Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, Zambrano Engines Company exchanged 5,000 shares of its $12 par value common stock for all the outstanding stock of Hawkins

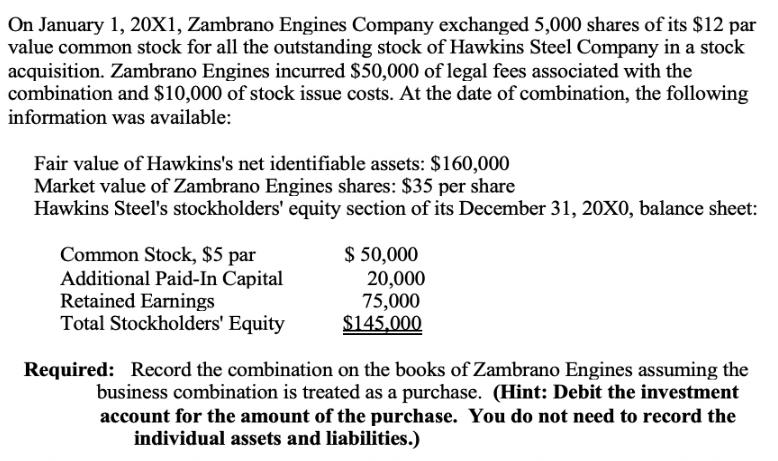

On January 1, 20X1, Zambrano Engines Company exchanged 5,000 shares of its $12 par value common stock for all the outstanding stock of Hawkins Steel Company in a stock acquisition. Zambrano Engines incurred $50,000 of legal fees associated with the combination and $10,000 of stock issue costs. At the date of combination, the following information was available: Fair value of Hawkins's net identifiable assets: $160,000 Market value of Zambrano Engines shares: $35 per share Hawkins Steel's stockholders' equity section of its December 31, 20X0, balance sheet: Common Stock, $5 par Additional Paid-In Capital Retained Earnings Total Stockholders' Equity $ 50,000 20,000 75,000 $145.000 Required: Record the combination on the books of Zambrano Engines assuming the business combination is treated as a purchase. (Hint: Debit the investment account for the amount of the purchase. You do not need to record the individual assets and liabilities.)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Value of Share exchanges 17500000 Legal Fees 5000000 Stock Issu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started