Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Pronghorn Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine

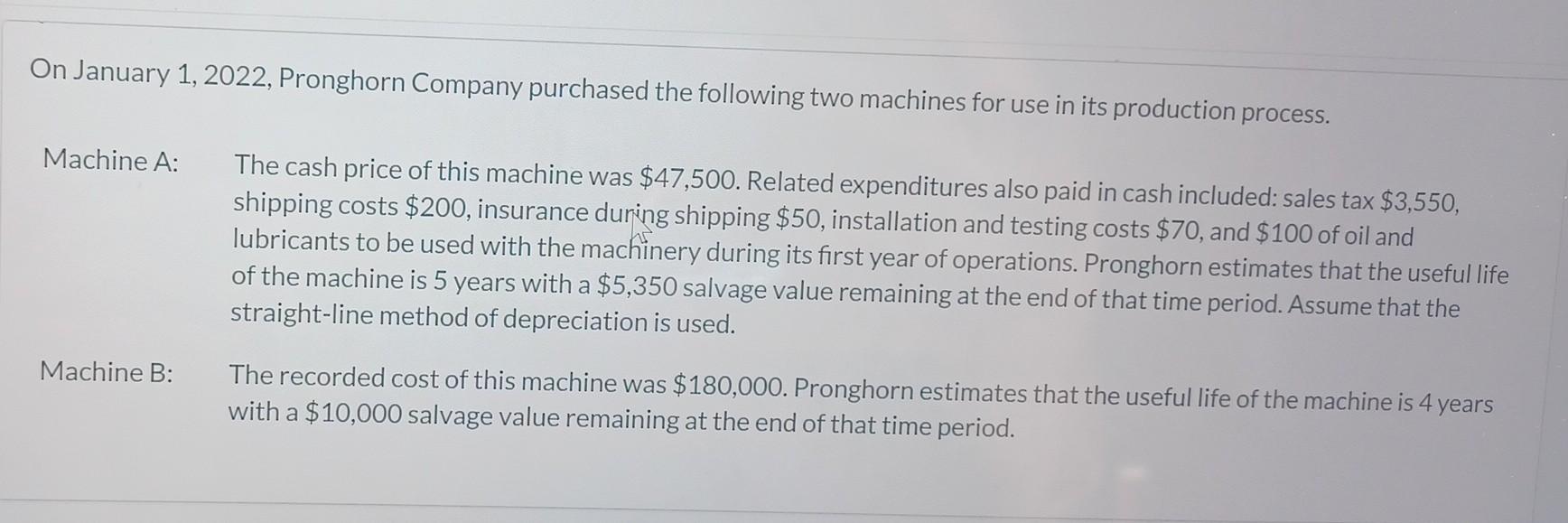

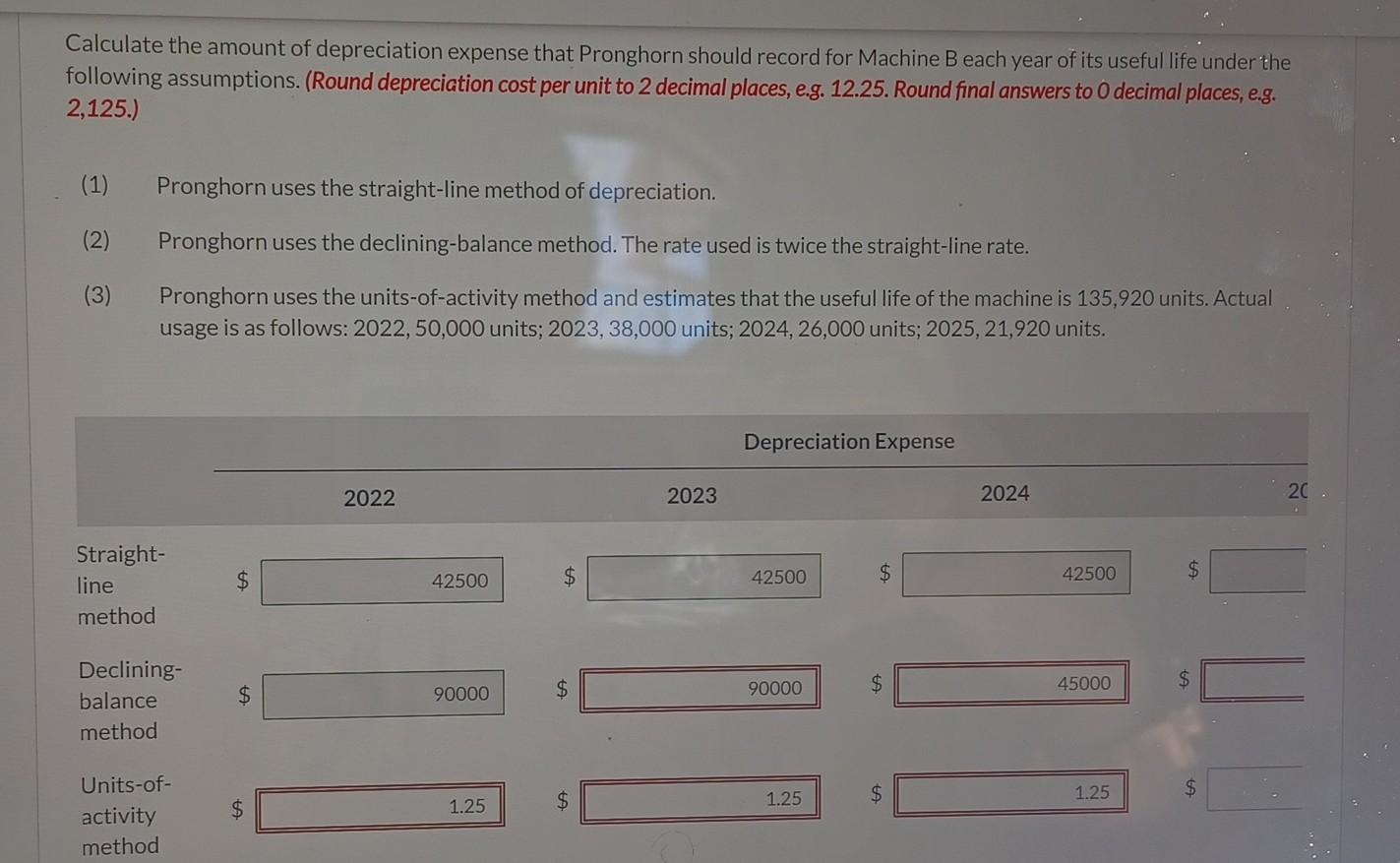

On January 1, 2022, Pronghorn Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $47,500. Related expenditures also paid in cash included: sales tax $3,550, shipping costs $200, insurance during shipping $50, installation and testing costs $70, and $100 of oil and lubricants to be used with the machinery during its first year of operations. Pronghorn estimates that the useful life of the machine is 5 years with a $5,350 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. Machine B: The recorded cost of this machine was $180,000. Pronghorn estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period. Calculate the amount of depreciation expense that Pronghorn should record for Machine B each year of its useful life under the following assumptions. (Round depreciation cost per unit to 2 decimal places, e.g. 12.25. Round final answers to 0 decimal places, e.g. 2,125.) (1) Pronghorn uses the straight-line method of depreciation. (2) Pronghorn uses the declining-balance method. The rate used is twice the straight-line rate. (3) Pronghorn uses the units-of-activity method and estimates that the useful life of the machine is 135,920 units. Actual usage is as follows: 2022,50,000 units; 2023,38,000 units; 2024,26,000 units; 2025,21,920 units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started