Question

On January 1, 2023, EL Ltd. purchased the right to extract oil from proven oil reserves on provincial government land. It paid $3,000,000 for production

On January 1, 2023, EL Ltd. purchased the right to extract oil from proven oil reserves on provincial government land. It paid $3,000,000 for production equipment and debited the "Equipment" account for the purchase price. Operations began on that day, and the agreement provided for three years of operations (until December 31, 2025), at which time it was estimated the oil reserves would be exhausted. ELR planned to extract the oil evenly over the three-year period and therefore decided to depreciate the cost of the equipment using the straight-line method, with no residual or salvage value. Included in the agreement with the government was a provision that the business would clean up the site at the end of the three years. On the date of purchase, ELR's engineers and accountants estimated that the total cost to clean up the site on December 31, 2025 would total $352,000, and the discount rate to be applied to that future cost would be 8%. (Note: clean-up costs are also being debited to "Equipment"). On December 31, 2025, a contractor was paid $342,400 to clean up the site, and in January 2026 the site was closed. ELR's fiscal year end was December 31, and the company followed ASPE.

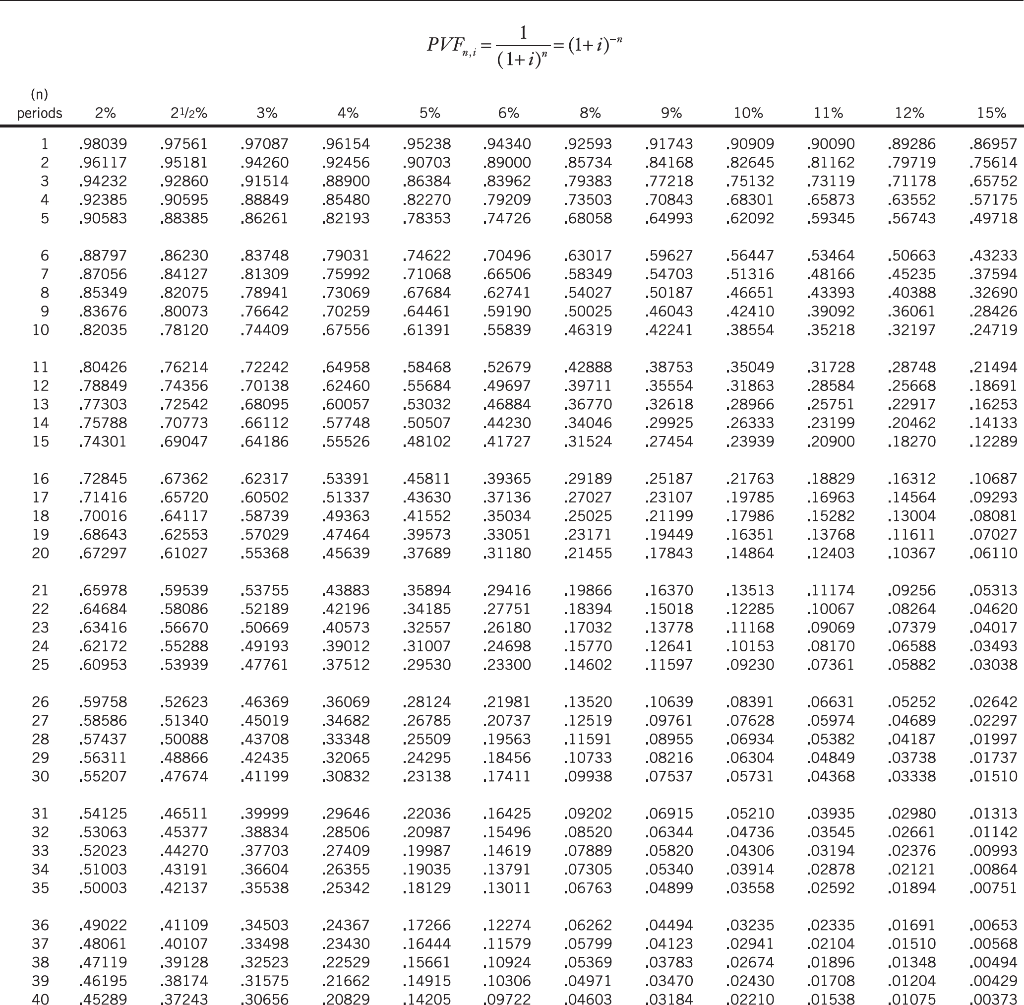

Prepare the required journal entries for each of the following dates, using the expense approach. (Note: no inventory or sales related journal entries are required): January 1, 2023 Use (a) factor Table A.2, (b) a financial calculator, or (c) Excel function PV. December 31,2023 December 31, 2024 December 31, 2025

PVF==(1+i)n1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started