Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Dino Corporation makes an investment in a new factory. They provide you with the following information: begin{tabular}{|c|c|c|} hline Cost of the

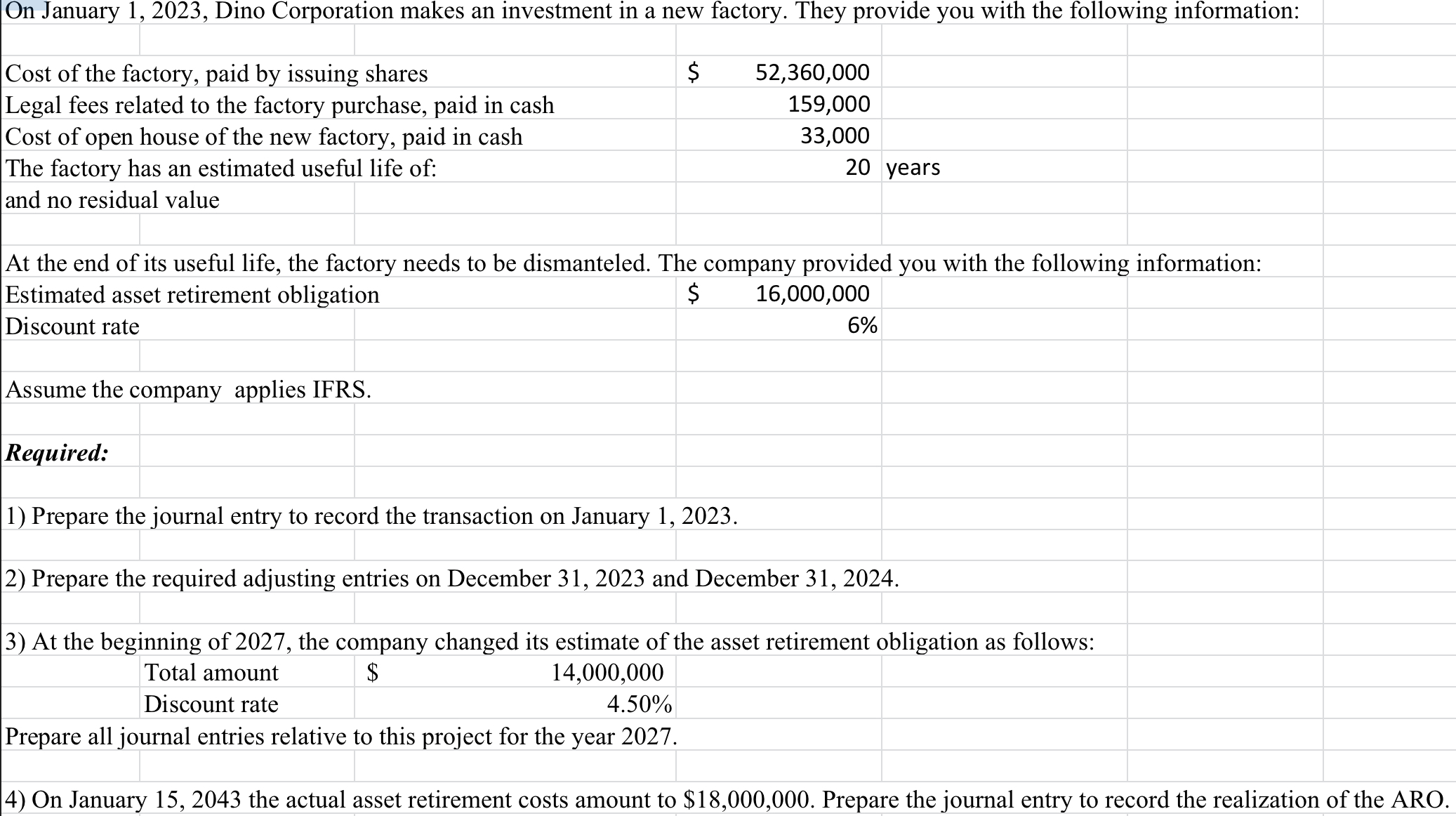

On January 1, 2023, Dino Corporation makes an investment in a new factory. They provide you with the following information: \begin{tabular}{|c|c|c|} \hline Cost of the factory, paid by issuing shares & $ & 52,360,000 \\ \hline Legal fees related to the factory purchase, paid in cash & & 159,000 \\ \hline Cost of open house of the new factory, paid in cash & & 33 \\ \hline The factory has an estimated useful life of: & & \\ \hline \end{tabular} At the end of its useful life, the factory needs to be dismanteled. The company provided you with the following information: Assume the company applies IFRS. Required: 1) Prepare the journal entry to record the transaction on January 1, 2023. 2) Prepare the required adjusting entries on December 31, 2023 and December 31, 2024. 3) At the beginning of 2027 , the company changed its estimate of the asset retirement obligation as follows: \begin{tabular}{|c|c|c|} \hline Total amount & $ & 14,000,000 \\ \hline Discount rate & & 50% \\ \hline \end{tabular} Prepare all journal entries relative to this project for the year 2027. 4) On January 15,2043 the actual asset retirement costs amount to $18,000,000. Prepare the journal entry to record the realization of the ARO

On January 1, 2023, Dino Corporation makes an investment in a new factory. They provide you with the following information: \begin{tabular}{|c|c|c|} \hline Cost of the factory, paid by issuing shares & $ & 52,360,000 \\ \hline Legal fees related to the factory purchase, paid in cash & & 159,000 \\ \hline Cost of open house of the new factory, paid in cash & & 33 \\ \hline The factory has an estimated useful life of: & & \\ \hline \end{tabular} At the end of its useful life, the factory needs to be dismanteled. The company provided you with the following information: Assume the company applies IFRS. Required: 1) Prepare the journal entry to record the transaction on January 1, 2023. 2) Prepare the required adjusting entries on December 31, 2023 and December 31, 2024. 3) At the beginning of 2027 , the company changed its estimate of the asset retirement obligation as follows: \begin{tabular}{|c|c|c|} \hline Total amount & $ & 14,000,000 \\ \hline Discount rate & & 50% \\ \hline \end{tabular} Prepare all journal entries relative to this project for the year 2027. 4) On January 15,2043 the actual asset retirement costs amount to $18,000,000. Prepare the journal entry to record the realization of the ARO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started