Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, DDD Corporation purchased as a long-term investment P4,000,000 face amount, 12% bonds of EEE Corporation for P4,600,000 plus direct transaction

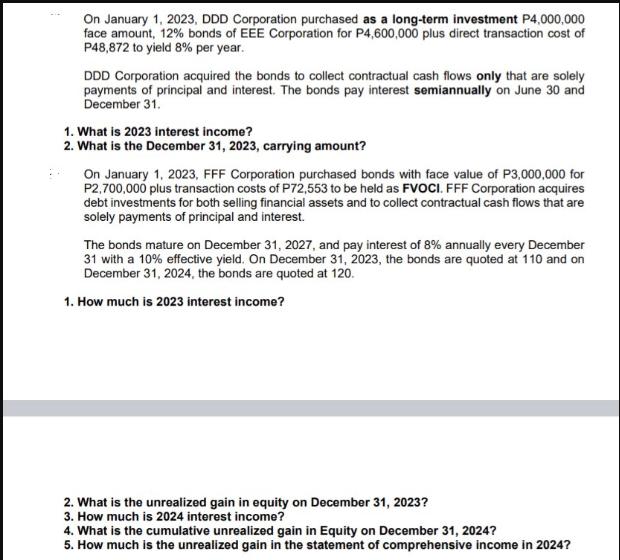

On January 1, 2023, DDD Corporation purchased as a long-term investment P4,000,000 face amount, 12% bonds of EEE Corporation for P4,600,000 plus direct transaction cost of P48,872 to yield 8% per year. DDD Corporation acquired the bonds to collect contractual cash flows only that are solely payments of principal and interest. The bonds pay interest semiannually on June 30 and December 31. 1. What is 2023 interest income? 2. What is the December 31, 2023, carrying amount? On January 1, 2023, FFF Corporation purchased bonds with face value of P3,000,000 for P2,700,000 plus transaction costs of P72,553 to be held as FVOCI. FFF Corporation acquires debt investments for both selling financial assets and to collect contractual cash flows that are solely payments of principal and interest. The bonds mature on December 31, 2027, and pay interest of 8% annually every December 31 with a 10% effective yield. On December 31, 2023, the bonds are quoted at 110 and on December 31, 2024, the bonds are quoted at 120. 1. How much is 2023 interest income? 2. What is the unrealized gain in equity on December 31, 2023? 3. How much is 2024 interest income? 4. What is the cumulative unrealized gain in Equity on December 31, 2024? 5. How much is the unrealized gain in the statement of comprehensive income in 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 DDD Corporation a 2023 Interest Income Face Amount of Bonds x Stated Interest Rate P40000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started