Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Pikes estimated that the fair value of Venti's equity shares equaled $92,000 while Venti's book value was $72,000. Any excess

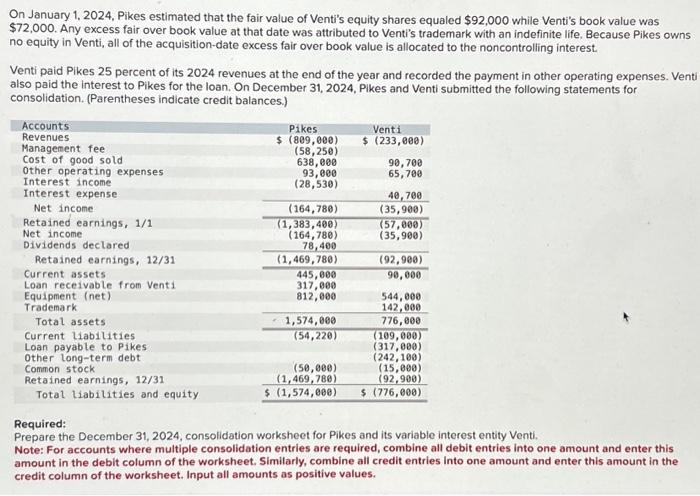

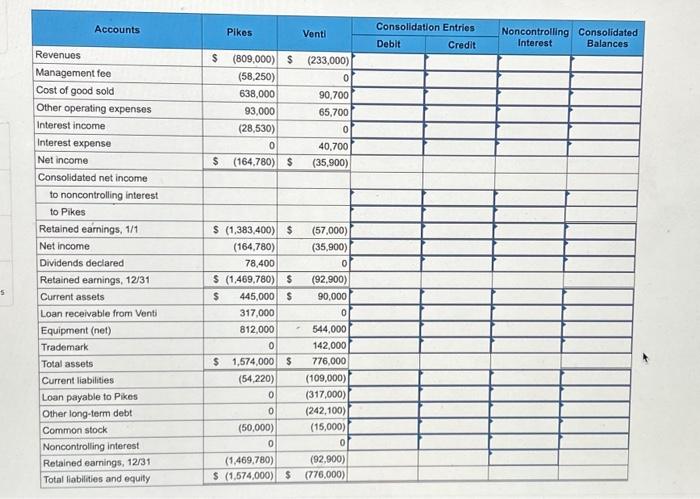

On January 1, 2024, Pikes estimated that the fair value of Venti's equity shares equaled $92,000 while Venti's book value was $72,000. Any excess fair over book value at that date was attributed to Venti's trademark with an indefinite life. Because Pikes owns no equity in Venti, all of the acquisition-date excess fair over book value is allocated to the noncontrolling interest. Venti paid Pikes 25 percent of its 2024 revenues at the end of the year and recorded the payment in other operating expenses. Venti also paid the interest to Pikes for the loan. On December 31, 2024, Pikes and Venti submitted the following statements for consolidation. (Parentheses indicate credit balances.) Accounts Revenues Management fee Cost of good sold. Other operating expenses Interest income Interest expense Net income. Retained earnings, 1/1 Net income Dividends declared Retained earnings, 12/31 Current assets Loan receivable from Venti Equipment (net) Trademark Total assets Current liabilities. Loan payable to Pikes Other long-term debt Common stock Retained earnings, 12/31 Total liabilities and equity Pikes $ (809,000) (58,250) 638,000 93,000 (28,530) (164,780) (1,383,400) (164,780) 78,400 (1,469,780) 445,000 317,000 812,000 1,574,000 (54,220) (50,000) (1,469,780) $ (1,574,000) Venti $ (233,000) 90,700 65,700 40,700 (35,900) (57,000) (35,900) (92,980) 90,000 544,000 142,000 776,000 (109,000) (317,000) (242,100) (15,000) (92,900) $ (776,000) Required: Prepare the December 31, 2024, consolidation worksheet for Pikes and its variable interest entity Venti. Note: For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values. 5 Accounts Revenues Management fee Cost of good sold Other operating expenses Interest income Interest expense Net income Consolidated net income to noncontrolling interest to Pikes Retained earnings, 1/1 Net income Dividends declared Retained earnings, 12/31 Current assets Loan receivable from Venti Equipment (net) Trademark Total assets Current liabilities Loan payable to Pikes Other long-term debt Common stock Noncontrolling interest Retained earnings, 12/31 Total liabilities and equity Pikes $ (809,000) $ (233,000) (58,250) 638,000 93,000 (28,530) 0 $ (164,780) $ S (1,383,400) $ (164,780) 78,400 $ (1,469,780) $ $ 445,000 $ 317,000 812,000 0 $ 1,574,000 $ (54,220) 0 0 (50,000) 0 Venti . 0 90,700 65,700 0 40,700 (35,900) (57,000) (35,900) 0 (92,900) 90,000 0 544,000 142,000 776,000 (109,000) (317,000) (242,100) (15,000) 0 (1,469,780) (92,900) $ (1,574,000) $ (776,000) Consolidation Entries Credit Debit Noncontrolling Consolidated Interest Balances

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To compile the consolidation worksheet for Pikes and its variable interest subsidiary Venti for Dece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started