On January 1, 2024, Bloom Company purchased Machine #729. The following information relating to Machine #729 was gathered at the end of January: Price

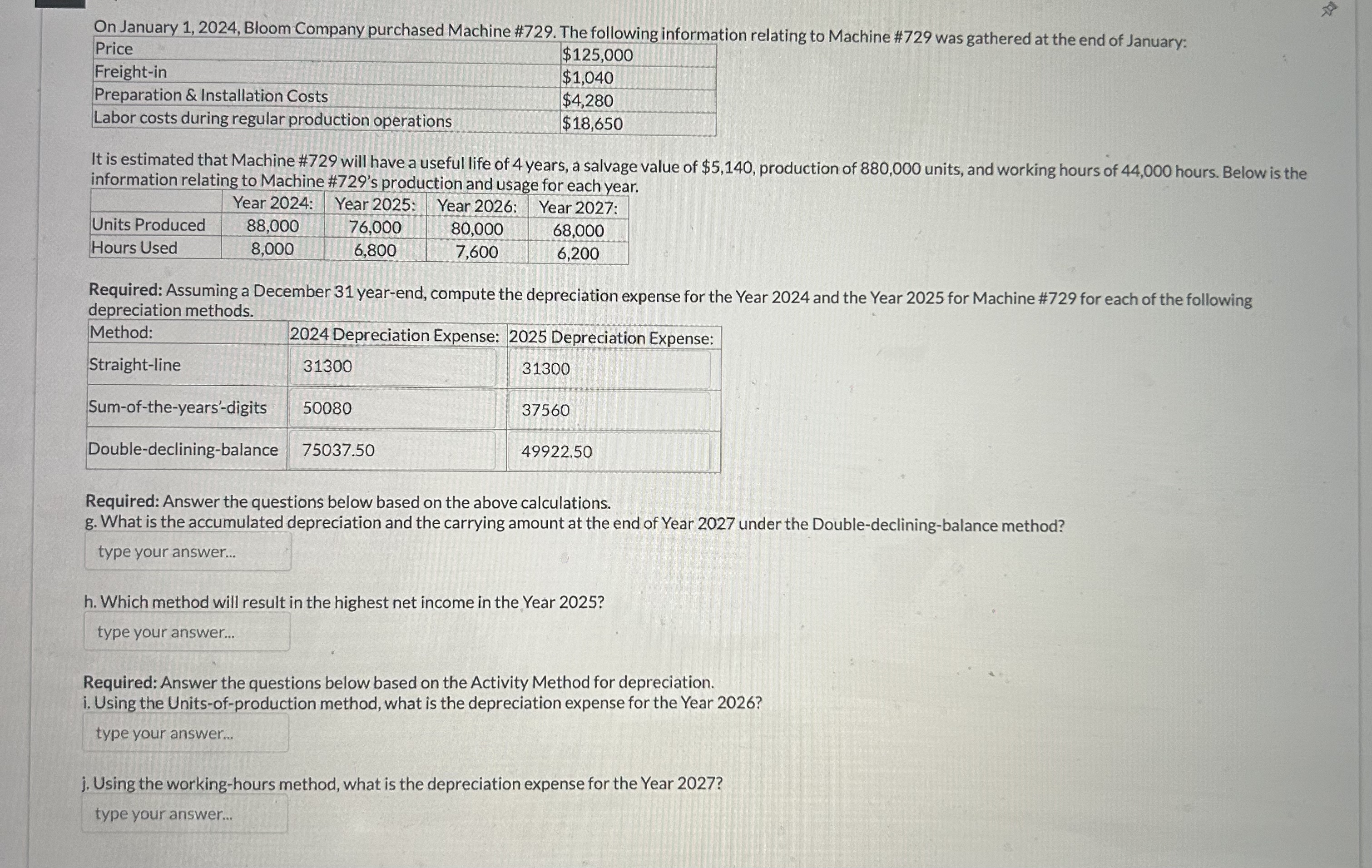

On January 1, 2024, Bloom Company purchased Machine #729. The following information relating to Machine #729 was gathered at the end of January: Price Freight-in Preparation & Installation Costs Labor costs during regular production operations $125,000 $1,040 $4,280 $18,650 It is estimated that Machine #729 will have a useful life of 4 years, a salvage value of $5,140, production of 880,000 units, and working hours of 44,000 hours. Below is the information relating to Machine #729's production and usage for each year. Units Produced Hours Used Year 2024: Year 2025: 88,000 8,000 76,000 6,800 Year 2026: 80,000 7,600 Year 2027: 68,000 6,200 Required: Assuming a December 31 year-end, compute the depreciation expense for the Year 2024 and the Year 2025 for Machine #729 for each of the following depreciation methods. 2024 Depreciation Expense: 2025 Depreciation Expense: Method: Straight-line 31300 Sum-of-the-years'-digits 50080 Double-declining-balance 75037.50 31300 37560 49922.50 Required: Answer the questions below based on the above calculations. g. What is the accumulated depreciation and the carrying amount at the end of Year 2027 under the Double-declining-balance method? type your answer... h. Which method will result in the highest net income in the Year 2025? type your answer... Required: Answer the questions below based on the Activity Method for depreciation. i. Using the Units-of-production method, what is the depreciation expense for the Year 2026? type your answer... j. Using the working-hours method, what is the depreciation expense for the Year 2027? type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started