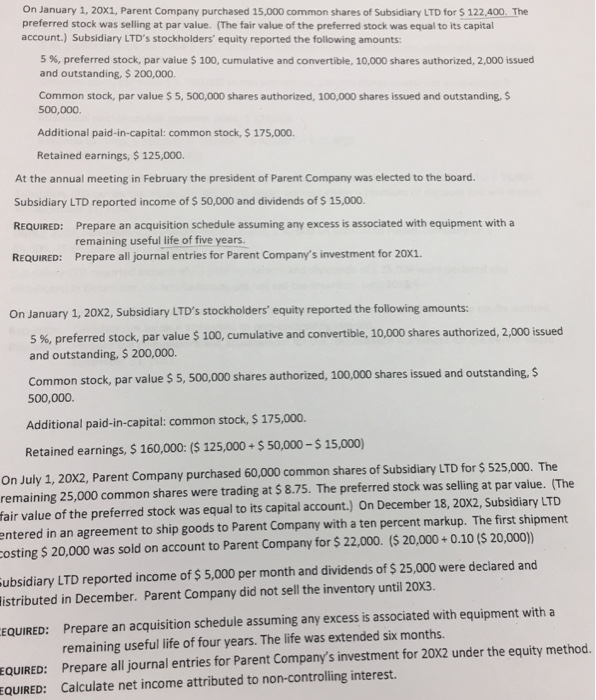

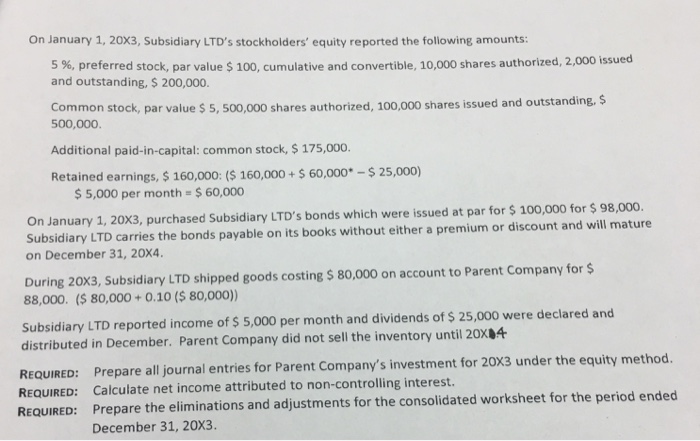

On January 1, 20x1, Parent Company purchased 15.000 common shares of subsidiary LT preferred stock was selling at par value. The fair value of the preferred stock was equal to its capital account.) Subsidiary LTD's stockholders' equity reported the following amounts: 5 preferred stock, par value 100, cumulative and convertible, 10,000 shares authorized, 2,000 issued and outstanding, 200,000. Common stock, par value 5, 500,000 shares authorized, 100,000 shares issued and outstanding 500,000 Additional paid-in-capital: common stock, 175,000. Retained earnings, $125,000. At the annual meeting in February the president of Parent Company was elected to the board. Subsidiary LTD reported income of 50,000 and dividends of $15,000 REQUIRED: Prepare an acquisition schedule assuming any excess is associated with equipment with a remaining useful life of five REQUIRED: Prepare all journal entries for Parent Company's investment for 20x1. On January 1, 20x2, subsidiary LTD's stockholders' equity reported the following amounts: 5%, preferred stock, par value s 100, cumulative and convertible, 10,000 shares authorized, 2,000 issued and outstanding, 200,000. Common stock, par value s 5, 500,000 shares authorized, 100,000 shares issued and outstanding, s 500,000. Additional paid-in-capital: common stock, $175,000 Retained earnings, 160.000 125,000 S50.000-$15,000) common shares of Subsidiary LTD for $525,000. The remaining 25,000 common shares were trading at $875. The preferred stock was selling at par value. The value of the preferred stock was equal to its capital account.) on December 18, 20x2,subsidiary LTD entered in an agreement to ship goods to Parent Company with a ten percent markup. The first shipment costing 20,000 was sold on account to Parent Company for 22,000. (S 20,000+0.10 (s 20,000) LTD reported income of 5,000 per month and dividends of $25,000 were declared and in December. Parent Company did not sell the inventory until 20x3. EauIRED: Prepare an acquisition schedule assuming any excess is associated with equipment with a remaining useful life of four years. The life was extended six months. Prepare all journal entries for Parent Company's investment for 20X2 under the equity method EQUIRED Calculate net income attributed to non-controlling interest