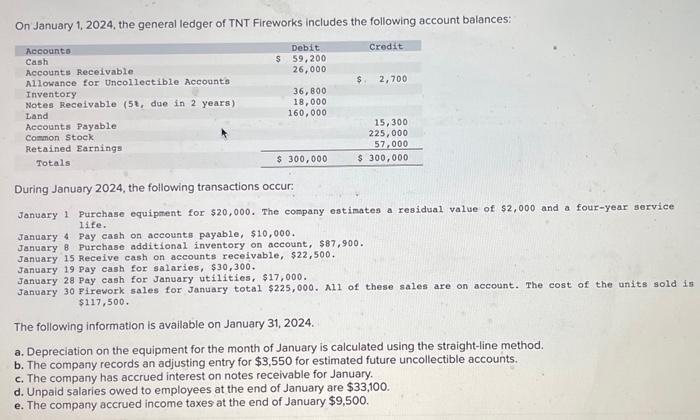

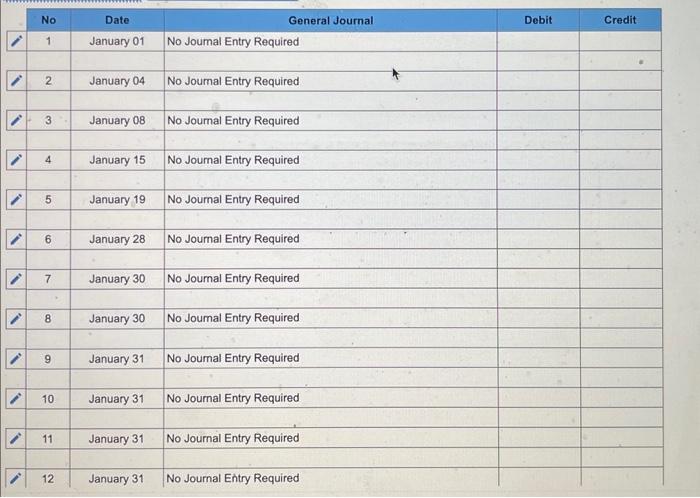

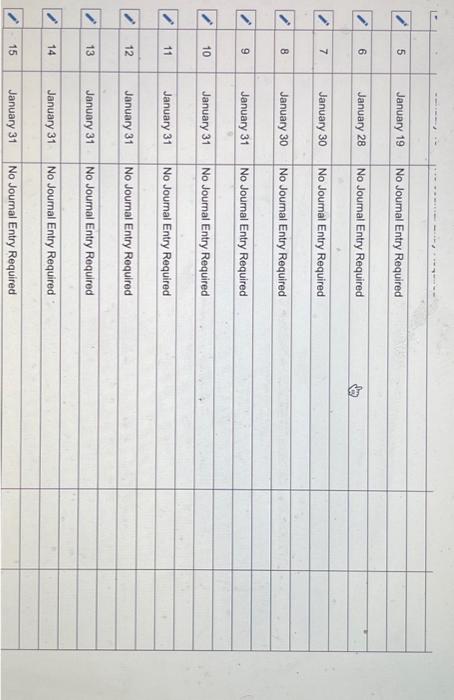

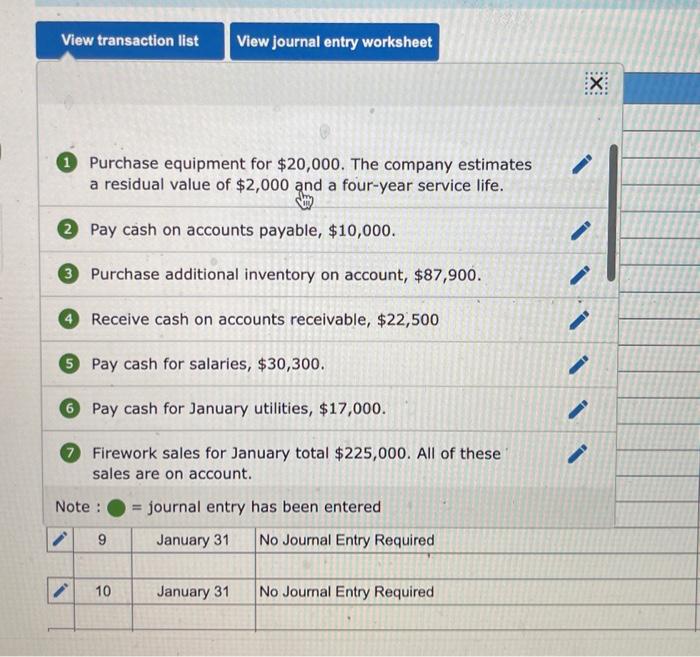

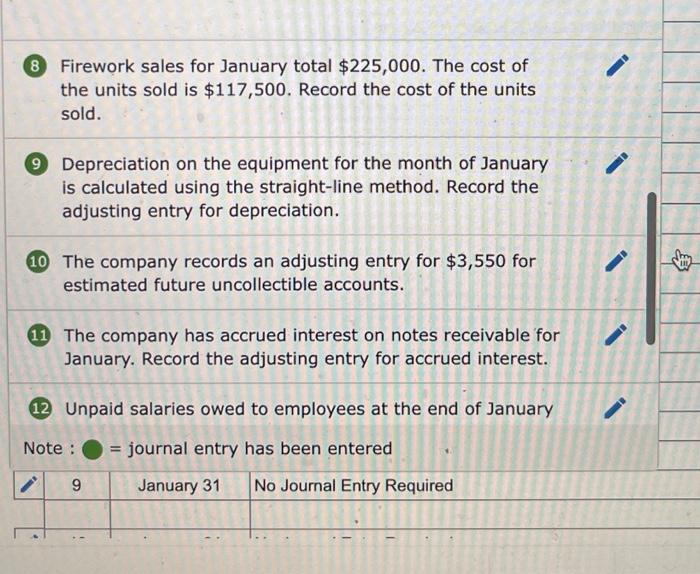

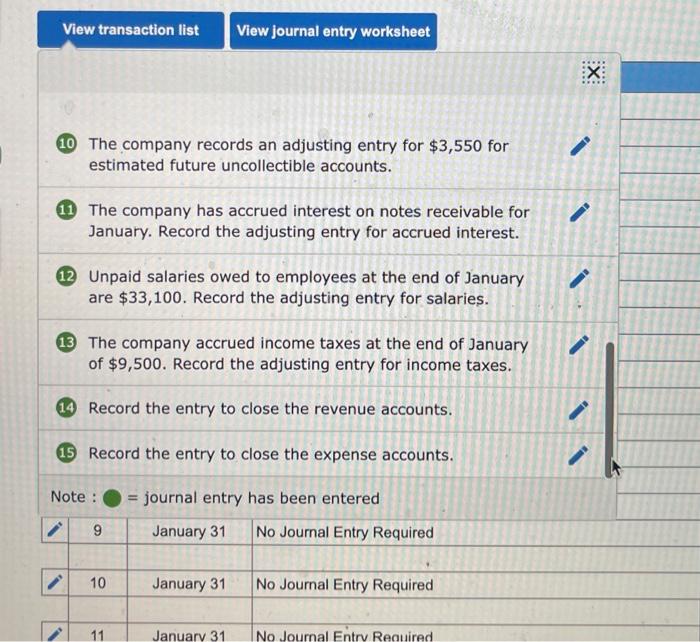

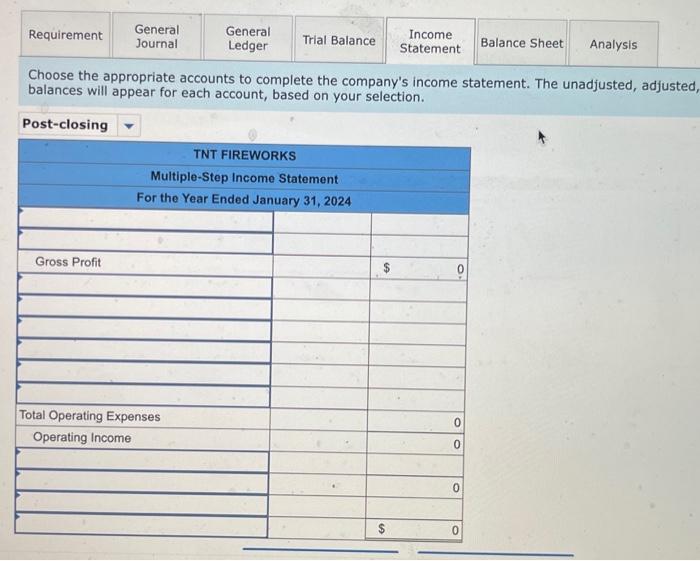

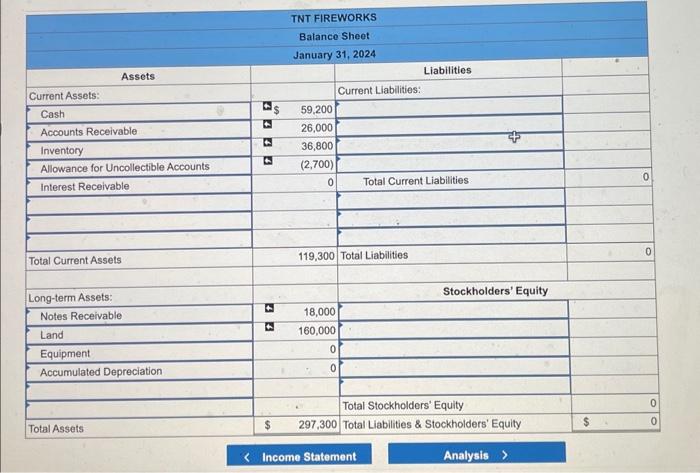

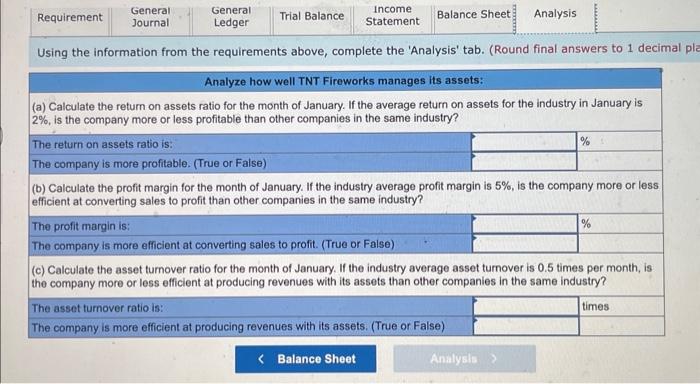

On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Purchase equipment for $20,000. The company estimates a residual value of $2,000 and a four-year service life. January 4. Pay cash on accounts payable, $10,000. January 8 Purchase additional inventory on account, $87,900. January 15 receive cash on accounts receivable, $22,500. January 19 Pay cash for salaries, $30,300. January 28 Pay cash for January utilities, $17,000. January 30 Firework sales for January total $225,000. A11 of these sales are on account. The cost of the units sold is $117,500. The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $3,550 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January. d. Unpaid salaries owed to employees at the end of January are $33,100. e. The company accrued income taxes at the end of January $9,500. Purchase equipment for $20,000. The company estimates a residual value of $2,000 and a four-year service life. Pay cash on accounts payable, $10,000. Purchase additional inventory on account, $87,900. Receive cash on accounts receivable, $22,500 Pay cash for salaries, $30,300. Pay cash for January utilities, $17,000. Firework sales for January total $225,000. All of these sales are on account. Note : = journal entry has been entered Firework sales for January total $225,000. The cost of the units sold is $117,500. Record the cost of the units sold. Depreciation on the equipment for the month of January is calculated using the straight-line method. Record the adjusting entry for depreciation. The company records an adjusting entry for $3,550 for estimated future uncollectible accounts. 1) The company has accrued interest on notes receivable for January. Record the adjusting entry for accrued interest. - The company records an adjusting entry for $3,550 for estimated future uncollectible accounts. The company has accrued interest on notes receivable for January. Record the adjusting entry for accrued interest. Unpaid salaries owed to employees at the end of January are $33,100. Record the adjusting entry for salaries. The company accrued income taxes at the end of January of $9,500. Record the adjusting entry for income taxes. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted balances will appear for each account, based on your selection. > (Round final answers to 1 decir