Question

On January 1, 2023, Pharoah Corporation had 93,600 common shares outstanding. On April 1, the company issued an additional 37,800 shares. On July 1,

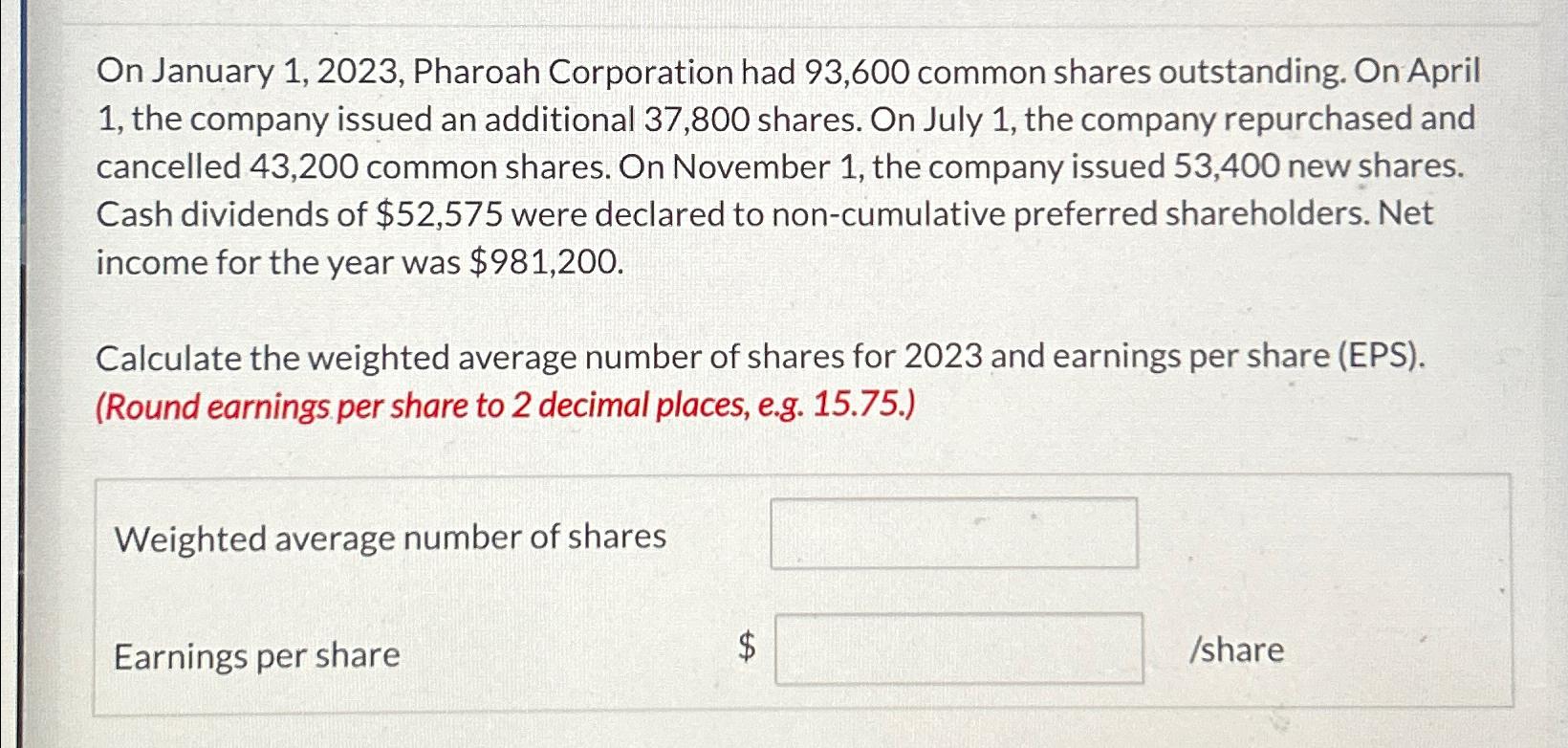

On January 1, 2023, Pharoah Corporation had 93,600 common shares outstanding. On April 1, the company issued an additional 37,800 shares. On July 1, the company repurchased and cancelled 43,200 common shares. On November 1, the company issued 53,400 new shares. Cash dividends of $52,575 were declared to non-cumulative preferred shareholders. Net income for the year was $981,200. Calculate the weighted average number of shares for 2023 and earnings per share (EPS). (Round earnings per share to 2 decimal places, e.g. 15.75.) Weighted average number of shares Earnings per share $ /share

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Weighted Average Number of Shares and EPS for Pharoah Corporation Weighted Average Number of Shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

1st edition

978-0133251579, 133251578, 013216230X, 978-0134102313, 134102312, 978-0132162302

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App