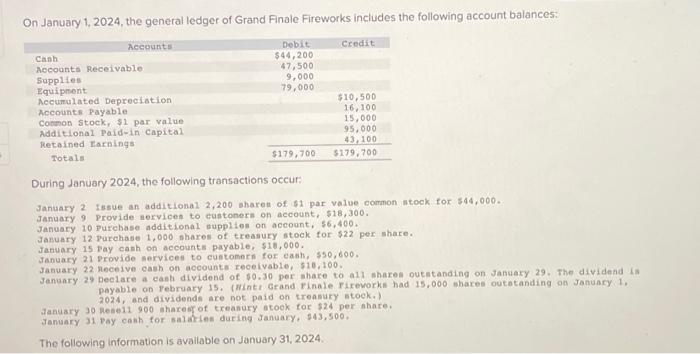

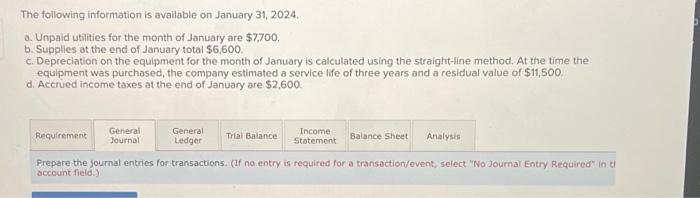

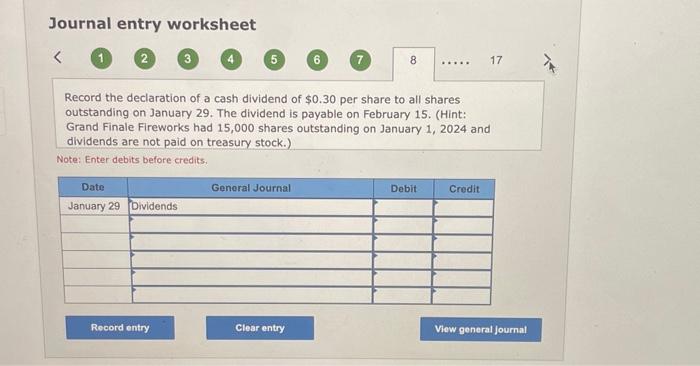

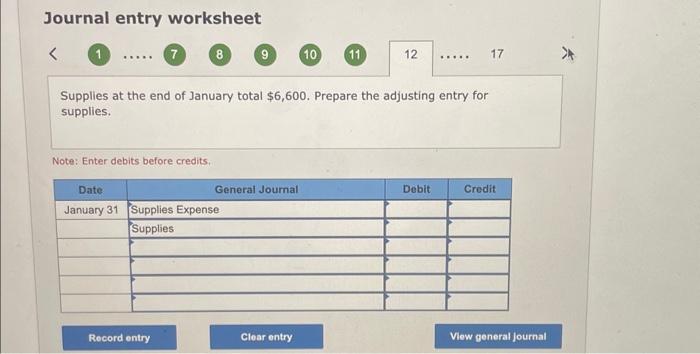

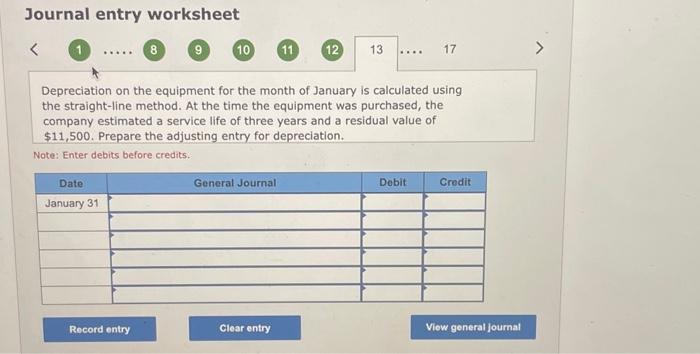

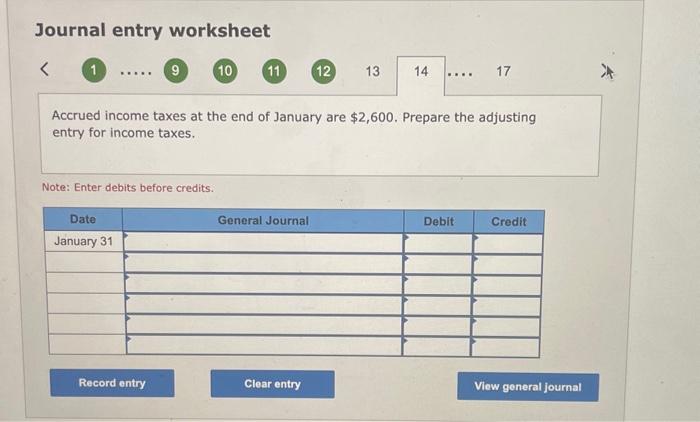

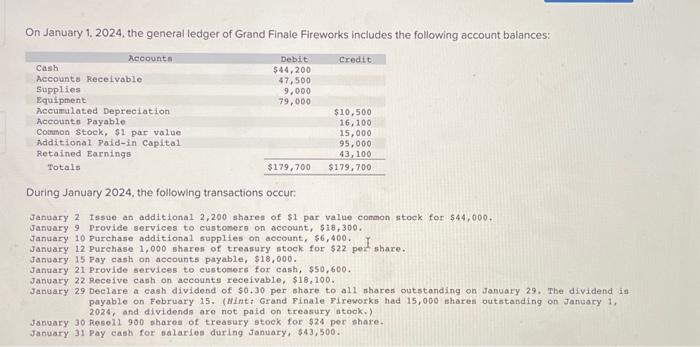

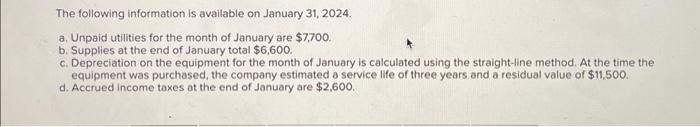

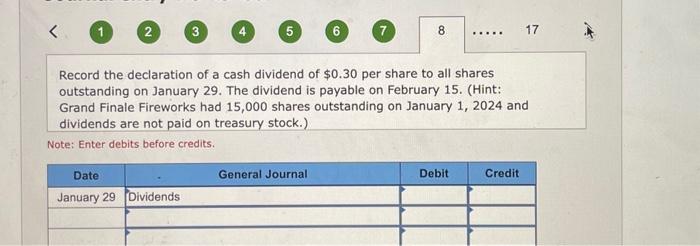

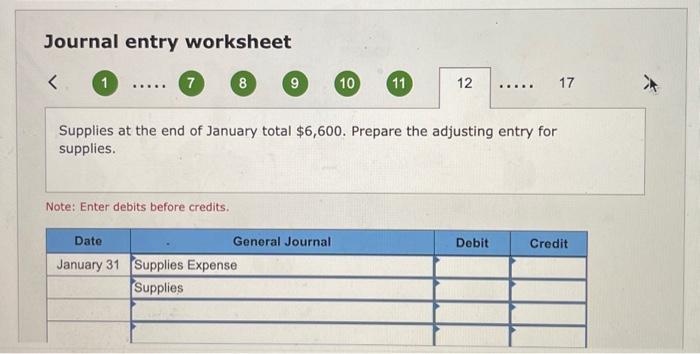

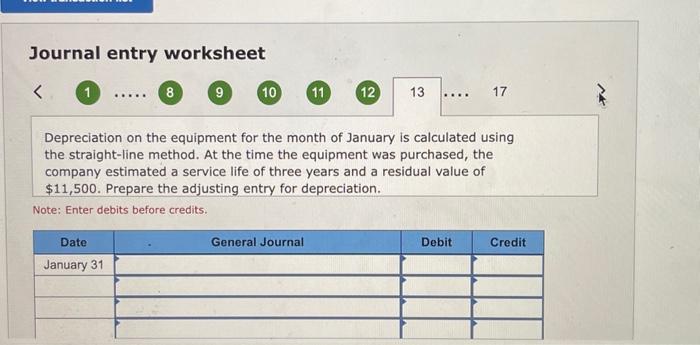

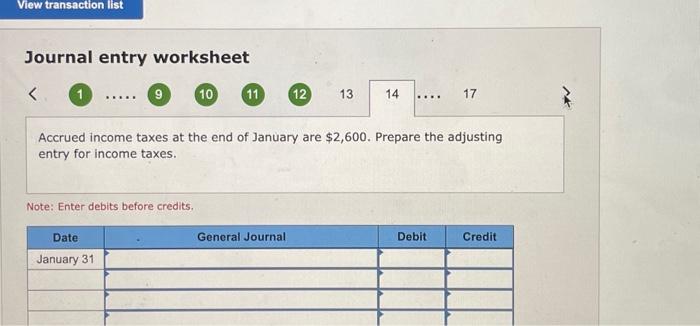

On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 issue an additional 2,200 sharen of 51 par value cormon stock for 544,000 . January 9 Provide aervicen to eastonern on account, $18,300. January 10 Purchase additional supplies on account, 56,400 . Jasuary 12 purehase 1,000 shares of treasury stock for 522 per share. January 15 pay cash on accounts payable, $10,000. January 21 Provide nervicen to cuntomern for eash, $50,600, January 22 receive cash on accounte recelvable, 516,100. January 29 beclare a canh dividend of 50.30 per mhare to all sharen outatanding on January 29. The dividend in payable on Yebruary 15. (minte Geand rinale Fireworkn had 15,000 shares outatanding on Jonuary 1 , 2024, and dividends are not paid on treanury stoek. January 30 hese11 900 mares of treasury atook tor 524 per abare. Jamunry 31 vay canh for salakines during January, 543,500 . The following information is available on January 31,2024. The following information is avallable on January 31, 2024. a. Unpaid utilities for the month of January are $7,700, b. Supplies at the end of January total $6,600. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,500 d. Accrued income taxes at the end of January are $2,600. Prepare the journal entries for transaction5. (It no entry is required for a transoction/event, select "No Journal Entry Required" in account field.) Journal entry worksheet 1 (2) 3 (4) (5) 6 7 17 Record the declaration of a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 15,000 shares outstanding on January 1, 2024 and dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet 1 7 8 (9) 10 11 17 Supplies at the end of January total $6,600. Prepare the adjusting entry for supplies. Note: Enter debits before credits. Journal entry worksheet Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,500. Prepare the adjusting entry for depreciation. Note: Enter debits before credits. Journal entry worksheet 1 9 17 Accrued income taxes at the end of January are $2,600. Prepare the adjusting entry for income taxes. Note: Enter debits before credits. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Issue an additional 2,200 sharee of $1 par value common sitock for $44,000. January 9 Provide services to customere on account, $18,300. January 10 Purchase additional supplies on account, $6,400. January 12 Purchase 1,000 sharen of treasury stock for $22 peI share. January 15 Pay cash on accounts payable, $18,000. January 21 Provide services to cubtocers for cash, $50,600. January 22 Receive canh on accounte receivable, $18,100. January 29 Declare a cash dividend of $0.30 per share to all sharen outstanding on January 29. The dividend is payable on February 15. (Hint; Grand Finale Fireworks had 15,000 shares outstanding on January 1 , 2024, and dividends are not paid on treasury atook.) January 30 Resell 900 shares of treasury stoek for $24 per share. January 31 Pay cash for balaries during January, $43,500. The following information is available on January 31,2024. a. Unpaid utilities for the month of January are $7,700. b. Supplies at the end of January total $6,600. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,500. d. Accrued income toxes at the end of January are $2,600. Record the declaration of a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 15,000 shares outstanding on January 1, 2024 and dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet Supplies at the end of January total $6,600. Prepare the adjusting entry for supplies. Note: Enter debits before credits. Journal entry worksheet Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,500. Prepare the adjusting entry for depreciation. Note: Enter debits before credits. Journal entry worksheet (1) ,9 11 1317 Accrued income taxes at the end of January are $2,600. Prepare the adjusting entry for income taxes. Note: Enter debits before credits