Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Land's End Construction purchased a used truck for $41,500. A new motor had to be installed to get the truck in

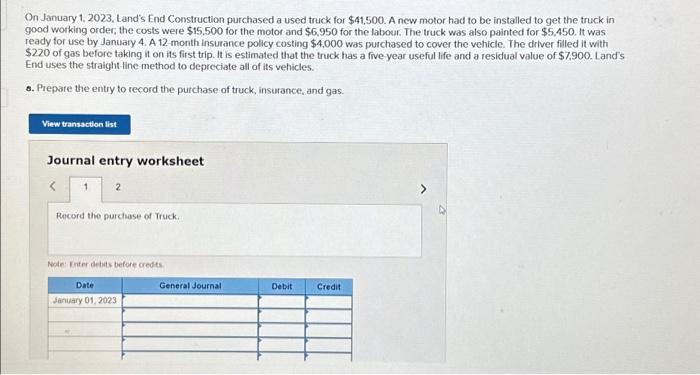

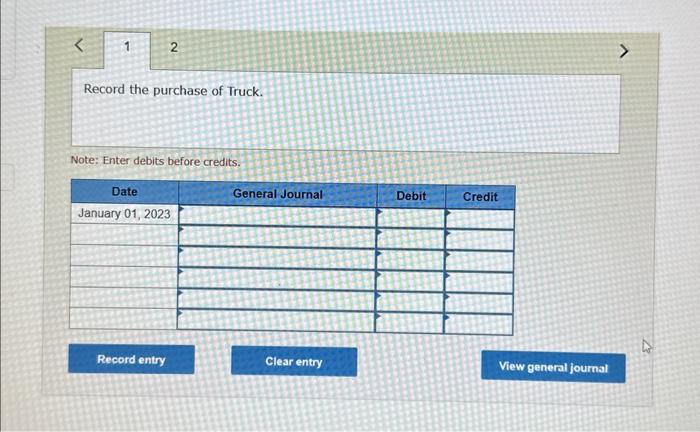

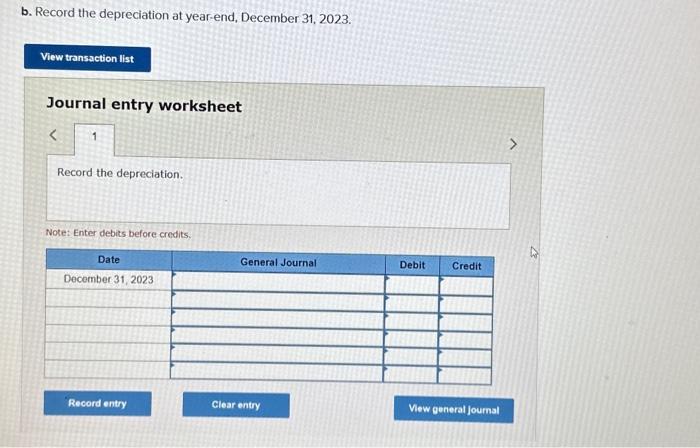

On January 1, 2023, Land's End Construction purchased a used truck for $41,500. A new motor had to be installed to get the truck in good working order; the costs were $15,500 for the motor and $6,950 for the labour. The truck was also painted for $5,450. It was ready for use by January 4. A 12-month insurance policy costing $4,000 was purchased to cover the vehicle. The driver filled it with $220 of gas before taking it on its first trip. It is estimated that the truck has a five-year useful life and a residual value of $7,900. Land's End uses the straight-line method to depreciate all of its vehicles. a. Prepare the entry to record the purchase of truck, insurance, and gas. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started