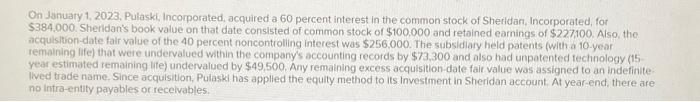

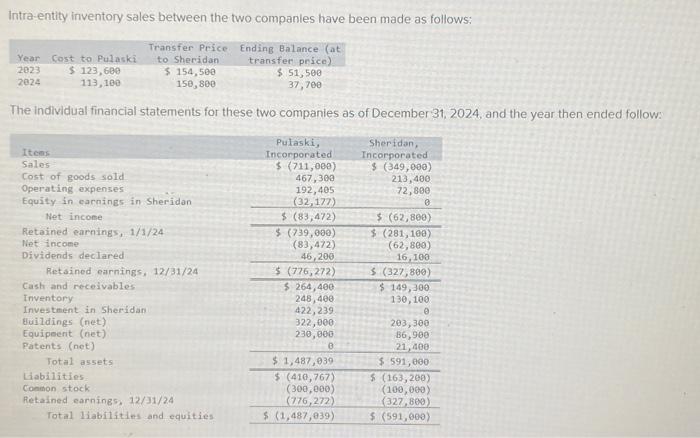

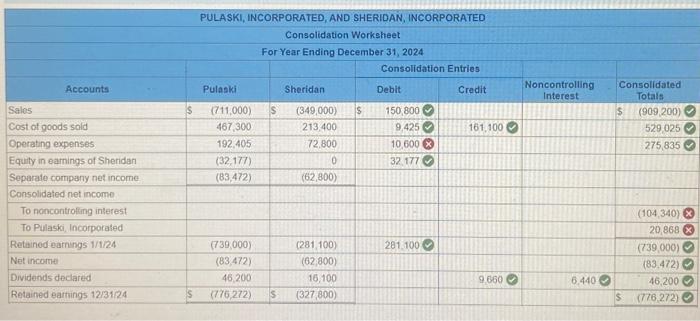

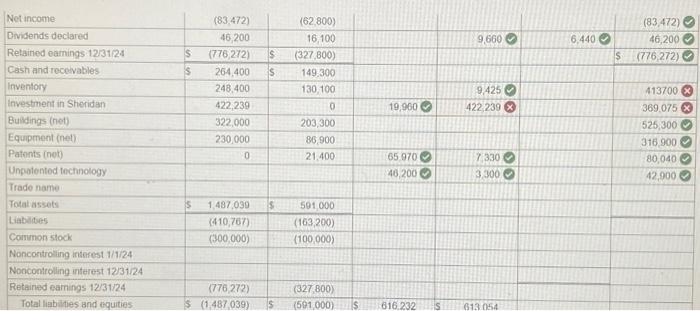

On January 1, 2023, Pulaski, Incorporated, acquired a 60 percent interest in the common stock of Shetidan, Incorporated, for $384,000. Sheridan's book value on that date consisted of common stock of $100.000 and retained eamings of $227100. Also, the acquisition-date falr value of the 40 percent noncontrolling interest was $256,000. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the companys accounting records by $73,300 and also had unpatented technology ( 15 . year estimated remaining lite) undervalued by $49,500. Any remaining excess acquisition-date fait value was assigned to an indefinite: lived trade name, Since acquisition, Pulaski has applied the equity method to its Investment in Sheridan account. At year-end, there are no intra-entity payables or recelvables. Intra-entity inventory sales between the two companies have been made as follows: The indlvidual financial statements for these two companies as of December 31,2024 , and the year then ended follow: PULASKI, INCORPORATED, AND SHERIDAN, INCORPORATED Consolidation Worksheet For Year Ending December 31, 2024 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Accounts } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Pulaski }} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Sheridan }} & \multicolumn{3}{|c|}{ Consoliation Entries } & \multirow[b]{2}{*}{\begin{tabular}{c} Noncontrolling \\ Interest \end{tabular}} & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{l} Consolidated \\ Totals \end{tabular}}} \\ \hline & & & & & & Debit & Credit & & & \\ \hline Salos & s & (711,000) & s & (349,000) & $ & 150,8000 & & & 5 & (909,200) \\ \hline Cost of goods sold & & 467,300 & & 213,400 & & 9,425 & 161,100 & & & 529.025 \\ \hline Operating expenses & & 192,405 & & 72.800 & & 10,600 & & & & 275,835 \\ \hline Equity in earnings of Sheridan & & (32,177) & & 0 & & 32,177 & & & & \\ \hline Separale company net income & & (83,472) & & (62,800) & & & & & & \\ \hline \multicolumn{11}{|l|}{ Consolidated net income } \\ \hline To noncontrofting interest & & & & & & & & & & (104,340) \\ \hline To Pulaski, Incorporated & & & & & & & & & & 20,868 \\ \hline Retained earnings 1/1/24 & & (739,000) & & (281,100) & & 281.1000 & & & & (739,000) \\ \hline Net income & & (83,472) & & (62,800) & & & & & & (83.472)0 \\ \hline Dividends declared & & 46,200 & & 16,100 & & & 26600 & 6.4400 & & 46,2000 \\ \hline Retained eartings 12/31/24 & s & (776,272) & 5 & (327,800) & & & & & $ & (776,272)0 \\ \hline \end{tabular}