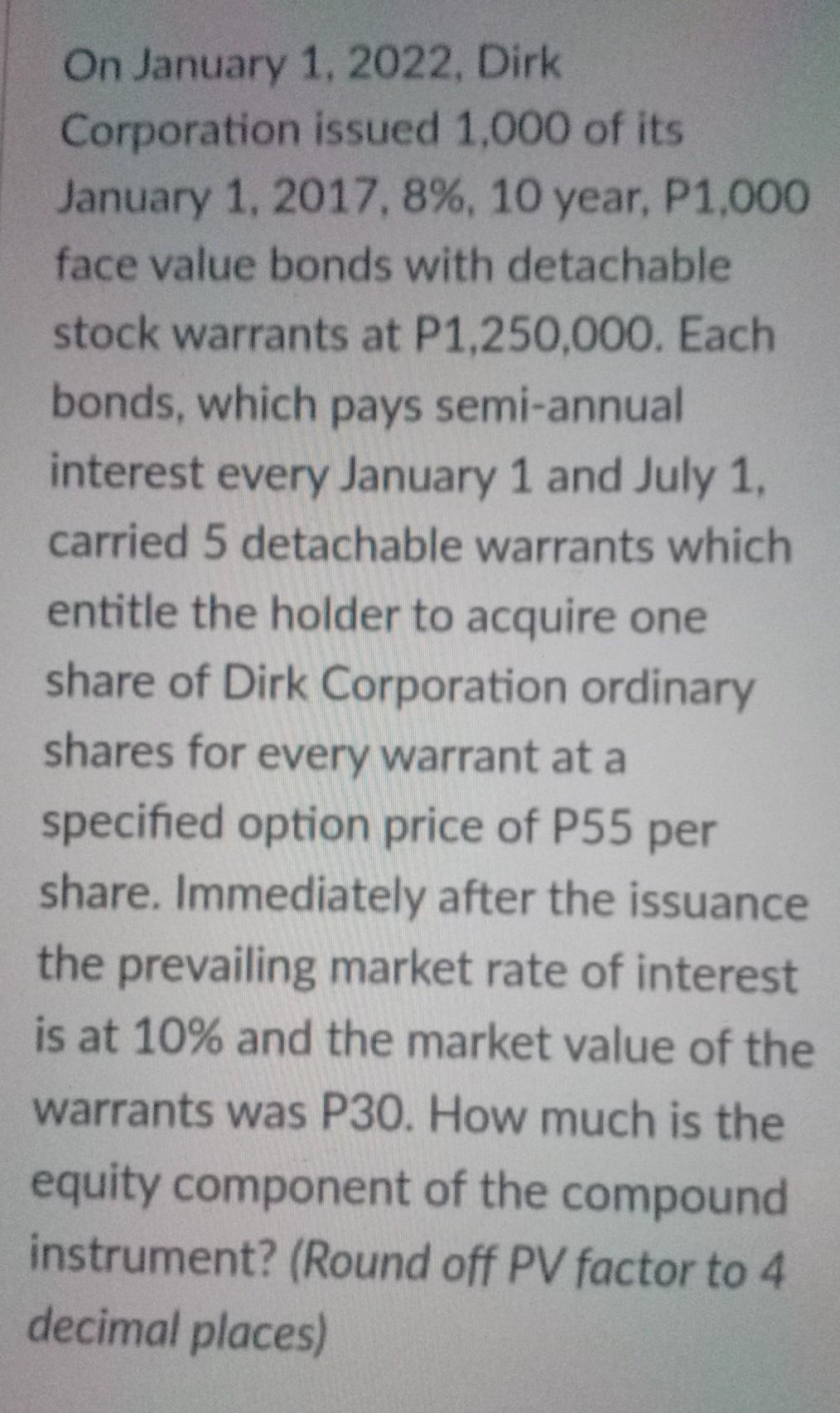

On January 1, 2022, Dirk Corporation issued 1,000 of its January 1, 2017.8%, 10 year, P1,000 face value bonds with detachable stock warrants at P1,250,000.

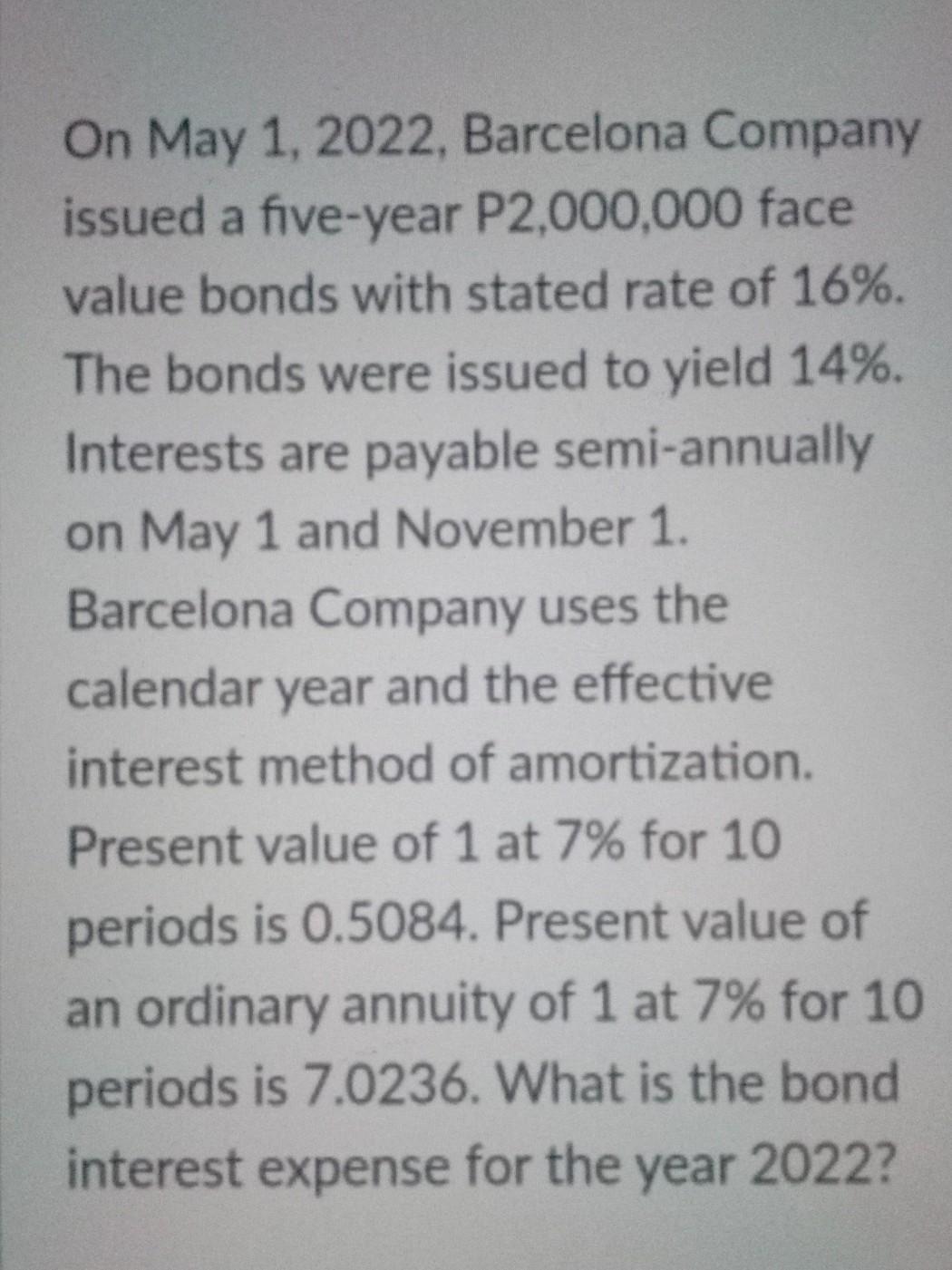

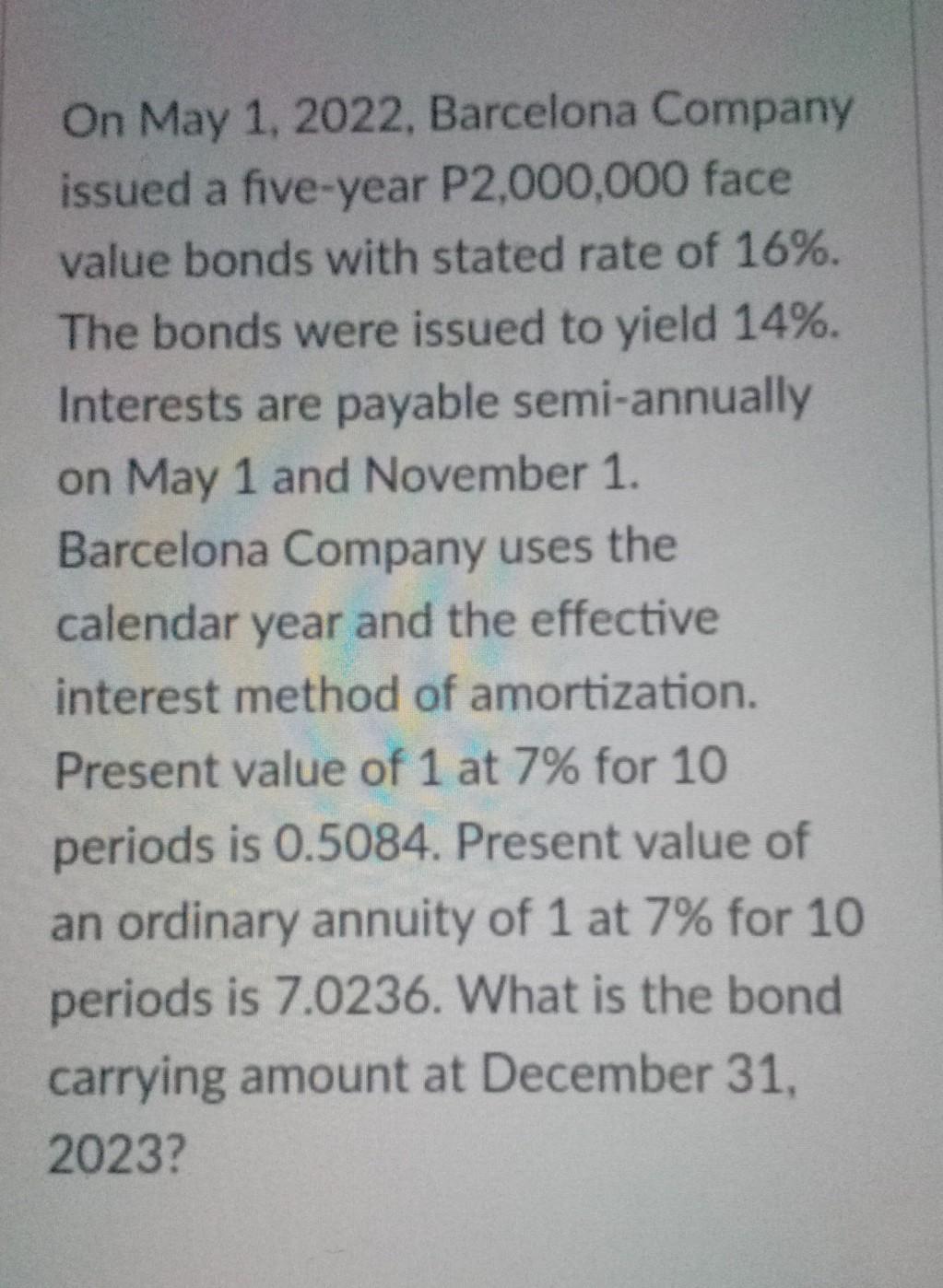

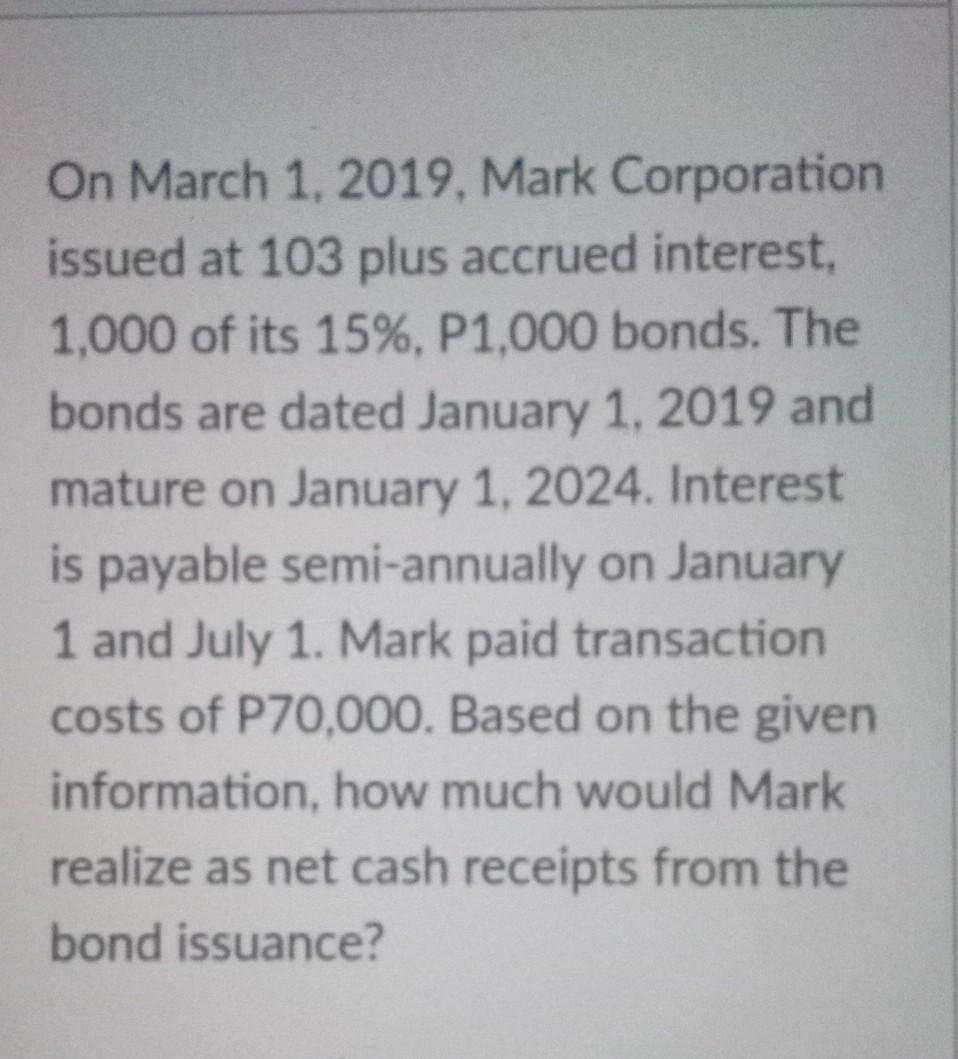

On January 1, 2022, Dirk Corporation issued 1,000 of its January 1, 2017.8%, 10 year, P1,000 face value bonds with detachable stock warrants at P1,250,000. Each bonds, which pays semi-annual interest every January 1 and July 1, carried 5 detachable warrants which entitle the holder to acquire one share of Dirk Corporation ordinary shares for every warrant at a specified option price of P55 per share. Immediately after the issuance the prevailing market rate of interest is at 10% and the market value of the warrants was P30. How much is the equity component of the compound instrument? (Round off PV factor to 4 decimal places) On May 1, 2022, Barcelona Company issued a five-year P2,000,000 face value bonds with stated rate of 16%. The bonds were issued to yield 14%. Interests are payable semi-annually on May 1 and November 1. Barcelona Company uses the calendar year and the effective interest method of amortization. Present value of 1 at 7% for 10 periods is 0.5084. Present value of an ordinary annuity of 1 at 7% for 10 periods is 7.0236. What is the bond interest expense for the year 2022? On May 1, 2022, Barcelona Company issued a five-year P2,000,000 face value bonds with stated rate of 16%. The bonds were issued to yield 14%. Interests are payable semi-annually on May 1 and November 1. Barcelona Company uses the calendar year and the effective interest method of amortization. Present value of 1 at 7% for 10 periods is 0.5084. Present value of an ordinary annuity of 1 at 7% for 10 periods is 7.0236. What is the bond carrying amount at December 31, 2023? On March 1, 2019. Mark Corporation issued at 103 plus accrued interest, 1,000 of its 15%, P1,000 bonds. The bonds are dated January 1, 2019 and mature on January 1, 2024. Interest is payable semi-annually on January 1 and July 1. Mark paid transaction costs of P70,000. Based on the given information, how much would Mark realize as net cash receipts from the bond issuance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started