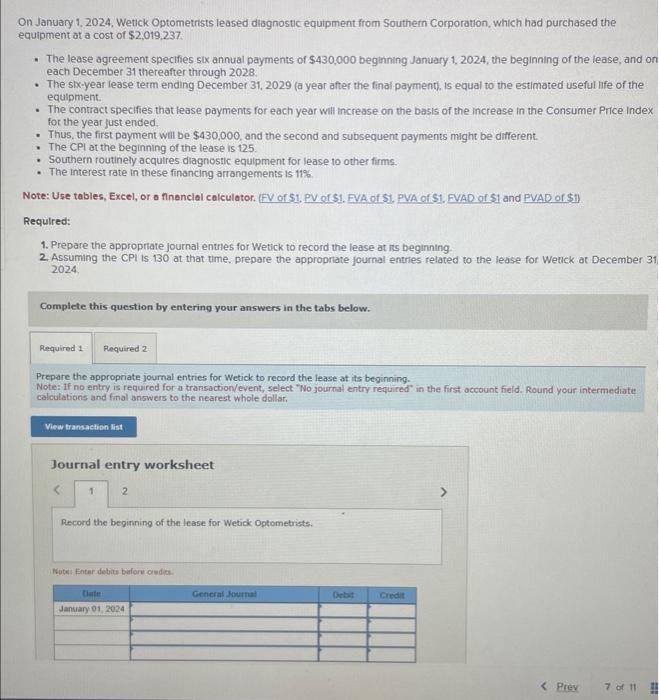

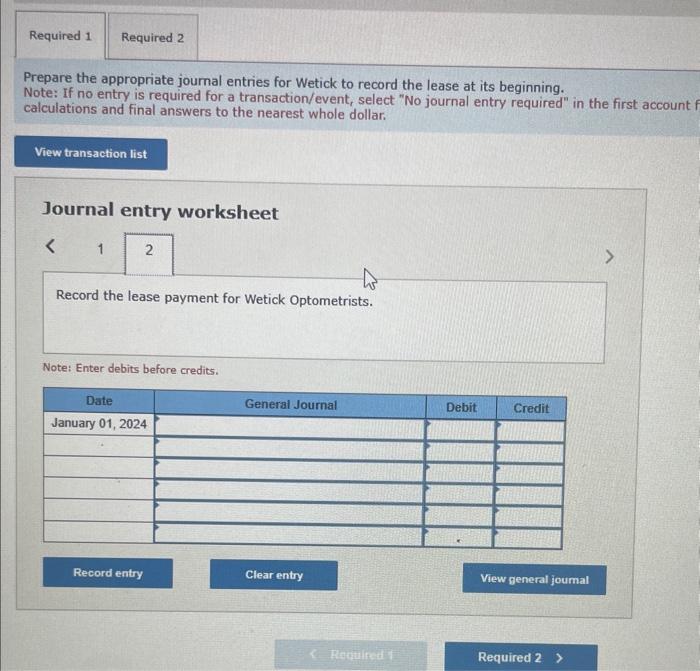

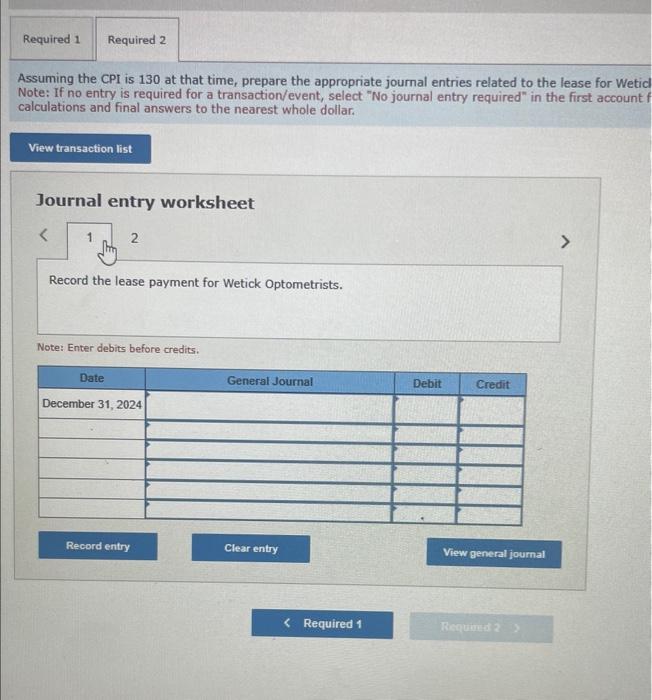

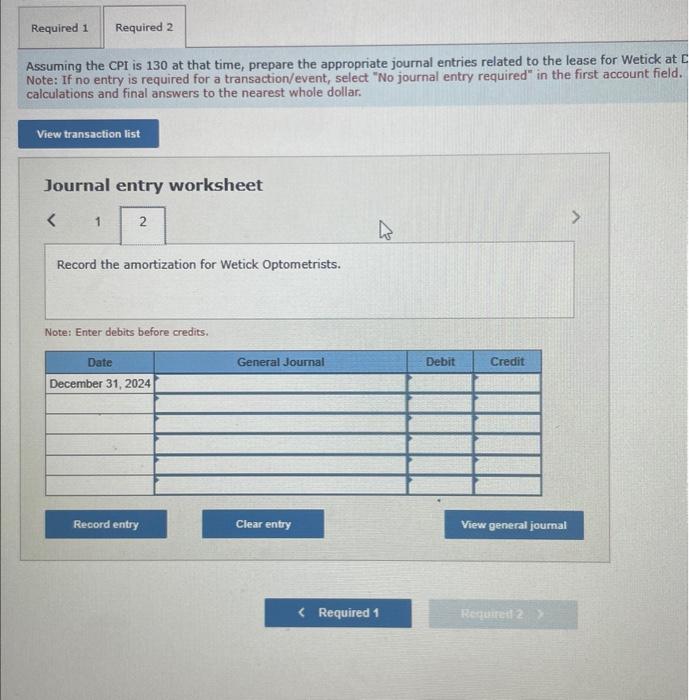

On January 1, 2024. Wetick Optometrists leased diagnostic equipment from Southern Corporation, which had purchased the equipment at a cost of $2,019,237 - The lease agreement specifies six annual payments of $430,000 beginning January 1, 2024, the beginning of the lease, and of each December 31 thereafter through 2028 - The six-year lease term ending December 31, 2029 (a year after the final payment), is equal to the estimated useful life of the equipment. - The contract specifies that lease payments for each year will increase on the basis of the increase in the Consumer Price Index for the year fust ended - Thus, the first payment will be $430,000, and the second and subsequent payments might be different. - The CPI at the beginning of the lease is 125 - Southern routinely acquires diagnostic equipment for lease to other firms - The interest rate in these financing arrangements is 11% Note: Use tables, Excel, or a finenclal colculator. (FV of S1. PV of S1. PVA of S1. PVA of S1. PVAD of S1 and PVAD of S1) Required: 1. Prepare the appropntate journal entries for Wetick to record the lease at ins beginning 2. Assuming the CPI is 130 at that time, prepare the appropriate journal entries related to the lease for Wenck at December 3 2024 Complete this question by entering your answers in the tabs below. Prepare the appropriate joumal entries for Wetick to record the lease at its beginning. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first occount field. Round your intermediate calculations and final answers to the nearest whole dollar. Journal entry worksheet 2 Record the beginning of the lease for Wetick Optometrists. Futesi Enter debitu boroore oudion. Prepare the appropriate journal entries for Wetick to record the lease at its beginning. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account calculations and final answers to the nearest whole dollar. Journal entry worksheet Record the lease payment for Wetick Optometrists. Note: Enter debits before credits. Assuming the CPI is 130 at that time, prepare the appropriate journal entries related to the lease for Weti Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account calculations and final answers to the nearest whole dollar. Journal entry worksheet 2 Record the lease payment for Wetick Optometrists. Note: Enter debits before credits. Assuming the CPI is 130 at that time, prepare the appropriate journal entries related to the lease for Wetick at Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. calculations and final answers to the nearest whole dollar. Journal entry worksheet Record the amortization for Wetick Optometrists. Note: Enter debits before credits