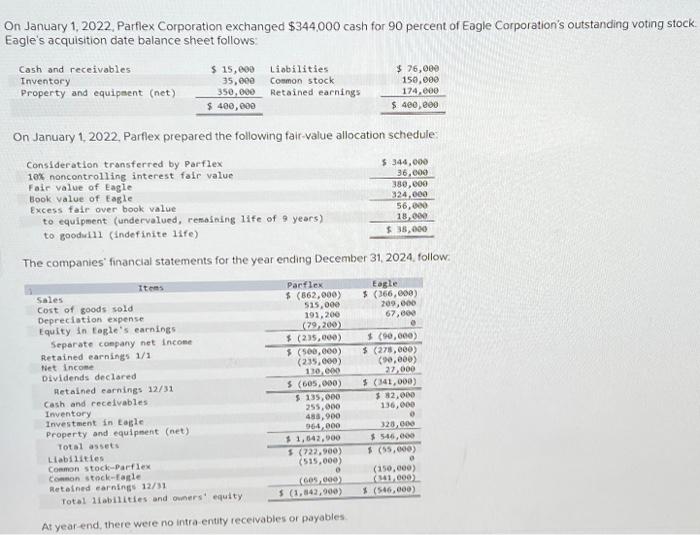

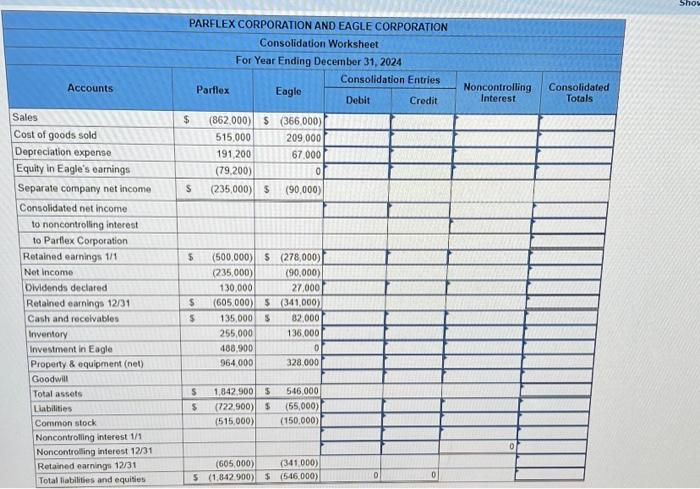

On January 1, 2022, Parflex Corporation exchanged $344,000 cash for 90 percent of Eagle Corporation's outstanding voting stock. Eagle's acquisition date balance sheet follows: On January 1,2022, Parflex prepared the following fair-value allocation schedule: The companies' financial statements for the year ending December 31, 2024, follow: At year-end, there were no intra-entity receivables or payables PARFLEX CORPORATION AND EAGLE CORPORATION Consolidation Worksheet For Year Ending December 31, 2024 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Accounts } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Parflex }} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Eagle: }} & \multicolumn{2}{|c|}{ Consolidation Entries } & \multirow{2}{*}{\begin{tabular}{l} Noncontrolling \\ Interest \end{tabular}} & \multirow{2}{*}{\begin{tabular}{c} Consolidated \\ Totals \end{tabular}} \\ \hline & & & & & Debit & Credit & & \\ \hline Sales & $ & (862,000) & $ & (366,000) & & & & \\ \hline Cost of goods sold & & 515,000 & & 209,000 & & & & \\ \hline Depreciation expense & & 191,200 & & 67.000 & & & & \\ \hline Equity in Eagle's earnings & & (79,200) & & of & & & & \\ \hline Separate company net income & $ & (235,000) & 5 & (90,000) & & & & \\ \hline \multicolumn{9}{|l|}{ Consolidated net income } \\ \hline \multicolumn{9}{|l|}{ to noncontrolling interest } \\ \hline \multicolumn{9}{|l|}{ to Parflex Corporation } \\ \hline Retained earnings 1/1 & $ & (500.000) & 5 & (278,000) & & & & \\ \hline Net income & & (235,000) & & (90,000) & & & & \\ \hline Dividends declared & & 130.000 & & 27,000 & & & & \\ \hline Retained earnings 12/31 & 5 & (605.000) & $ & (341,000) & & & & \\ \hline Cash and recelvables & s & 135,000 & $ & 32.000 & & & & \\ \hline Inventory & & 255,000 & & 136.000 & & & & \\ \hline Investment in Eagle & & 488.900 & & 0 & & & & \\ \hline Property 8 equipment (net) & & 964,000 & & 328.000 & & & & \\ \hline \multicolumn{9}{|l|}{ Goodwill } \\ \hline Total assets & 5 & 1.842 .900 & 5 & 546.000 & & & & \\ \hline Llabilities & $ & (722.900) & s & (55,000) & & & & \\ \hline Common stock & & (515,000) & & (150,000) & & & & \\ \hline \multicolumn{9}{|l|}{ Noncontrolling interest 1/1} \\ \hline Noncontrolling interest 12/31 & & & & & & & & \\ \hline Retained earnings 12/31 & & (605,000) & & (341.000) & & & & \\ \hline Total tiabilities and equities & 5 & (1,842,900) & $ & (546.000) & 0 & 0 & & \\ \hline \end{tabular}