Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, the Yacaman Company accepted a 3-year non-interest-bearing note from Thomas Inc for the sale of land. Thomas will pay $300,000 at

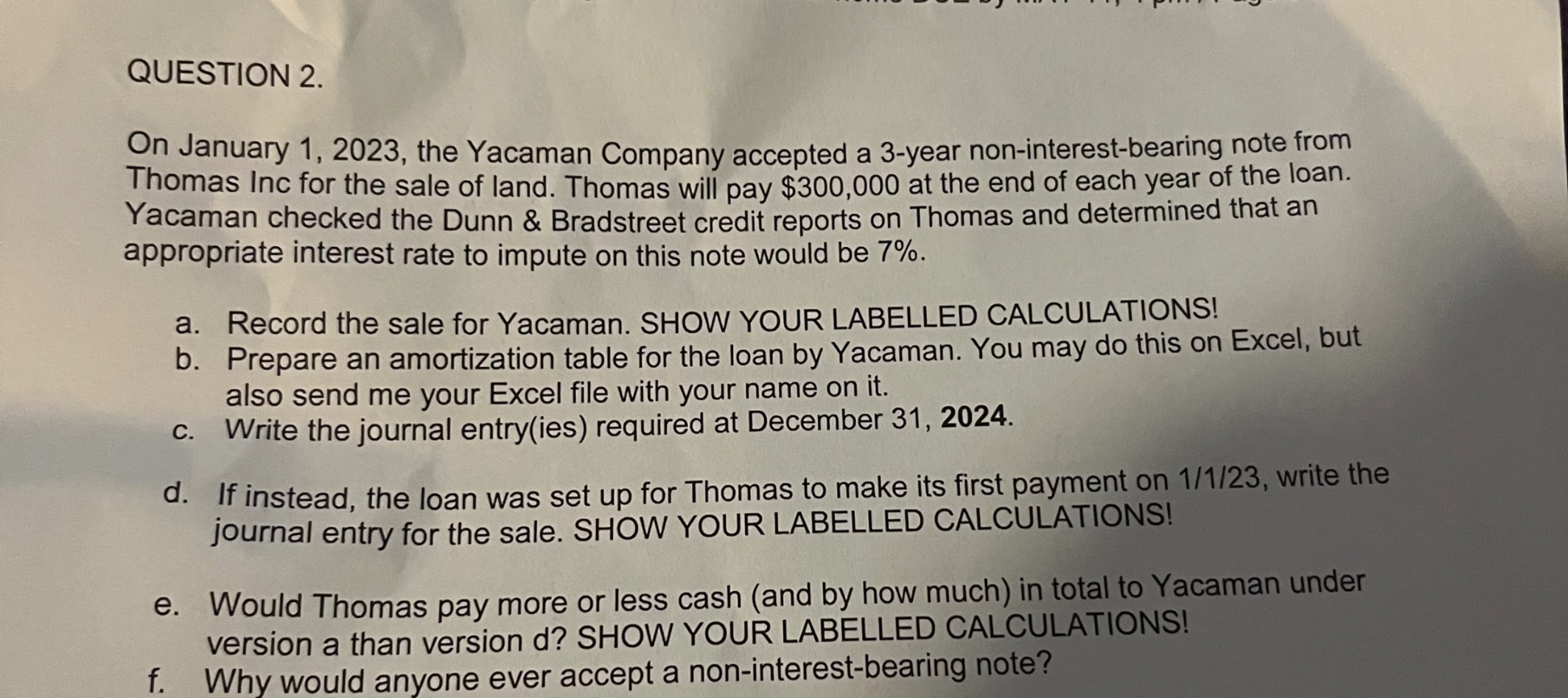

On January 1, 2023, the Yacaman Company accepted a 3-year non-interest-bearing note from Thomas Inc for the sale of land. Thomas will pay $300,000 at the end of each year of the loan. Yacaman checked the Dunn \& Bradstreet credit reports on Thomas and determined that an appropriate interest rate to impute on this note would be 7%. a. Record the sale for Yacaman. SHOW YOUR LABELLED CALCULATIONS! b. Prepare an amortization table for the loan by Yacaman. You may do this on Excel, but also send me your Excel file with your name on it. c. Write the journal entry(ies) required at December 31, 2024. d. If instead, the loan was set up for Thomas to make its first payment on 1/1/23, write the journal entry for the sale. SHOW YOUR LABELLED CALCULATIONS! e. Would Thomas pay more or less cash (and by how much) in total to Yacaman under version a than version d? SHOW YOUR LABELLED CALCULATIONS! f. Why would anyone ever accept a non-interest-bearing

On January 1, 2023, the Yacaman Company accepted a 3-year non-interest-bearing note from Thomas Inc for the sale of land. Thomas will pay $300,000 at the end of each year of the loan. Yacaman checked the Dunn \& Bradstreet credit reports on Thomas and determined that an appropriate interest rate to impute on this note would be 7%. a. Record the sale for Yacaman. SHOW YOUR LABELLED CALCULATIONS! b. Prepare an amortization table for the loan by Yacaman. You may do this on Excel, but also send me your Excel file with your name on it. c. Write the journal entry(ies) required at December 31, 2024. d. If instead, the loan was set up for Thomas to make its first payment on 1/1/23, write the journal entry for the sale. SHOW YOUR LABELLED CALCULATIONS! e. Would Thomas pay more or less cash (and by how much) in total to Yacaman under version a than version d? SHOW YOUR LABELLED CALCULATIONS! f. Why would anyone ever accept a non-interest-bearing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started