Question

on January 1, 2022, you purchase a 2500 square-foot single-family house for $425,000 with 20% down payment. Your mortgage has a fixed rate of 4.00%

on January 1, 2022, you purchase a 2500 square-foot single-family house for $425,000 with 20% down payment. Your mortgage has a fixed rate of 4.00% for 30 years. According to tax assessors office, 75% of the value of the property lies in the building and 25% in the land.

- it will take about two months to find the renter. In other words the house will be vacant for two months, so no rental income. The rent will be $2000 per month and the rent will be increased by 3% every year there after.

-well you were trying to find a renter for your house you spent $3,500 on paint and repairs. Do you plan on spending the same amount of money for next year and then increase that spending by 2% every year there after.

-Tenant will pay for all utilities

-You will pay $50 per month for landscaping and it will increase by 5% every year

-you will pay $4,500 per year for property taxes and it will increase by 1% every year

-he will pay $975 for property insurance per year and it will increase by 2% per year.

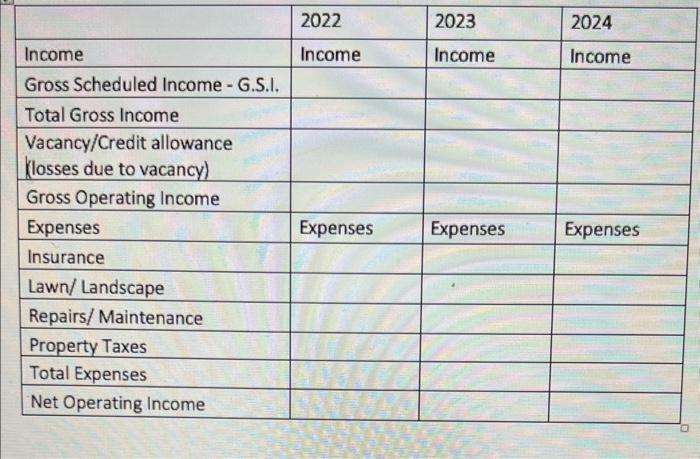

Income Gross Scheduled Income - G.S.I. Total Gross Income Vacancy/Credit allowance losses due to vacancy) Gross Operating Income Expenses Insurance Lawn/Landscape Repairs/ Maintenance Property Taxes Total Expenses Net Operating Income 2022 Income Expenses 2023 Income Expenses 2024 Income Expenses

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 2022 Income Gross Scheduled Income GSI 0 2 months vacancy Total Gross Income 0 Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started