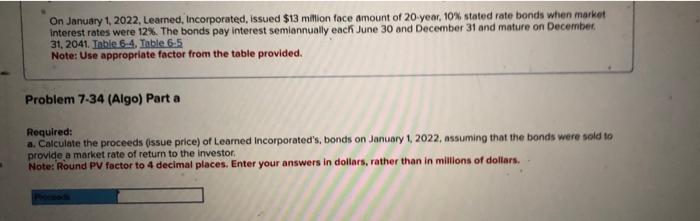

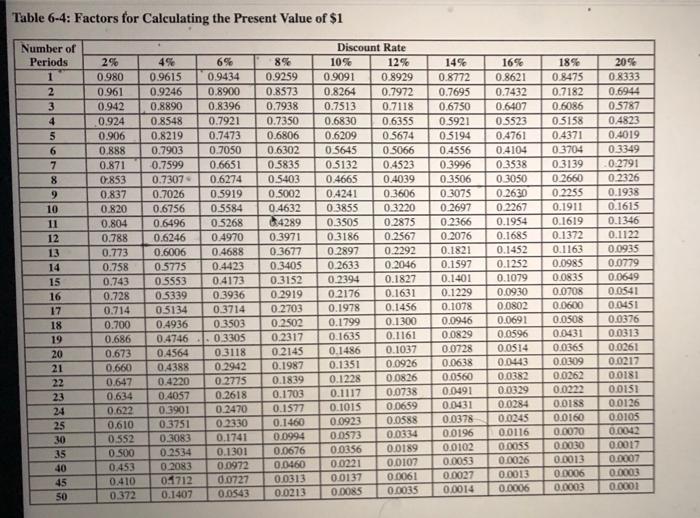

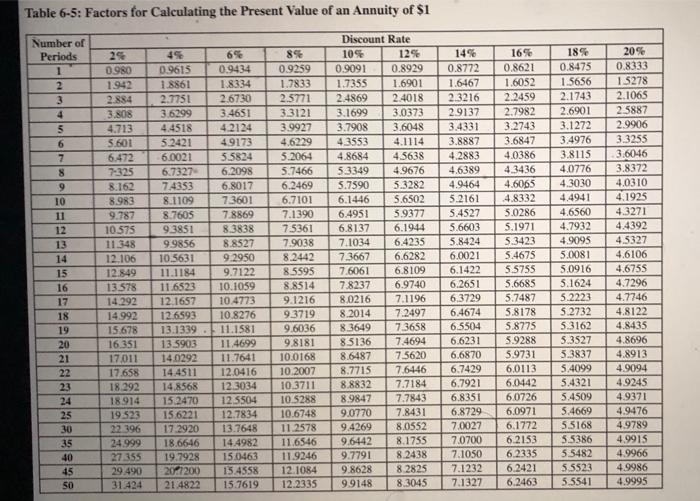

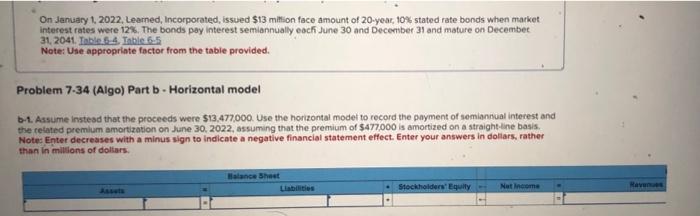

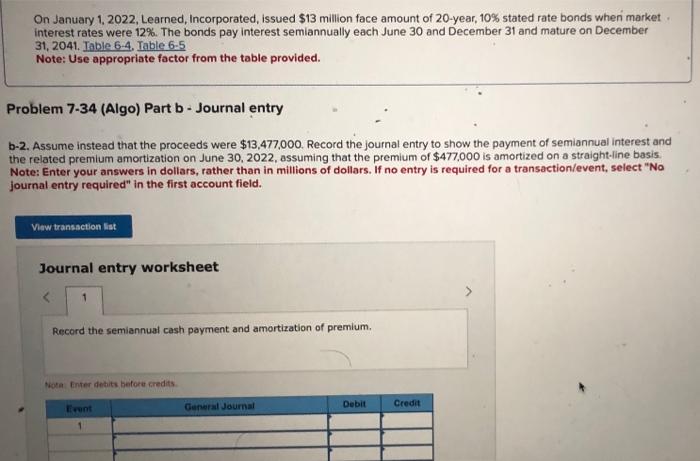

On January 1, 2022, Learned, Incorporated, issued $13 mition face amount of 20 -year, 10% stated rate bonds when market interest rates were 12%. The bonds pay interest semiannually each June 30 and December 31 and mature on December. 31, 2041. Table 6.4. Toble 6.5 Note: Use appropriate factor from the table provided. roblem 7.34 (Algo) Part a required: 1. Calculate the proceeds (issue price) of Learned incorporated's, bonds on January 1, 2022, assuming that the bonds were sold to rovide, a market rate of return to the investor. Mote: Round PV factor to 4 decimal places. Enter your answers in dollars, rather than in millions of dollars. Table 6-4: Factors for Calculating the Present Value of $1 Table 6-5: Factors for Calculating the Present Value of an Annuity of $1 On January 1, 2022, Learned, Incorporated, issued $13 mition face amount of 20-yeac, 10% stated rate bonds when market interest rates were 12%. The bonds poy interest semiannually each June 30 and Decenber 31 and mature on Decembec. 31, 2041. Iable.6-4. Table 6.5 Note: Use appropriate factor from the table provided. Problem 7.34 (Algo) Part b - Horizontal model b-1. Assume instesd that the proceeds were $13,477,000. Use the horizontal modef to record the payment of somiannual interest and the related premium amortization on June 30, 2022, assuming that the premium of $477,000 is amortized on a straight-line basis. Notes Enter decreases with a minus sign to indicate a negative financial statement effect. Enter your answers in doliars, rather than in millions of doltars. On January 1, 2022, Learned, Incorporated, issued $13 million face amount of 20year,10% stated rate bonds when market interest rates were 12%. The bonds pay interest semiannually each June 30 and December 31 and mature on December 31, 2041. Table 6-4. Table 6-5 Note: Use appropriate factor from the table provided. roblem 7-34 (Algo) Part b - Journal entry -2. Assume instead that the proceeds were $13,477,000. Record the journal entry to show the payment of semiannual interest and he related premium amortization on June 30,2022 , assuming that the premium of $477,000 is amortized on a straight-line basis. Note: Enter your answers in dollars, rather than in millions of dollars. If no entry is required for a transaction/event, select "No ournal entry required" in the first account field. Journal entry worksheet Record the semiannual cash payment and amortization of premium. Hota finter debits betore riedits