Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27

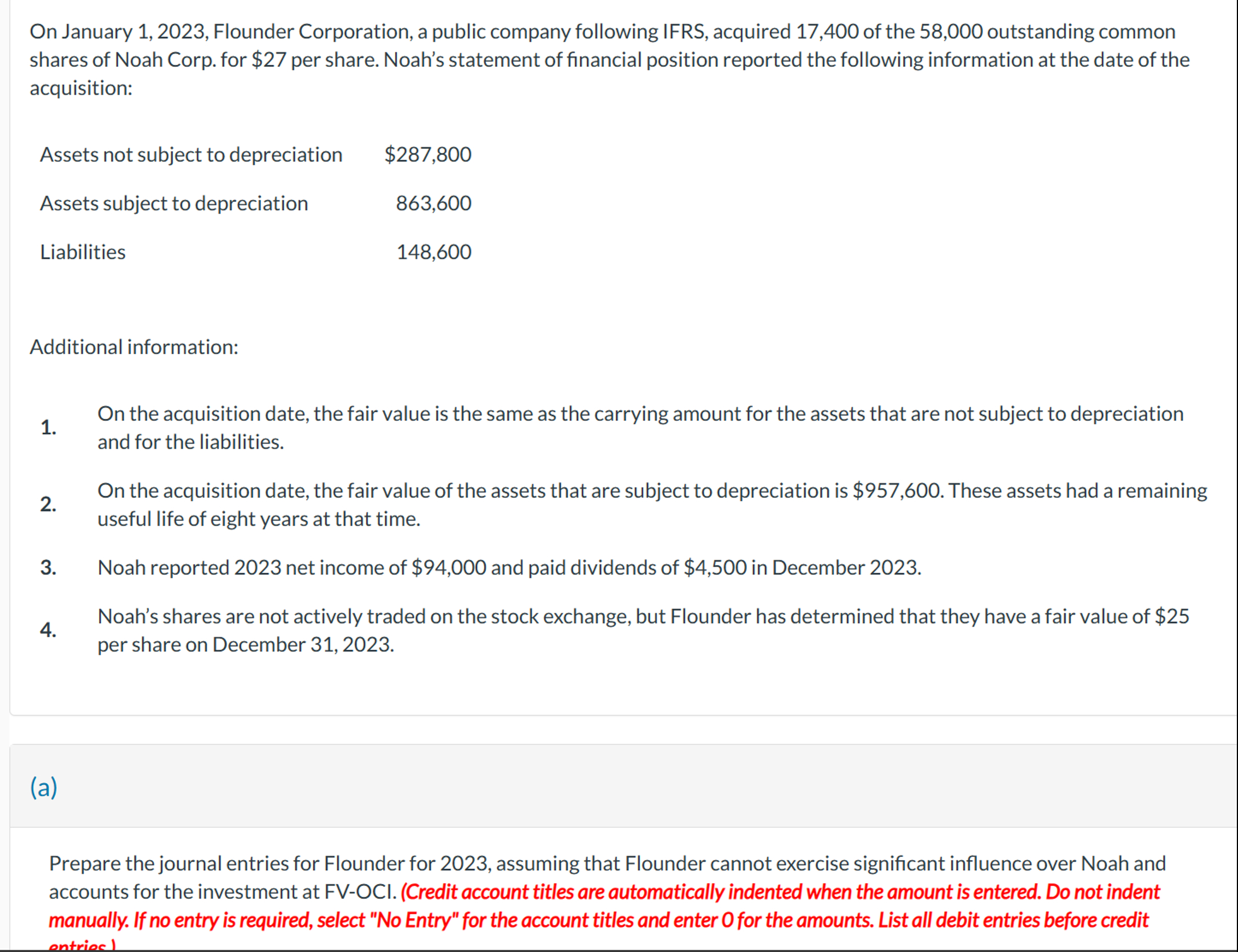

On January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal entries for Flounder for 2023, assuming that Flounder cannot exercise significant influence over Noah and accounts for the investment at FV-OCI. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Here are the journal entries for Flounder Corporation for 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d7fb86e1d6_966211.pdf

180 KBs PDF File

663d7fb86e1d6_966211.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started