Question

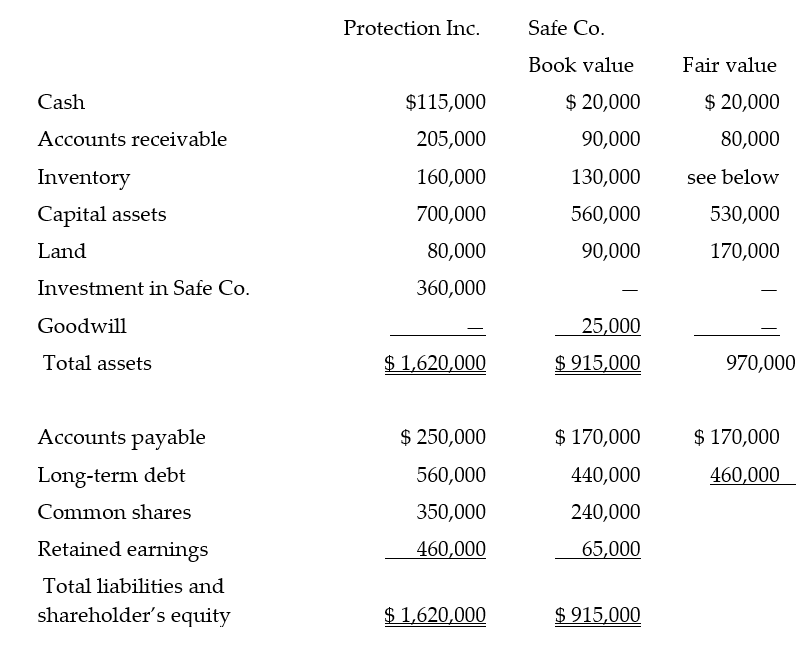

On January 1, 2022, Protection Inc. purchased 60% of the outstanding shares of Safe Co. for $360,000. The balance sheets for both companies immediately after

On January 1, 2022, Protection Inc. purchased 60% of the outstanding shares of Safe Co. for $360,000. The balance sheets for both companies immediately after the transaction appear below.

Required:

Using the Entity theory (FVE method), calculate goodwill using fair values. The fair value of Safe Company inventory is $130,000. Please highlight the goodwill amount in yellow.

Calculate goodwill using net book values, including allocation of the acquisition differential. You must also calculate the value of non-controlling interest in this calculation. Please highlight the NCI amount in yellow.

Prepare a consolidated Statement of Financial Position. Your statement must be in good form as per the assignment submission guidelines. Marks will be deducted for poor presentation. Please note that the above balance sheets are for your information and are not considered to be good form.

Protection Inc. Safe CoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started