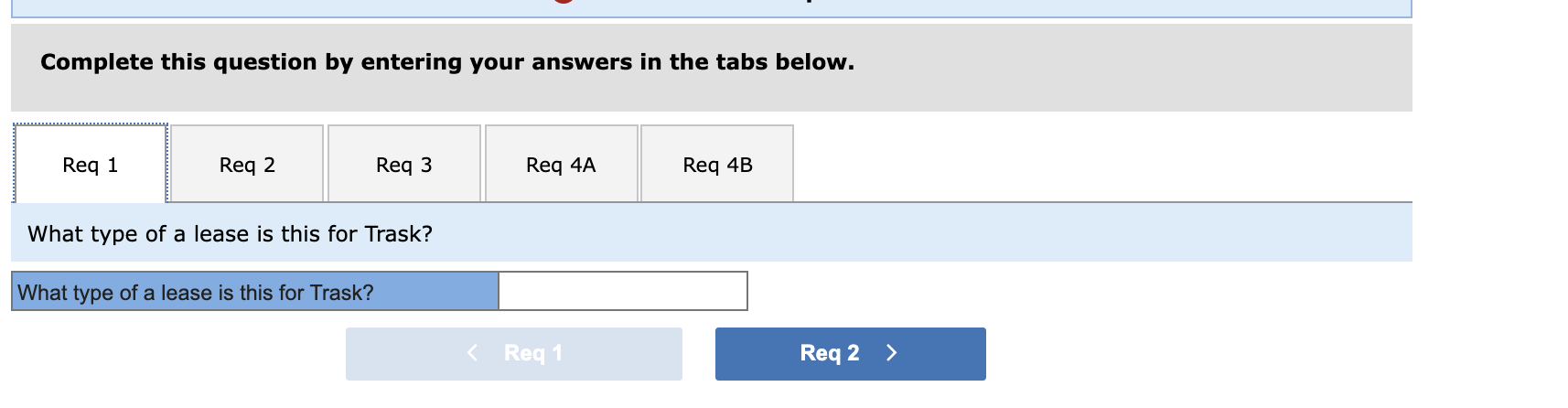

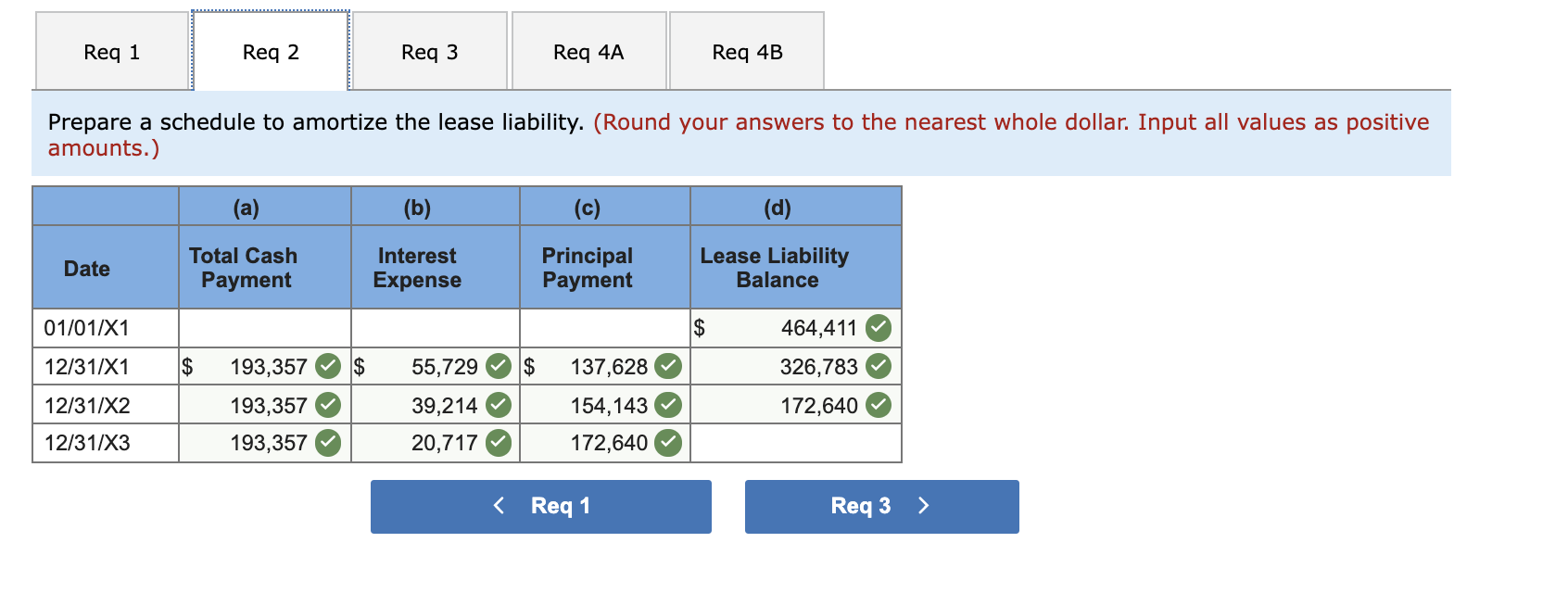

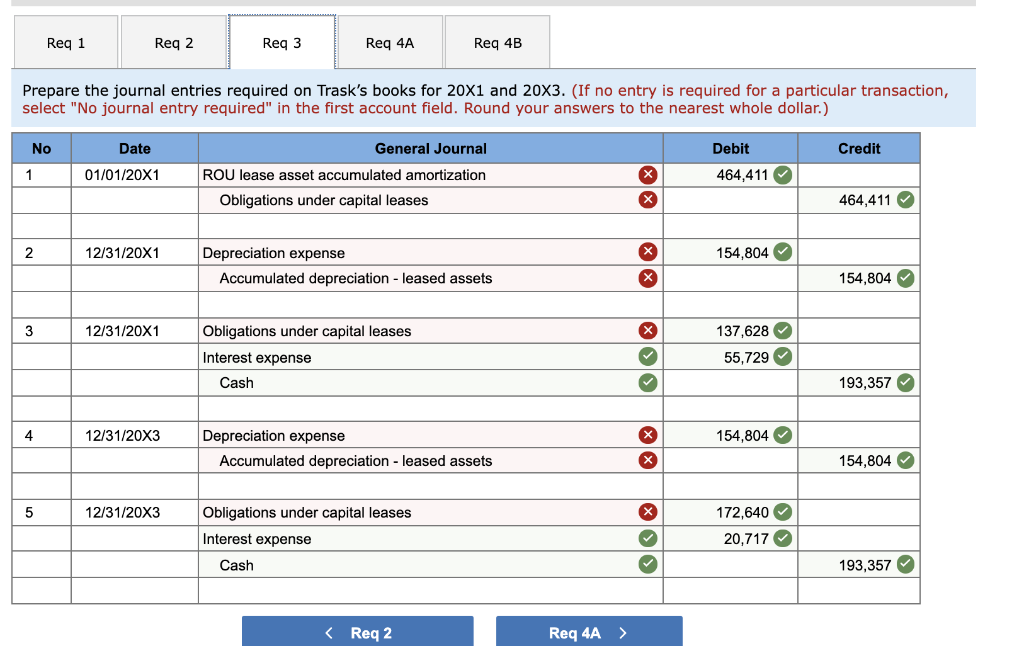

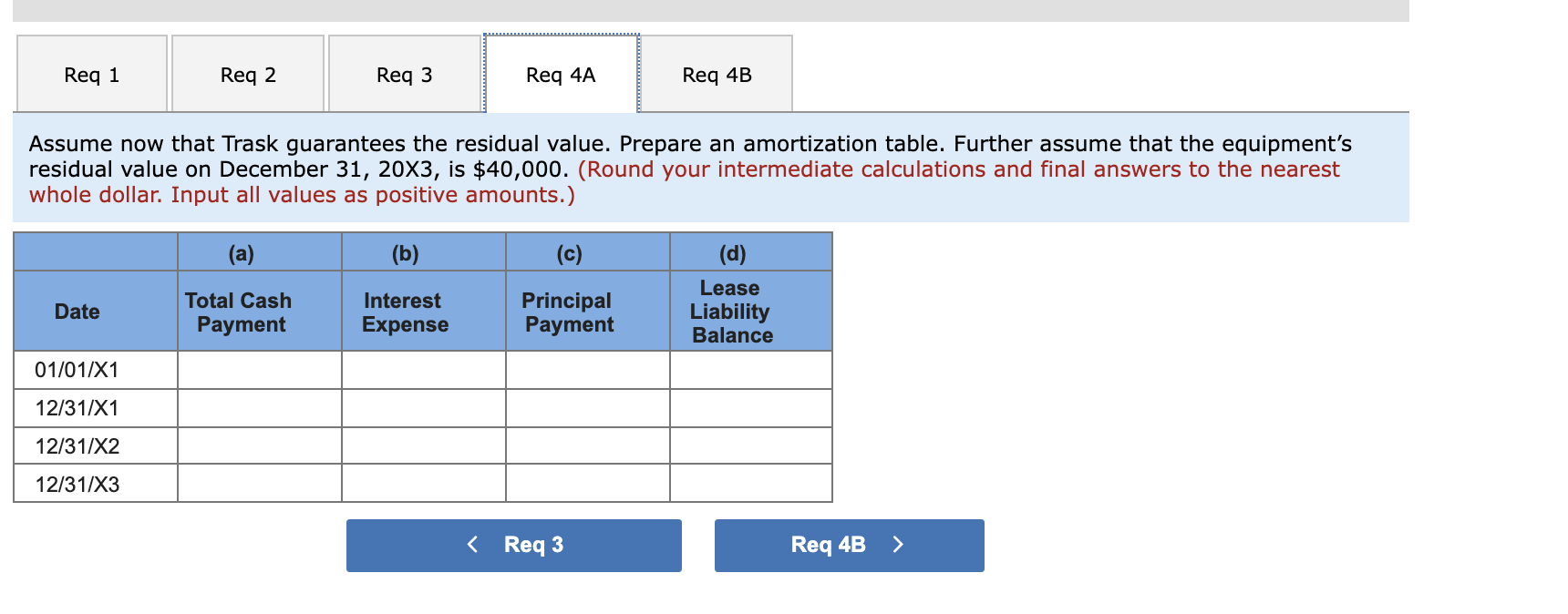

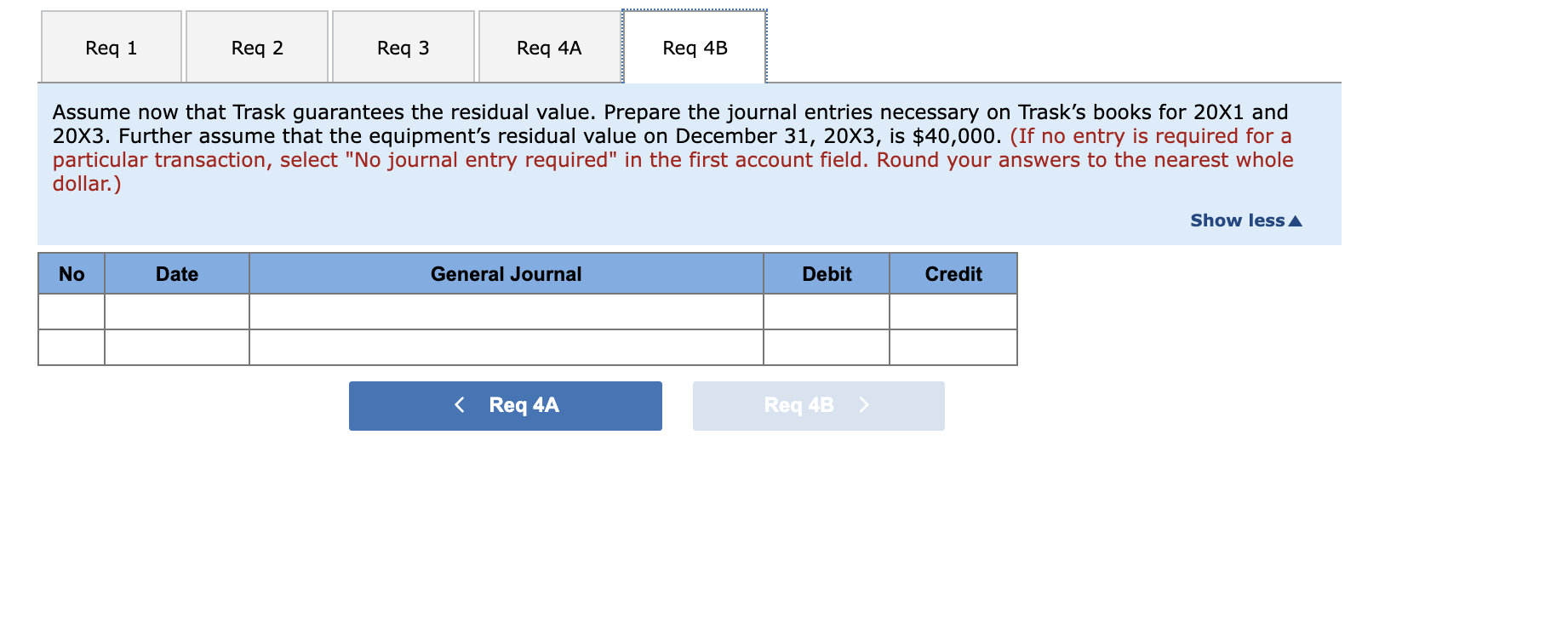

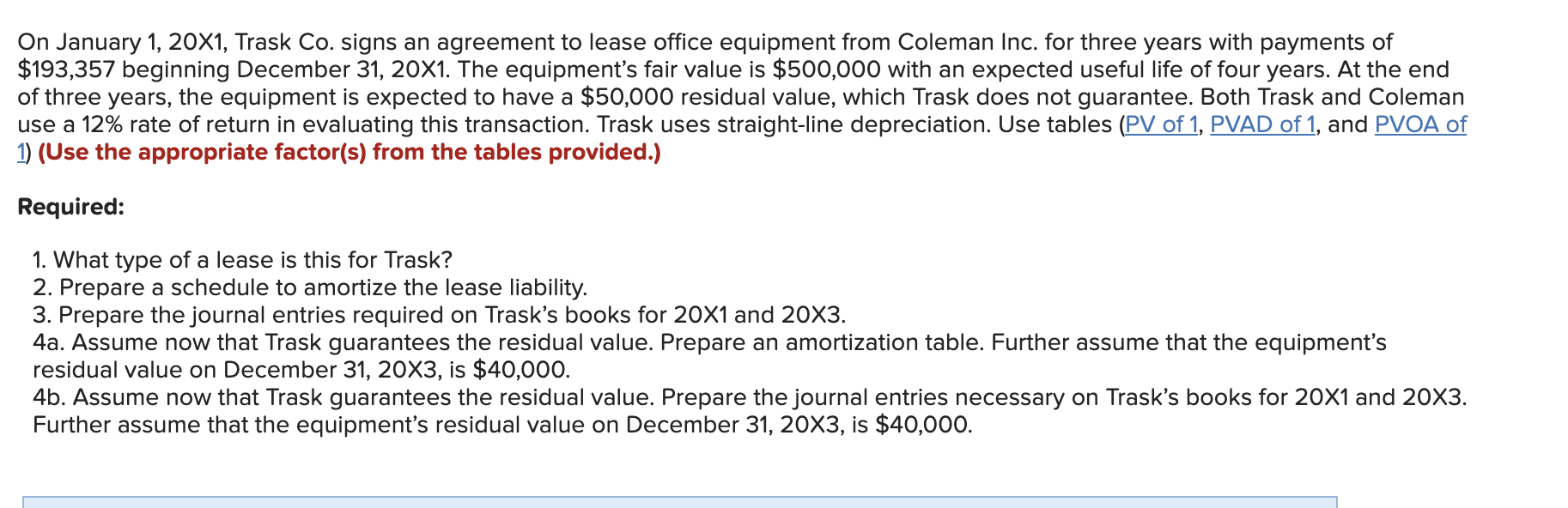

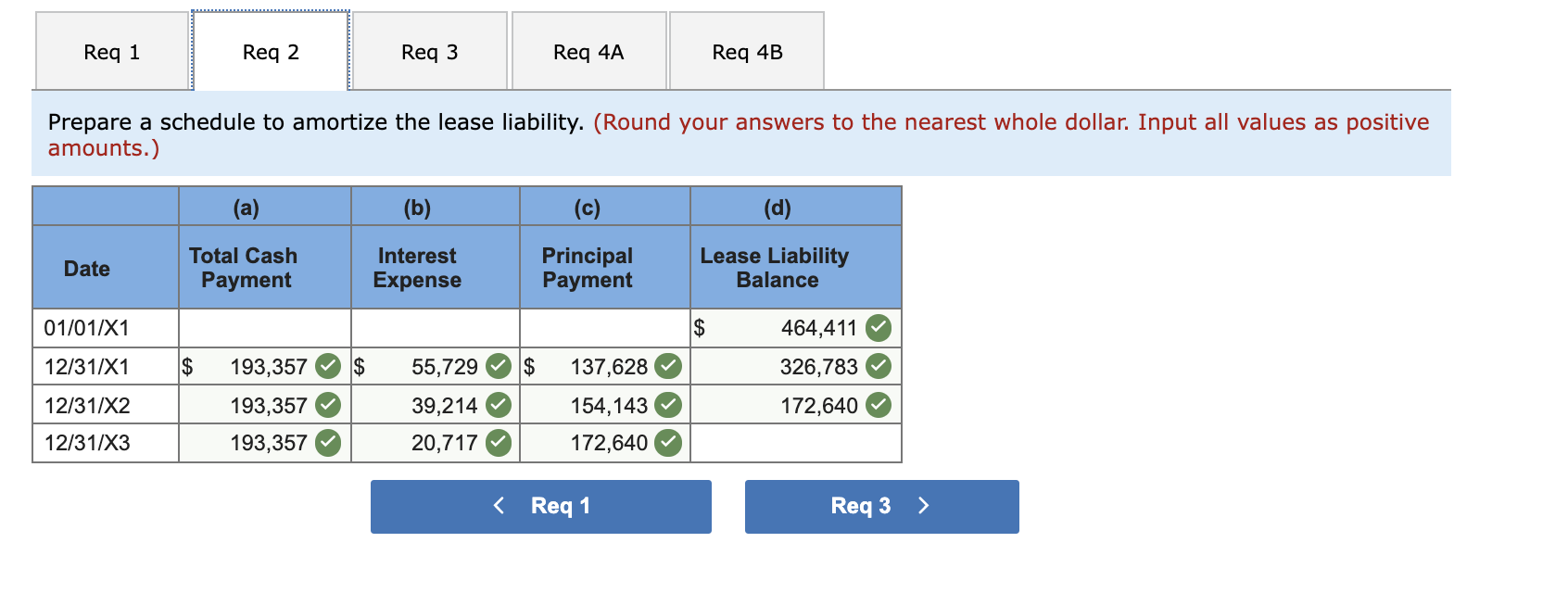

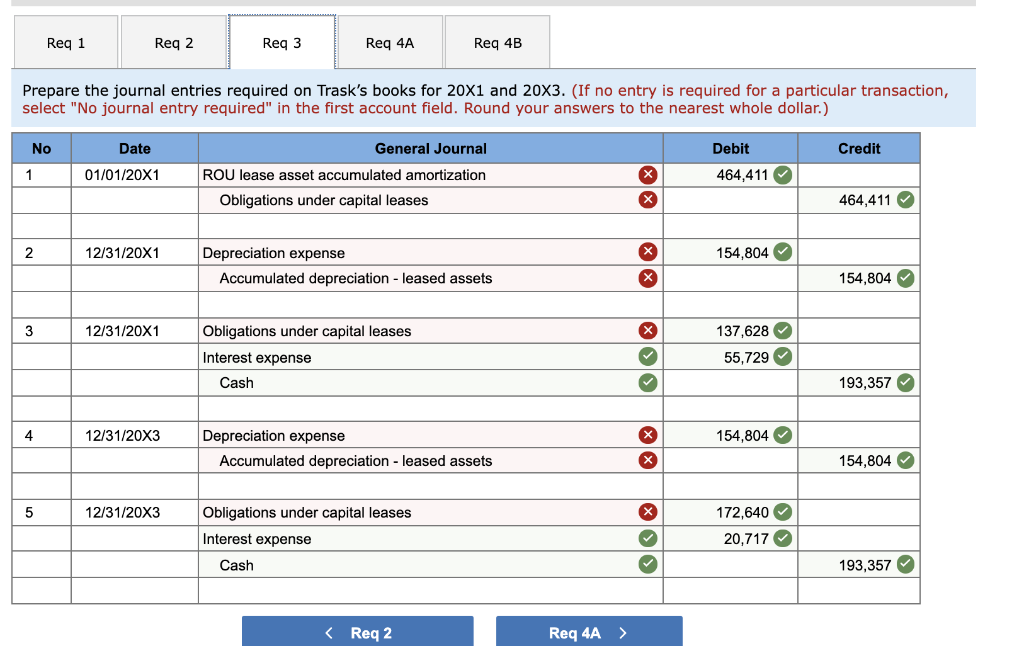

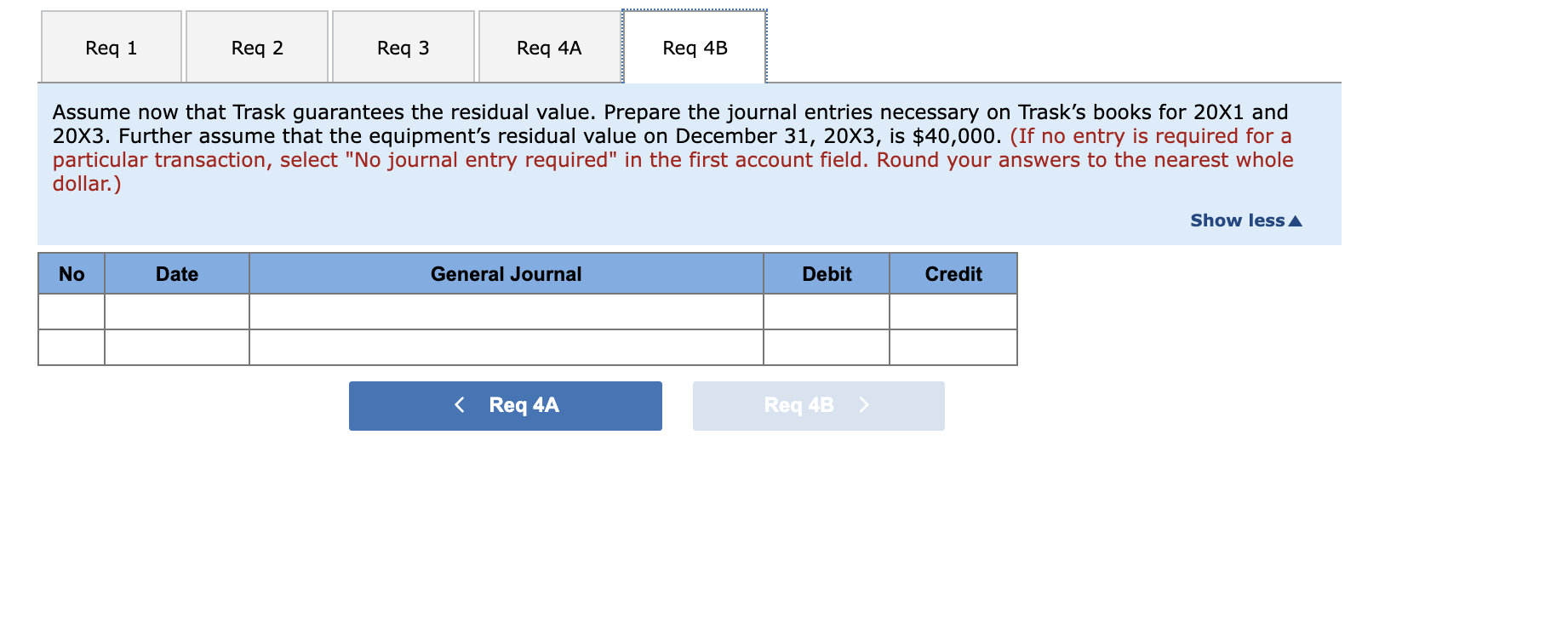

On January 1, 20X1, Trask Co. signs an agreement to lease office equipment from Coleman Inc. for three years with payments of $193,357 beginning December 31, 20X1. The equipment's fair value is $500,000 with an expected useful life of four years. At the end of three years, the equipment is expected to have a $50,000 residual value, which Trask does not guarantee. Both Trask and Coleman use a 12% rate of return in evaluating this transaction. Trask uses straight-line depreciation. Use tables (PV of 1, PVAD of 1, and PVOA of 1) (Use the appropriate factor(s) from the tables provided.) Required: 1. What type of a lease is this for Trask? 2. Prepare a schedule to amortize the lease liability. 3. Prepare the journal entries required on Trask's books for 20X1 and 20X3. 4a. Assume now that Trask guarantees the residual value. Prepare an amortization table. Further assume that the equipment's residual value on December 31, 20X3, is $40,000. 4b. Assume now that Trask guarantees the residual value. Prepare journal entries necessary on Trask's books for 20X1 and 20X3. Further assume that the equipment's residual value on December 31, 20X3, is $40,000. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Req 4A Reg 4B What type of a lease is this for Trask? What type of a lease is this for Trask? Req 1 Req 2 > Reg 1 Reg 2 Reg 3 Reg 4A Req 4B Prepare a schedule to amortize the lease liability. (Round your answers to the nearest whole dollar. Input all values as positive amounts.) (a) (b) (c) (d) Date Total Cash Payment Interest Expense Principal Payment Lease Liability Balance 01/01/X1 $ 464,411 12/31/X1 $ 193,357 $ $ 137,628 326,783 172,640 12/31/X2 55,729 39,214 20,717 193,357 193,357 154,143 172,640 12/31/X3 Reg 1 Reg 2 Req 3 Req 4A Req 4B Prepare the journal entries required on Trask's books for 20X1 and 20X3. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar.) No Date Debit Credit 1 01/01/20X1 General Journal ROU lease asset accumulated amortization Obligations under capital leases X 464,411 x 464,411 2 12/31/20X1 X 154.804 Depreciation expense Accumulated depreciation - leased assets X 154,804 3 12/31/20X1 x Obligations under capital leases Interest expense Cash 137,628 55,729 193,357 4 12/31/20X3 x 154,804 Depreciation expense Accumulated depreciation - leased assets x 154,804 5 12/31/20X3 x Obligations under capital leases Interest expense Cash 172,640 20,717 193,357 Req 1 Reg 2 Reg 3 Req 4A Req 4B Assume now that Trask guarantees the residual value. Prepare an amortization table. Further assume that the equipment's residual value on December 31, 20X3, is $40,000. (Round your intermediate calculations and final answers to the nearest whole dollar. Input all values as positive amounts.) (a) (b) (c) Total Cash Payment Date Interest Expense (d) Lease Liability Balance Principal Payment 01/01/X1 12/31/X1 12/31/X2 12/31/X3 Reg 1 Req 2 Req 3 Req 4A Req 4B Assume now that Trask guarantees the residual value. Prepare the journal entries necessary on Trask's books for 20X1 and 20X3. Further assume that the equipment's residual value on December 31, 20X3, is $40,000. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar.) Show less No Date General Journal Debit Credit