Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Pontiac Corp acquired 30,000 shares (30% of the outstanding shares) of Studebaker at a price of $9.50 per share, giving it

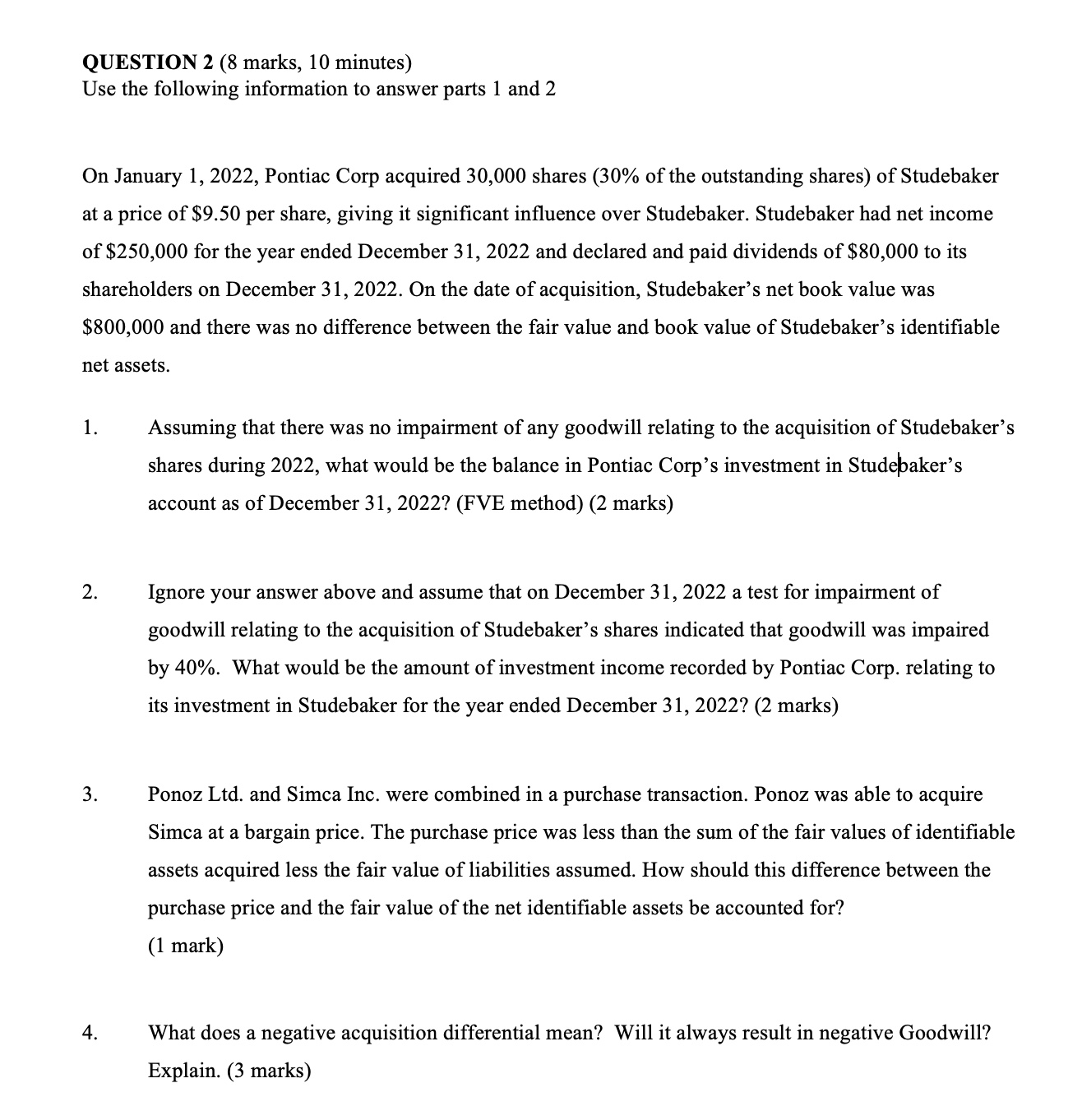

On January 1, 2022, Pontiac Corp acquired 30,000 shares (30\% of the outstanding shares) of Studebaker at a price of $9.50 per share, giving it significant influence over Studebaker. Studebaker had net income of $250,000 for the year ended December 31, 2022 and declared and paid dividends of $80,000 to its shareholders on December 31, 2022. On the date of acquisition, Studebaker's net book value was $800,000 and there was no difference between the fair value and book value of Studebaker's identifiable net assets. 1. Assuming that there was no impairment of any goodwill relating to the acquisition of Studebaker's shares during 2022, what would be the balance in Pontiac Corp's investment in Studepaker's account as of December 31, 2022? (FVE method) (2 marks) 2. Ignore your answer above and assume that on December 31, 2022 a test for impairment of goodwill relating to the acquisition of Studebaker's shares indicated that goodwill was impaired by 40%. What would be the amount of investment income recorded by Pontiac Corp. relating to its investment in Studebaker for the year ended December 31, 2022? (2 marks) 3. Ponoz Ltd. and Simca Inc. were combined in a purchase transaction. Ponoz was able to acquire Simca at a bargain price. The purchase price was less than the sum of the fair values of identifiable assets acquired less the fair value of liabilities assumed. How should this difference between the purchase price and the fair value of the net identifiable assets be accounted for? (1 mark) 4. What does a negative acquisition differential mean? Will it always result in negative Goodwill? Explain

On January 1, 2022, Pontiac Corp acquired 30,000 shares (30\% of the outstanding shares) of Studebaker at a price of $9.50 per share, giving it significant influence over Studebaker. Studebaker had net income of $250,000 for the year ended December 31, 2022 and declared and paid dividends of $80,000 to its shareholders on December 31, 2022. On the date of acquisition, Studebaker's net book value was $800,000 and there was no difference between the fair value and book value of Studebaker's identifiable net assets. 1. Assuming that there was no impairment of any goodwill relating to the acquisition of Studebaker's shares during 2022, what would be the balance in Pontiac Corp's investment in Studepaker's account as of December 31, 2022? (FVE method) (2 marks) 2. Ignore your answer above and assume that on December 31, 2022 a test for impairment of goodwill relating to the acquisition of Studebaker's shares indicated that goodwill was impaired by 40%. What would be the amount of investment income recorded by Pontiac Corp. relating to its investment in Studebaker for the year ended December 31, 2022? (2 marks) 3. Ponoz Ltd. and Simca Inc. were combined in a purchase transaction. Ponoz was able to acquire Simca at a bargain price. The purchase price was less than the sum of the fair values of identifiable assets acquired less the fair value of liabilities assumed. How should this difference between the purchase price and the fair value of the net identifiable assets be accounted for? (1 mark) 4. What does a negative acquisition differential mean? Will it always result in negative Goodwill? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started